CAR CHARGING GROUP, INC.

June 30, 2012

(A Development Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Car Charging Group Inc. (“CCGI”) was incorporated on October 3, 2006 under the laws of the State of Nevada as New Image Concepts, Inc. On November 20, 2009, New Image Concepts, Inc. changed its name to Car Charging Group, Inc.

Car Charging, Inc., (“CCI”) was incorporated as a Delaware corporation on September 3, 2009. Car Charging Inc. was created to develop electric charging service facilities for the electric vehicle (EV) automobile market. Pursuant to its business plan, Car Charging Inc. (or its affiliates) acquires and installs EV charging stations, and shares servicing fees received from customers that use the charging stations with the property owner(s), on a property by property basis. Car Charging, Inc., therefore, enters into individual arrangements for this purpose with various property owners, which may include cities, counties, garage operators, hospitals, shopping-malls and facility owner/operators.

During February 2011, the Shareholders and Board of Directors authorized a decrease of the Company’s issued and outstanