UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Year Ended December 31, 2011

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File No. 333-149784

CAR CHARGING GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

03-0608147

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

| |

|

|

|

1691 Michigan Avenue, Suite 601

|

|

|

|

Miami Beach, Florida

|

|

33139

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (305) 521-0200

|

Securities registered under Section 12(b) of the Exchange Act:

|

| |

|

|

Title of each class:

|

Name of each exchange on which registered:

|

|

None

|

None

|

| |

|

Securities registered under Section 12(g) of the Exchange Act:

|

|

Common Stock, par value $0.001

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| |

|

|

|

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

| |

|

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2011: $8,264,094.

As of April 16, 2012, the registrant had 39,713,450 common shares issued and outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

| |

|

|

|

PART I

|

|

|

|

ITEM 1.

|

BUSINESS

|

1

|

|

ITEM 1A.

|

RISK FACTORS

|

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

|

ITEM 2.

|

PROPERTIES

|

7

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

7

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

7

|

|

PART II

|

|

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

7

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

8

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

9

|

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

14

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

F-

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

15

|

|

ITEM 9A.

|

CONTROLS AND PROCEDURES

|

16

|

|

ITEM 9B.

|

OTHER INFORMATION

|

|

|

PART III

|

|

|

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

17

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

19

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

20

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

21

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

21

|

|

PART IV

|

|

|

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

22

|

|

SIGNATURES

|

23

|

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of the Section 27A of the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future operations, future cash needs, business plans and future financial results, and any other statements that are not historical facts.

From time to time, forward-looking statements also are included in our other periodic reports on Forms 10-Q and 8-K, in our press releases, in our presentations, on our website and in other materials released to the public. Any or all of the forward-looking statements included in this Report and in any other reports or public statements made by us are not guarantees of future performance and may turn out to be inaccurate. These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

For discussion of factors that we believe could cause our actual results to differ materially from expected and historical results see “Item 1A — Risk Factors” below.

PART I

ITEM 1. BUSINESS

Overview

Car Charging Group, Inc. (the “Company”) provides an electric charging service for the electric vehicle (EV) automobile market, delivering convenient access for EV drivers to refuel their automobiles wherever they live, work and play. The Company seeks to become a leading provider of EV charging services throughout North America and ultimately in Europe and Asia. In order for electric vehicles to become a mainstream reality, public EV charging stations need to be in place and readily available to consumers nationally.

Car Charging installs electric charging services where EV owners are likely to live, commute, and shop, leading to a higher utilization on every installation investment. We contract with property owners and managers who control locations in high traffic areas where there is accelerating consumer adoption of electric cars as a less expensive means of transportation coupled with a focus on greenhouse gas savings.

Charging installs fast charging stations, enabling most EV owners to fully recharge their batteries from empty in about four hours. However, most drivers will use our service to “top off” their batteries, to re-energize their batteries from approximately half a charge to a full charge. Car Charging sets its price based on a variety of factors, some of which are local electricity tariffs, location, and competitive services. The stations that provide our service are sourced from a third party today, many of which are purchased from Coulomb Technologies.

Our approach is to become a strategic partner with property owners, who own high value real estate, and to demonstrate the value we offer their locations. Consumers seek businesses that support energy conservation and the Car Charging service provides a differentiator for those real estate owners who want to promote themselves as supporters of the “green” movement. Electric vehicle charging provides this missing component for many property owners. Furthermore, our business model provides for the potential for increased revenue per parking spot. Car Charging offers the property owner a share in the revenue stream generated from the charging sessions as well as any other revenue derived from the location.

Over the past year and half, Car Charging has contracts with and generated strong relationships with many of the essential property owners required to build a profitable charging business. Real estate segments we have established strong ties with include apartment complexes/MDUs for residential living, REITs, national parking garage owners and managers, retailers, shopping centers and malls, high population density municipalities, and office parks. Partnerships under contract in the parking market segment include ICON, Central, ACE, and LAZ parking. In the residential arena, contracts include Forest City, Equity One, Equity Residential, and Kettler. In the retail segment, relationships include Walgreens, Mall of America, Aventura Mall, and Four Seasons in Miami. Lastly, municipalities own and operate prime locations where we have relationships and those include the Pennsylvania Turnpike, Norwalk, and Dania Beach.

Our main source of revenue will be derived from the electric charging services, with pricing set as an hourly rate or on a per kilowatt hour rate. As more states adopt electricity deregulation, Car Charging will be in a more advantageous position to be competitively price its service vis-a-vis refueling at home. As a first mover in the Electric Vehicle infrastructure category, Car Charging is set to capitalize on the opportunities presented by this emerging industry.

Our Company is able to facilitate the purchase of EV charging stations through its wholly owned subsidiary, eCharging Stations, LLC. The installation and maintenance of the EV charging equipment is subcontracted through approved local vendors. It is competitively bid so as to maintain the lowest installation and on-going costs possible.

History

The Company was incorporated in October 2006 in Nevada with the intention of providing personal consultation services to the general public. On December 7, 2009, we entered into a Share Exchange Agreement with Car Charging, Inc., a Delaware corporation (“Car Charging”).

At closing, pursuant to the majority consent of our board of directors and shareholders, we approved (i) an amendment to our Articles of Incorporation changing our name to Car Charging Group, Inc. and (ii) the authorization of 20,000,000 shares of preferred stock of the Company. Additionally, we filed a Certificate of Designation with the state of Nevada designating rights to the authorized preferred stock of the Company (the “Series A Convertible Preferred Stock”).

During February, 2011, the Shareholders and Board of Directors authorized a decrease of our issued and outstanding common stock, in the form of a reverse stock-split, on a one-for-fifty (1:50) basis (the “Reverse Stock-Split”). All share and per share amounts included in the consolidated financial statements have been adjusted retroactively to reflect the effects of the Reverse Stock-Split.

Corporate Structure

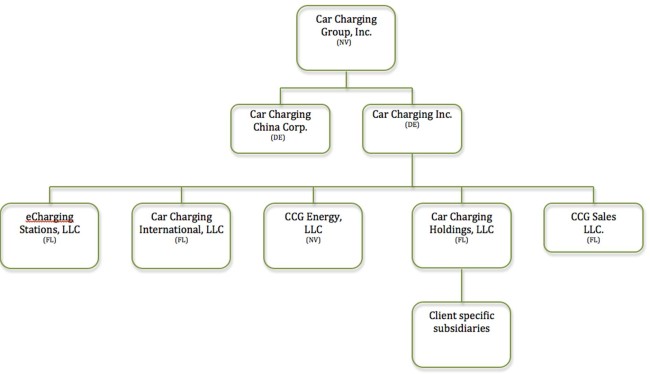

Car Charging Group, Inc. is the parent company of Car Charging, Inc., a Delaware corporation, which serves as the main operating company and is, in turn, the parent company of several distinct wholly-owned subsidiary operating companies.

Industry Overview

The electric vehicle industry is set to accelerate over the next several years for a multiplicity of reasons. Gasoline prices continue to rise and could in fact approach the sky-high prices seen in Europe. Environmental awareness and CO2 impact is of great concern to consumers globally. States such as California have passed laws requiring significant reduction in greenhouse gas emissions from passenger vehicles. While hybrid automobiles are attaining improved gas mileage, they remain a severe pollutant.

Large scale market penetration and consumer adoption will occur over the next few years due to these five main reasons.

|

1.

|

U.S. legislative programs provides incentives to grow the industry

|

There has been a concerted effort on the part of the federal, state and local governments to foster the electric vehicle industry, supporting both the vehicles and the necessary infrastructure to recharge them. There have been an unprecedented number of loans and grants to insure this segment succeeds. The Ford Motor Company was awarded a $5.9 billion loan in June of 2009. Tesla Motors received a $465 million loan to build its plant in Fremont California and to support its production of its Model S 4-door sedan. Both of the aforementioned loans came from the US Government’s $25 billion program dedicated to the development of electric/plug-in hybrid vehicles.

The United States Government has approved a $7,500 tax credit to purchasers of electric vehicles, with legislation in place to raise this tax credit to $10,000. Whether it is for the actual manufacturing of a new car, or to startup companies looking to capitalize on new infrastructure technologies, governments have committed to spending billions of dollars to ensure that the electric vehicle industry as a whole will succeed.

|

2.

|

Maintain a relatively low cost of electricity when compared to gasoline

|

At the beginning of the 20th Century, electricity generally cost over $0.20 per kilowatt hour, and could have been as high as $0.40. During that same time period, gasoline could be purchased for $0.05 per gallon. Today, the average price of a gallon of regular gasoline across the United States exceeds $3.79 while the average cost of electricity is $.13 per kilowatt hour. The spread between gasoline and electricity continues to widen.

Concurrently, major utility companies are all working on upgrading their infrastructure to make it easier to charge an electric vehicle. The “smart-grid” investment that many utilities have already made will provide ample information to predict the required power requirements needed to support a widespread EV infrastructure.

|

3.

|

Variety of vehicles at price points that are consistent with today’s gasoline-powered vehicles

|

Almost all of the major car manufacturers have committed to build an electric vehicle by 2015. General Motors, Ford, Chrysler, Nissan, Honda, BMW, Mercedes, Tesla, and Fisker are just some of the examples of the car manufactures committed to making the electric vehicle industry a successful enterprise. Lease options from General Motors for the Chevy Volt are extremely attractive at $349 price per month. The BMW ActiveE has an unlimited mileage lease for $499 per month.

Once the U.S. government incentives are subtracted, an EV’s sticker price becomes much more attractive. Manufacturers and consumers will need to be weaned off of this stipend as the government cannot afford to provide this incentive for an extended period of time. Technology advances from the private sector will enable manufacturers to establish a very competitive price point in the coming years.

|

4.

|

Battery costs decrease while recharge life increases

|

Battery technology is advancing at a blistering pace. Not only are the battery costs per kilowatt hour decreasing rapidly, but also are the size and weight. All three variables are necessary components required to drive down the costs of an electric vehicle. Additionally, battery lifespan is critical to EV acceptance, and companies such as A123Systems are leading the way towards increased battery longevity.

|

5.

|

EV Infrastructure that supports consumer driving habits

|

Consumers are fickle and do not want to alter their daily routine or driving habits. And while many believe that most EV charging will be completed at home, the need for a robust, pervasive public EV charging infrastructure is required to eliminate range anxiety. Public and residential charging eliminates the need for drivers to go out of their way to fill their gas tank. Instead, charging stations will be located in popular destination locations where drivers currently park. Be it for 20 minutes at a local Walgreens, for a few hours while parking at work, or at home overnight, the recharging infrastructure build-out will be more than sufficient for nearly all drivers.

The Ford Motor Company was awarded a $5.9 billion loan in June of 2009. In 2010 Tesla Motors, Silicon Valley’s electric car manufacturer received a $465 million loan. Both of the aforementioned loans came from the US Government’s $25 billion program dedicated to the development of electric/plug-in hybrid vehicles.

In 2010, the government of France took the lead in Europe by announcing that it would spend $2.2 billion to build a network of charging stations. Remarkably, France is putting the burden on building owners: the installation of charging stations will be mandatory in all office parking lots by 2015 and all new apartment buildings with parking lots must host charging stations by December, 2012. We anticipate that other governments will follow the French example.

Equipment and Network Utilized

Many of the EV charging stations installed today include the CT2000 family of ChargePoint Networked Charging Stations, manufactured by Coulomb Technologies, which are specifically designed for the North American market. The CT2000 family of charging stations supports fast charging known as Level 2 (208/240V @ 32A) charging. The ChargePoint Networked Charging Stations combined with the ChargePoint Network Operating System (NOS) form a smart charging infrastructure for plug-in electric vehicles.

Although we do not exclusively use Coulomb’s charging stations, we believe they are at the forefront of the electric vehicle charging station market. Strategically, it makes the most sense to be aligned with their devices and network infrastructure. As the market continues to mature, we intend to upgrade when new technologies become available. Car Charging has been provided many charging stations under the Coulomb ChargePoint America (CPA) program which enables us to lower our average overall equipment costs.

Competition

The competitive landscape in the development of a national or regional electric vehicle infrastructure is young and still fragmented. No clear leader or leaders have emerged, leaving room for new arrivals to ascend. The terrain, however, is such that competitors may quickly become complimentary to one another, allowing for greater mobility and enhanced driving distance for the electric vehicle operator through the ability to charge at charging stations owned and/or operated by different owners. This, in turn, will work towards further expansion of the electric vehicle industry, bringing additional revenue to all these companies and allowing the infrastructure to grow. Furthermore, because Car Charging is in the business of owning and operating EV charging stations and not developing the technology behind the chargers, potential competitors become partners if and when Car Charging seeks new chargers to with which to equip additional locations as the technology further develops

The electric vehicle charging marketplace is made up of a variety of companies who either offer direct distribution or work with independent distributors, including:

General Electric is currently developing a Level 2 (220 Volt) Networked Charging Station.

Better Place is a company developing the technology and working on the deployment of a network of battery charging stations and battery switch stations. Better Place is building its first electric vehicle network in Israel. Better Place has also announced an agreement with Renault-Nissan where they will develop an electric vehicle with the capacity to have its battery removed and swapped through the better place switching stations being developed.

350Green is a project developer that designs, builds and operates networks of plug-in electric vehicle (EV) charging stations. The company distributes its stations by partnering with retail hosts at select, high-traffic shopping centers and other places.

Beam Charging has a similar business model to ours but is currently only operating in the New York area.

Ecotality manufactures and sells Level 2 and 3 “Blink” chargers. Under a Federal Grant “The EV Project” they anticipate installation of approximately 14,000 Level 2 and 300-400 Level 3 chargers in 6 states.

NRG offers home and public charging at fixed monthly rates, and currently only offers this in Dallas/Ft Worth and Houston. They anticipate a 20 city rollout of EV charging station infrastructure, with an emphasis on monthly subscriptions.

Customers

We launched our business in the State of Florida but have expanded to locations throughout the United States. Our goal is to expand both nationally and internationally in conjunction with the demand for our service. Currently, our customers are made up of apartment complexes/MDUs for residential living, REITs, national parking garage owners and managers, retailers, shopping centers and malls, high population density municipalities and office parks.

Sales and Marketing

When evaluating our future, we believe the most important consideration is the number of locations we sign up to install charging stations. We could sign up a 600 spot parking garage, but only install one charging station upon the signing of our contract. What that location now represents to us as a company is 599 other potential charging locations that will yield future potential revenues in essential EV markets. We will have minimum capital needs to secure locations, and will only spend as the market warrants. Through the use of technology, we will be able to monitor the usage of the charging stations. As the market develops, we can increase the number of charging stations installed at each location.

We employ a direct sales team located both on the east and west coast, as well as a team of independent contractors located throughout the United States actively pursuing and closing deals.

Car Charging’s website is located at www.carcharging.com and will leverage this as a storefront to market our services to property owners as well as to consumers. We frequently utilize public relations to announce our new property partnerships through an outside agency. And, we employ social networking such as facebook and twitter to ensure there is much discussion on the topic of EV charging in the public domain.

Government/Regulatory Approval

Local regulations for charging station installation vary from city to city. Compliance with such regulation(s) may cause installation delays, but these issues are standard and expected for any product that requires construction as part of its installation.

Currently, the Company charges customers hourly for its services, rather than base charges on kilowatt hours used so as not to be treated as a regulated public utility. California, Oregon, Virginia and the State of Washington have determined that companies that sell electric vehicle charging services to the public will not be regulated as utilities, therefore allowing us to charge based on kilowatt usage. These individual state determinations are not binding on any other regulator or jurisdiction; however, they demonstrate a trend in the way states view the industry. Other jurisdictions, including Florida and Michigan are in the process of adopting such reforms.

Employees

As of April 16, 2012, there are nine employees.

Intellectual Property

The Company has entered into a Licensing Agreement with Michael D. Farkas and Balance Holdings, LLC for the exclusive use of filed provisional patent applications for the following inventions:

EVSE Parking Bumper: An inductive charging station in the form of a parking bumper that will reduce the visual and physical clutter in already-congested parking lots and garages. (Provisional Patent Application Number: 61529016)

Under-the-Street Inductive Charging System: An inductive charging system to be used underneath the road that will charge EVs while they are driving. (Provisional Patent Application Number: 61529022)

Both products allow EV drivers to wirelessly power and pay for their charging services in an automated and seamless transaction.

Other Information

We maintain our principal offices at 1691 Michigan Avenue, Miami Beach, Florida, 33139. Our telephone number is (305) 521-0200. A Silicon Valley office was also recently established to house our marketing and sales departments and to provide improved support for west coast operations. Our website is www.CarCharging.com; we can be contacted by email at info@CarCharging.com.

ITEM 1A. RISK FACTORS

Risks Relating to Our Business

WE HAVE A LIMITED OPERATING HISTORY THAT YOU CAN USE TO EVALUATE US, AND THE LIKELIHOOD OF OUR SUCCESS MUST BE CONSIDERED IN LIGHT OF THE PROBLEMS, EXPENSES, DIFFICULTIES, COMPLICATIONS AND DELAYS FREQUENTLY ENCOUNTERED BY A SMALL DEVELOPING COMPANY.

We were incorporated in Nevada in October, 2006. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company starting a new business enterprise and the potentially highly competitive environment in which we will operate. Since we have a limited operating history, we cannot assure you that our business will be profitable or that we will ever generate sufficient revenues to meet our expenses and support our anticipated activities.

WE NEED TO MANAGE GROWTH IN OPERATIONS TO MAXIMIZE OUR POTENTIAL GROWTH AND ACHIEVE OUR EXPECTED REVENUES AND OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUE.

In order to maximize growth in our current and potential markets, we believe that we must expand our marketing operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures and management information systems. We will also need to effectively train, motivate and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

In order to achieve the above-mentioned targets, the general strategies of our company are to maintain and search for hard-working employees who have innovative initiatives; as well as to keep a close eye on expansion opportunities through merger or and/or acquisition.

IF WE NEED ADDITIONAL CAPITAL TO FUND OUR GROWING OPERATIONS, WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS.

If adequate additional financing is not available on reasonable terms, we may not be able to undertake expansion or continue our marketing efforts and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us.

In connection with our growth strategies, we may experience increased capital needs; accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products and/or services by our competition; (iii) the level of our investment in research and development; (iv) the amount of our capital expenditures, including acquisitions, and (v) our growth. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

OUR FUTURE SUCCESS IS DEPENDENT, IN PART, ON THE PERFORMANCE AND CONTINUED SERVICE OF OUR OFFICERS.

We are presently dependent to a great extent upon the experience, abilities and continued services of Michael D. Farkas, Andy Kinard and Jack Zwick, our management team. The loss of services of Mr. Farkas, Mr. Kinard or Mr. Zwick could have a material adverse effect on our business, financial condition or results of operation.

NEED FOR ADDITIONAL EMPLOYEES

Our future success also depends upon our ability to attract and retain highly qualified personnel. Expansion of our business and the management and operation of the Company will require additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. There can be no assurance that we will be able to attract or retain highly qualified personnel. As our industry continues to evolve, competition for skilled personnel with the requisite experience will be significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

WE ARE IN AN INTENSELY COMPETITIVE INDUSTRY AND THERE CAN BE NO ASSURANCE THAT WE WILL BE ABLE TO COMPETE WITH OUR COMPETITORS WHO MAY HAVE GREATER RESOURCES.

The Company could face strong competition within the local area from competitors in the EV charging services industry who could duplicate the model. These competitors may have substantially greater financial, marketing and development resources and other capabilities than the Company. In addition, there are very few barriers to enter into the market for our services. There can be no assurance, therefore, that any of our competitors, many of whom have far greater resources, will not independently develop services that are substantially equivalent or superior to our services. Therefore, an investment in the Company is very risky and speculative due to the competitive environment in which the Company intends to operate.

OUR FUTURE SUCCESS IS DEPENDENT UPON THE FUTURE GENERATION OF A MARKET FOR OUR SERVICE

The Company currently remains and will continue to remain in a position of dependence on the creation and sustainability of the electric car market. While a vast majority of the major car manufacturers have made strong financial commitments to the electric vehicle industry going forward, there is no guaranty that the industry will become viable. Without a fleet of electric vehicles on the road needing recharging, there exists no opportunity for the Company to provide its intended service. Therefore, an investment in the Company is very risky and speculative due to the uncertain future of the electric vehicle market.

Risks Associated with Our Shares of Common Stock

IF WE FAIL TO ESTABLISH AND MAINTAIN AN EFFECTIVE SYSTEM OF INTERNAL CONTROL, WE MAY NOT BE ABLE TO REPORT OUR FINANCIAL RESULTS ACCURATELY OR TO PREVENT FRAUD. ANY INABILITY TO REPORT AND FILE OUR FINANCIAL RESULTS ACCURATELY AND TIMELY COULD HARM OUR REPUTATION AND ADVERSELY IMPACT THE TRADING PRICE OF OUR COMMON STOCK.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operations and access to capital. We have not performed an in-depth analysis to determine if in the past un-discovered failures of internal controls exist, and may in the future discover areas of our internal control that need improvement. We currently do not have an audit committee or audit committee financial expert. Our Code of Ethics requires members of our management team to report any conduct by our Chief Executive Officer or Chief Financial Officer, believed to be in violation of law or business ethics or in violation of any provision of the Code of Ethics to our audit committee. Because of the lack of an audit committee, violations of our Code of Ethics or violation of law or business ethics by Chief Executive Officer and Chief Financial Officer may go unreported.

OUR COMMON STOCK IS QUOTED ONLY ON THE OTC BULLENTIN BOARD (“OTCBB”), WHICH MAY HAVE AN UNFAVORABLE IMPACT ON OUR STOCK PRICE AND LIQUIDITY.

Our common stock is quoted on the OTCBB. The OTCBB is a significantly more limited market than the New York Stock Exchange or the NASDAQ Stock Market. The quotation of our shares on the OTCBB may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future.

There can be no assurance that there will be an active market for our shares of common stock either now or in the future. Market liquidity will depend on the perception of our operating business and any steps that our management might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. As a result holders of our securities may not find purchasers for our securities should they to desire to sell them. Consequently, our securities should be purchased only by investors having no need for liquidity in their investment and who can hold our securities for an indefinite period of time.

OUR SHARES OF COMMON STOCK ARE VERY THINLY TRADED, AND THE PRICE MAY NOT REFLECT OUR VALUE AND THERE CAN BE NO ASSURANCE THAT THERE WILL BE AN ACTIVE MARKET FOR OUR SHARES OF COMMON STOCK EITHER NOW OR IN THE FUTURE.

Our shares of common stock are very thinly traded, and the price, if traded, may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business and any steps that our management might take to increase awareness of the Company with investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for loans.

FUTURE ISSUANCE OF OUR COMMON STOCK COULD DILUTE THE INTEREST OF EXISITNG STOCKHOLDERS.

We may issue additional shares of our common stock in the future. The issuance of a substantial amount of common stock could have the effect of substantially diluting the interests of our current stockholders. In addition, the sale of a substantial amount of common stock in the public market, either in the initial issuance or in a subsequent resale by the target company in an acquisition which received such common stock as consideration or by investors who acquired such common stock in a private placement could have an adverse affect on the market price of our common stock.

THE APPLICATION OF THE SEC’S “PENNY STOCK” RULES TO OUR COMMON STOCK COULD LIMIT TRADING ACIVITY IN THE MARKET, AND OUR STOCKHOLDERS MAY FIND IT MORE DIFFICULT TO SELL THEIR STOCK.

Our common stock is currently trading at less than $5.00 per share and is therefore subject to the SEC’s penny stock rules. Before a broker-dealer can sell a penny stock, these rules require that it first approve the customer for the transaction and receive from the customer a written agreement to the transaction. It must furnish the customer a document describing the risks of investing in penny stocks. The broker-dealer must also tell the customer the current market quotation, if any, for the penny stock and the compensation the firm and its broker will receive for the trade. Finally, it must send monthly account statements showing the market value of each penny stock held in the customer’s account. These disclosure requirements tend to make it more difficult for a broker-dealer to make a market in penny stocks, and could, therefore, reduce the level of trading activity in a stock that is subject to the penny stock rules. Consequently, our stockholders may find it more difficult to sell their stock as compared to other securities.

WE DO NOT INTEND TO PAY DIVIDENDS FOR THE FORESEEABLE FUTURE, AND YOU MUST RELY ON INCREASES IN THE MARKET PRICES OF OUR COMMON STOCK FOR RETURNS ON YOUR INVESTMENT.

For the foreseeable future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our common stock. Accordingly, investors must be prepared to rely on sales of their common stock after price appreciation to earn an investment return, which may never occur. Investors seeking cash dividends should not purchase our common stock. Any determination to pay dividends in the future will be made at the discretion of our board of directors and will depend on our results of operations, financial condition, contractual restrictions, restrictions imposed by applicable law and other factors our board of directors deems relevant.

ITEM 1B. UNRESOLVED STAFF COMMENTS

This information is not required for smaller reporting companies.

ITEM 2. PROPERTIES

We currently occupy office space in Miami Beach, Florida. The facility is 4,244 square feet, which provides us with ample space to facilitate our operations.

We currently lease an additional office facility in San Jose, California. The lease is for an initial term of 3 years. The facility is 1,543 square feet.

ITEM 3. LEGAL PROCEEDINGS

In March and April 2012, a former officer and director of the Company filed declaratory actions against the Company relating to compensatory matters, certain warrant exercise rights and the termination of his employment. No determination can be made as to the outcome of this matter at this time. Management believes these suits to be without merit and intends to vigorously defend itself.

The Company has a lawsuit pending for past due fees due to a consulting firm in the amount of $41,000. Although the outcome of this matter is uncertain, the Company has reserved for this amount in accounts payable and accrued expenses at December 31, 2011.

From time to time, the Company is a defendant or plaintiff in various legal actions which arise in the normal course of business. As such the Company is required to assess the likelihood of any adverse outcomes to these matters as well as potential ranges of probable losses. A determination of the amount of the provision required for these commitments and contingencies, if any, which would be charged to earnings, is made after careful analysis of each matter. The provision may change in the future due to new developments or changes in circumstances. Changes in the provision could increase or decrease the Company’s earnings in the period the changes are made. It is the opinion of management, after consultation with legal counsel, that the ultimate resolution of these matters will not have a material adverse effect on the Company’s financial condition, results of operations or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY COMMON SECURITIES.

Market Information

Our common stock has traded on the OTC Bulletin Board system under the symbol “CCGI” since December 2009. The OTCBB is a quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter (“OTC”) equity securities. An OTCBB equity security generally is any equity that is not listed or traded on a national securities exchange.

Price Range of Common Stock

The following table sets forth, for the periods indicated, the high and low bid prices per share for our common stock as reported by the OTCBB quotation service. Bid prices prior to February 25, 2011 are adjusted based on the Company’s 50 for 1 reverse stock split, effective that day. These bid prices represent prices quoted by broker-dealers on the OTCBB quotation service. The prices reflect inter-dealer quotations, do not include retail mark-ups, markdowns or commissions and do not necessarily reflect actual transactions.

|

Quarter ended

|

|

Low Price

|

|

|

High Price

|

|

| |

|

|

|

|

|

|

|

December 31, 2011

|

|

$ |

1.00

|

|

|

$ |

2.19

|

|

|

September 30, 2011

|

|

|

1.15

|

|

|

|

2.72

|

|

|

June 30, 2011

|

|

|

2.15

|

|

|

|

4.00

|

|

|

March 31, 2011

|

|

|

2.50

|

|

|

|

25.00

|

|

|

December 31, 2010

|

|

|

20.55

|

|

|

|

75.00

|

|

|

September 30, 2010

|

|

|

32.50

|

|

|

|

75.00

|

|

|

June 30, 2010

|

|

|

26.50

|

|

|

|

50.50

|

|

|

March 31, 2010

|

|

|

32.50

|

|

|

|

55.00

|

|

Approximated Number of Equity Security Holders

As of April 16, 2012 there were approximately 100 stockholders of record. Because shares of our common stock are held by depositaries, brokers and other nominees, the number of beneficial holders of our shares is substantially larger than the number of stockholders of record.

Dividends

To date, we have not declared or paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future.

Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have in effect any compensation plans under which our equity securities are authorized for issuance.

Warrants Granted

|

The following table summarizes outstanding warrants by Expiration Date at December 31, 2011:

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Exercise

|

|

Expiration

|

|

Quantity

|

|

|

Price

|

|

Date

|

| |

|

|

|

|

|

| |

5,000

|

|

|

|

$42.50

|

|

April 12, 2012

|

| |

200,000

|

|

|

|

$2.50

|

|

August 10, 2012

|

| |

515,000

|

|

|

|

$3.00

|

|

August 25, 2012

|

| |

100,000

|

|

|

|

$3.00

|

|

December 7, 2012

|

| |

50,000

|

|

|

|

$30.00

|

|

April 1, 2013

|

| |

5,000

|

|

|

|

$15.00

|

|

April 1, 2013

|

| |

2,200,000

|

|

|

|

$3.00

|

|

April 27, 2013

|

| |

500,000

|

|

|

|

$5.00

|

|

August 10, 2013

|

| |

500,000

|

|

|

|

$7.50

|

|

August 10, 2013

|

| |

500,000

|

|

|

|

$10.00

|

|

August 10, 2013

|

| |

4,652,165

|

|

|

|

$3.00

|

|

August 25, 2013

|

| |

10,000

|

|

|

|

$51.50

|

|

August 25, 2013

|

| |

250,000

|

|

|

|

$1.50

|

|

November 15, 2014

|

| |

1,277,170

|

|

|

|

$1.66*

|

|

January 19, 2015

|

| |

3,834

|

|

|

|

$30.00

|

|

May 5, 2015

|

| |

50,000

|

|

|

|

$20.00

|

|

January 11, 2016

|

| |

100,000

|

|

|

|

$1.00

|

|

September 22, 2018

|

| |

10,918,169

|

|

|

|

|

|

|

*Price may be lower if market closes at lower price on exercise date.

ITEM 6. SELECTED FINANCIAL DATA

We are not required to provide the information required by this Item because we are a smaller reporting company.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition for the year ended December 31, 2011 and 2010 should be read in conjunction with our consolidated financial statements and the notes to those consolidated financial statements that are included elsewhere in this Form 10-K. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors. See “Forward-Looking Statements.”

Overview

Car Charging Group, Inc. (formerly New Image Concepts, Inc.) was created as a result of a merger (Reverse Merger) on December 7, 2009, with Car Charging, Inc. New Image Concepts Inc. was a development stage entity with the intention of providing personal consultation services to the general public; Car Charging Inc. was formed on September 8, 2009 to develop a market to service electric vehicle charging. To that end, we are establishing a comprehensive network of EV charging stations that delivers easy, convenient access to drivers wherever they live, work and play. The charging stations are installed, maintained and owned by the Company and they are provided at no cost to the business/property owner “partner.” The use of the stations is not anticipated in any significant volume until sometime after the 4th quarter of 2012, when automobile manufacturers are scheduled to mass produce and sell electric vehicles to the public.

To date, the Company’s operations have been devoted primarily to developing a business plan, raising capital for future operations, entering into contracts with property owner/operators (the “Provider Agreements) and administrative functions. The Company intends to grow through internal development and selected acquisitions. During 2011, the Company installed 39 charging stations pursuant to the terms of its Provider Agreements. The ability of the Company to achieve its business objectives, however, is contingent upon its success in raising additional capital until adequate revenues are realized from operations. Therefore, no substantial revenue or profit is anticipated in the near or foreseeable future.

During 2010, the Company raised $1,448,046 in capital through private sales of its common stock.

During 2011, the Company increased its funding by $2,499,999 through additional private sales of its common stock.

Through April 16, 2012, the Company has raised $2,000,000 in capital through private sales of common stock and its yet-to-be-designated Series B Preferred Stock.

By December 31, 2011, the Company had entered into contracts to provide charging services on third party premises, “Provider Agreements”, with 37 entities and completed installation of 46 charging stations (EV devices).

The Company generally acquires charging stations from Coulomb Technologies Inc., but consistent with its policy and business plan, continuously reviews the availability of acquiring EV devices from other manufacturers.

The Company’s business plan anticipates that significant capital will be needed during 2012 and 2013 to continue building our network of charging stations throughout the United States. Accordingly, the amount of new capital needed will vary depending on several significant factors that include quantity of electric vehicle sales, gasoline prices, success of the Company’s Provider Agreement program, cost of EV's and the Company’s continued acceptance by the capital markets.

Pursuant to our business plan, to stimulate growth, control cash-flow and minimize costs, the Company has implemented a policy of both acquiring leads to property owners for Provider Agreements through independent contractors and the utilization of in-house personnel in pursuit of Provider Agreements. Company executives accordingly, are employed to close and maintain Provider Agreements and relationships, in addition to those who coordinate installations and operations of EV charging stations.

Wherever possible, the Company has adopted a policy of issuing warrants and stock to avoid cash compensation expenses and encourage stock sales (subscriptions). These warrant transactions can result in significant non-cash compensation charges and other non-cash charges that are generally reflected in the consolidated financial statements as “compensation”, “general and administrative” or as “change in fair value” in the statements of operations and cash flow.

The foregoing results in a balance sheet account referred to as “Derivative Liabilities.” Our cumulative liability related to these derivative transactions can be summarized at December 31, 2010 as consisting of liability related to warrants of $984,597 and conversion features of notes payable of $2,483,267. The Company evaluates its convertible debt, warrants or other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives to be separately accounted for in accordance with paragraph 810-10-05-4 of the FASB Accounting Standards Codification and paragraph 815-40-25 of the FASB Accounting Standards Codification. The result of this accounting treatment is that the fair value of the embedded derivative is marked-to-market each balance sheet date and recorded as a liability. In the event that the fair value is recorded as a liability, the change in fair value is recorded in the Statement of Operations as other income or expense, $3,211,356 gain for 2010. Upon conversion or exercise of a derivative instrument, the instrument is marked to fair value at the conversion date and then that fair value is reclassified to equity.

In March 2011, agreements between the Company and the note holders to fix the conversion rate stated in the convertible notes effectively removed the embedded derivative from the convertible notes. Accordingly, as future conversions were no longer subject to reset, the derivative liability related to the notes was adjusted to $0 and the Company recognized a gain on the change in value of the derivative liability of $2,701,894 upon execution.

In October 2011, the Company executed an agreement with the warrant holders which eliminated the reset feature of these warrants. As a result, the derivative liability associated with the reset is no longer present and the Company recognized a gain on the change in value of derivative liability of $786,721.

Results of Operations

Comparison of the year ended December 31, 2011 and 2010

Revenues

The Company generated revenues of $59,490 from sales of EV Charging Stations and $2,799 in revenues from service fees related to installed EV Charging Stations for the year ended December 31, 2011. The Company did not derive any revenue from operations for the year ended December 31, 2010. While the Company’s primary strategy is to earn revenue through the installation and maintenance of EV Charging Stations, the Company will sell EV Charging Stations on occasions when the opportunity presents itself.

Operating Expenses

Operating expenses include equipment and installation expenses, marketing and advertising expenses, operations, sales, marketing, finance and legal functions. As the number of property contracts increase, the equipment and installation expenses rise accordingly. Car Charging obtains competitive bids for each installation location in order to decrease these costs. Equipment costs have decreased approximately 19% over a one year period also contributing to reduced installation expenses.

Sales expenses are incurred once a contract is signed and the service is initiated. Marketing expenses include essential industry conference participation and regional exhibits to engage with prospective property owners as well as consultants who develop our website, public relations outreach as well as social media engagement.

Net Income and Loss before Provision for Income Taxes

Our net loss during the year ended December 31, 2011, is attributable to the fact that we have derived minimal revenue from operations to offset our business development expenses. Although we are pleased to note that auto manufacturers have initiated electric vehicle sales in the United States and that such sales should lead to production of revenue, our loss for the year ended December 31, 2011 amounted to $1,140,075, net of a gain on change in fair value of derivative liability of $3,488,615. The loss primarily consists of compensation including stocks and warrants issued for services of $1,872,820 and cash compensation for consulting services of $481,741; as well as non-cash charges of $485,000 issued as common stock in exchange for extinguishment of warrants. During the year, management entered into negotiations and agreements to install EV at locations throughout the United States; and is in the process of hiring additional sales personnel, arranging to lease additional office space and negotiating additional installation cites.

Manufacture and significant supply of electric vehicles that will require utilization of the Company’s services is not anticipated to be widespread until the 4th quarter of 2012; this gives the Company adequate time to develop its distribution plan and additional capital sources.

Our net loss during the year ended December 31, 2010, is attributable to the fact that we did not derive any revenue from operations to offset our business development expenses. Our loss for the year ended December 31, 2010 amounted to $5,709,559, net of a gain on change in fair value of derivative liability of $3,211,356. The loss primarily consists of compensation (including non-cash warrant compensation $6,995,084, and other cash compensation, including consulting, of $870,753; as well as non-cash general and administrative charges of $309,000 issued as common stock, rent of $70,011 and travel of $93,227.

CAR CHARGING GROUP, INC.

(A Development Stage Company)

December 31, 2011 and 2010

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION

Car Charging Group Inc. (“CCGI”) was incorporated on October 3, 2006 under the laws of the State of Nevada as New Image Concepts, Inc. On November 20, 2009, New Image Concepts, Inc. changed its name to Car Charging Group, Inc.

Car Charging, Inc., was incorporated as a Delaware corporation on September 3, 2009. Car Charging Inc. was created to develop electric charging service facilities for the electric vehicle (EV) automobile market. Pursuant to its business plan, Car Charging Inc. (or its affiliates) acquires and installs EV charging stations, and shares servicing fees received from customers that use the charging stations with the property owner(s), on a property by property basis. Additionally, the Company sells hardware to others. Car Charging, Inc., therefore, enters into individual arrangements for this purpose with various property owners, which may include, cities, counties, garage operators, hospitals, multi-family properties, shopping-malls and facility owner/operators.

During February, 2011, the Shareholders and Board of Directors authorized a decrease of our issued and outstanding common stock, in the form of a reverse stock-split, on a one-for-fifty (1:50) basis (the “Reverse Stock-Split”). There was no change to the authorized amount of shares or to the par value. All share and per share amounts included in the consolidated financial statements have been adjusted to reflect the effects of the Reverse Stock-Split.

Merger

On December 7, 2009, CCGI entered into a Share Exchange Agreement (the “Agreement”) among CCGI and Car Charging, Inc. (“CCI”)

Pursuant to the terms of the Agreement, CCGI agreed to issue an aggregate of 10,000,000 restricted shares of CCGI's common stock and 10,000,000 shares of its Series A Convertible Preferred Stock to the CCI Shareholders in exchange for all of the issued and outstanding shares of CCI.

The merger was accounted for as a reverse acquisition and recapitalization. CCI is the acquirer for accounting purposes and CCGI is the issuer. Accordingly, CCGI’s historical financial statements for periods prior to the acquisition become those of the acquirer retroactively restated for the equivalent number of shares issued in the merger. Operations prior to the merger are those of CCI. From inception on September 3, 2009 until the merger date, December 7, 2009, CCI had minimal operations with no revenues. Earnings per share for the period prior to the merger are restated to reflect the equivalent number of shares outstanding.

The consolidated financial statements consist of CCGI and its wholly-owned subsidiaries, collectively referred to herein as the “Company” or “Car Charging.” All intercompany transactions and balances have been eliminated in consolidation.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The accompanying consolidated financial statements and related notes have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for financial statements and with the rules and regulations of the United States Securities and Exchange Commission (“SEC”) for Form 10-K.

DEVELOPMENT STAGE COMPANY

The Company is a development stage company as defined by ASC 915-10 “Development Stage Entities.” The Company is still devoting substantially all of its efforts on establishing the business and developing revenue generating opportunities through its planned principal operations. In the latter half of 2011, the Company’s principal sales operations began however the Company did not recognize significant revenues during the period. All losses accumulated since inception have been considered as part of the Company’s development stage activities.

LIQUIDITY

Historically, the Company has been dependent on debt and equity raised from individual investors to sustain its operations. The Company’s product has not been placed in enough locations to generate significant revenue. The Company has incurred losses and used cash for operating activities since inception. As of December 31, 2011, the Company had an accumulated deficit of $13,650,817. In November, 2011, the Company entered into a stock purchase agreement for 2.5 million shares of common stock in exchange for $2.5 million in cash. In accordance with this agreement, the Company issued 1,500,000 shares of common stock at $1.00 per share. The agreement calls for the issuance of 500,000 additional shares to be issued in March of 2012 and 500,000 shares to be issued in June of 2012, each at $1.00 per share. The proceeds from the issuance of the March share subscription were received on April 3, 2012. Although there can be no assurance, management believes that the Company has sufficient resources to fund the Company’s operations through at least December 31, 2012.

USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the financial statements and reporting period. Accordingly, actual results could differ from those estimates.

PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation.

CASH AND CASH EQUIVALENTS

The company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents in both the Consolidated Balance Sheets and Consolidated Statement of Cash Flows. The Company has cash on deposits in several financial institutions which, at times, may be in excess of FDIC insurance limits. Management has deemed this a normal business risk.

EV CHARGING STATIONS

EV Charging Stations represents the depreciable cost of charging devices that have been installed on the premises of participating owner/operator properties. They are stated at cost less accumulated depreciation. Depreciation is provided on the straight-line basis over an estimated useful life of three years. Upon sale, replacement or retirement, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in the Consolidated Statements of Operations. The Company held approximately $185,000 in EV charging stations that were not placed in service as of December 31, 2011. The Company will begin depreciating this equipment when installation is substantially complete. Depreciation for the years ended December 31, 2011 and December 31, 2010 was $123,934 and $11,242, respectively.

In December 2010, management determined that EV Charging Stations that were previously recorded as inventory would be used for future installations and reclassified $72,768 in inventory to EV Charging Stations. While the Company’s primary strategy is to earn revenue through the installation and maintenance of EV Charging stations, the Company will sell EV Charging stations on occasion when the opportunity presents itself.

OFFICE AND COMPUTER EQUIPMENT

Office and computer equipment are stated at cost less accumulated depreciation. Depreciation is provided on the straight-line basis over an estimated useful life of five years. Upon sale or retirement of furniture and fixtures, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in Consolidated Statements of Operations. Depreciation for the years ended December 31, 2011 and December 31, 2010 was $9,437, and $4,932, respectively.

IMPAIRMENT OF LONG-LIVED ASSETS

The Company has adopted paragraph 360-10-35-17 of the FASB Accounting Standards Codification for its long-lived assets. The Company’s long-lived assets, which include EV Charging Stations, office and computer equipment and security deposit, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable.

The Company assesses the recoverability of its long-lived assets by comparing the projected undiscounted net cash flows associated with the related long-lived asset or group of long-lived assets over their remaining estimated useful lives against their respective carrying amounts. Impairment, if any, is based on the excess of the carrying amount over the fair value of those assets. Fair value is generally determined using the asset’s expected future discounted cash flows or market value, if readily determinable. If long-lived assets are determined to be recoverable, but the newly determined remaining estimated useful lives are shorter than originally estimated, the net book values of the long-lived assets are depreciated over the newly determined remaining estimated useful lives. The Company determined that there were no impairments of long-lived assets as of December 31, 2011 or December 31, 2010.

DISCOUNT ON DEBT

The Company allocated the proceeds received from convertible debt instruments between the underlying debt instruments and has recorded the conversion feature as a liability in accordance with paragraph 815-15-25-1 of the FASB Accounting Standards Codification. The conversion feature and certain other features that are considered embedded derivative instruments, such as a conversion reset provision have been recorded at their fair value within the terms of paragraph 815-15-25-1 of the FASB Accounting Standards Codification as its fair value can be separated from the convertible note and its conversion is independent of the underlying note value. The conversion liability is marked to market each reporting period with the resulting gains or losses shown on the Consolidated Statements of Operations.

DERIVATIVE INSTRUMENTS

The Company evaluates its convertible debt, warrants or other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives to be separately accounted for in accordance with paragraph 810-10-05-4 of the FASB Accounting Standards Codification and paragraph 815-40-25 of the FASB Accounting Standards Codification. The result of this accounting treatment is that the fair value of the embedded derivative is marked-to-market each balance sheet date and recorded as a liability. In the event that the fair value is recorded as a liability, the change in fair value is recorded in the Statement of Operations as other income or expense. Upon conversion or exercise of a derivative instrument, the instrument is marked to fair value at the conversion date and then that fair value is reclassified to equity.

In circumstances where the embedded conversion option in a convertible instrument is required to be bifurcated and there are also other embedded derivative instruments in the convertible instrument that are required to be bifurcated, the bifurcated derivative instruments are accounted for as a single, compound derivative instrument.

The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is re-assessed at the end of each reporting period. Equity instruments that are initially classified as equity that become subject to reclassification are reclassified to liability at the fair value of the instrument on the reclassification date. Derivative instrument liabilities will be classified in the balance sheet as current or non-current based on whether or not net-cash settlement of the derivative instrument is expected within 12 months of the balance sheet date.

FAIR VALUE OF FINANCIAL INSTRUMENTS

U.S. GAAP for fair value measurements establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three levels. The fair value hierarchy gives the highest priority to quoted market prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). Level 2 inputs are inputs, other than quoted prices included within Level 1, which are observable for the asset or liability, either directly or indirectly. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs.

The carrying amounts of the Company’s financial assets and liabilities, such as cash, deposits and advanced commissions, prepaid expenses, accounts payable and accrued expenses, approximate their fair values because of the short maturity of these instruments. The Company’s convertible notes payable approximates the fair value of such instrument based upon management’s best estimate of interest rates that would be available to the Company for similar financial arrangement at December 31, 2011 and 2010.

The Company revalues its derivative liability at every reporting period and recognizes gains or losses in the consolidated statement of operations that are attributable to the change in the fair value of the derivative liability. The Company has no other assets or liabilities measured at fair value on a recurring basis.

REVENUE RECOGNITION

The Company applies paragraph 605-10-S99-1 of the FASB Accounting Standards Codification for revenue recognition. The Company will recognize revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured. Accordingly, when a customer completes use of a charging station, the service can be deemed rendered and revenue may be recognized

RECLASSIFICATION

During the year ended December 31, 2011, Management revised the Company’s operating plan in response to customer requests to purchase charging stations that would be provided and serviced by the Company. Management believes that this type of sales activity will continue and will continue to function as a reseller of charging stations. Accordingly, a sale of equipment that was classified in other income (expense) in the second quarter was reclassified to sales revenue.

STOCK-BASED COMPENSATION FOR OBTAINING EMPLOYEE SERVICES

The Company accounts for equity instruments issued to employees and directors pursuant to paragraphs 718-10-30-6 of the FASB Accounting Standards Codification, whereby all transactions in which services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more readily measurable. The measurement date used to determine the fair value of the equity instrument issued is the earlier of the date on which the performance is complete or the date on which it is probably that performance will occur.

The Company’s policy is to recognize compensation cost for awards with service conditions and when applicable a graded vesting schedule on a straight-line basis over the requisite service period for the entire award.

EQUITY INSTRUMENTS ISSUED TO PARTIES OTHER THAN EMPLOYEES FOR ACQUIRING GOODS OR SERVICES

The Company accounts for equity instruments issued to parties other than employees for acquiring goods or services under guidance of section 505-50-30 of the FASB Accounting Standards Codification (“FASB ASC Section 505-50-30”). Pursuant to FASB ASC Section 505-50-30, all transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable. The measurement date used to determine the fair value of the equity instrument issued is the earlier of the date on which the performance is complete or the date on which it is probable that performance will occur.

ADVERTISING

The Company expenses non-direct advertising as incurred. Total advertising expense for the years ending December 31, 2011 and December 31, 2010 was $27,411 and $-0-, respectively.

INCOME TAXES

The Company follows Section 740-10-30 of the FASB Accounting Standards Codification, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are based on the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the Statements of Operations in the period that includes the enactment date.

The Company adopted section 740-10-25 of the FASB Accounting Standards Codification (“Section 740-10-25”). Section 740-10-25.addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under Section 740-10-25, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Section 740-10-25 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of Section 740-10-25.

NET LOSS PER COMMON SHARE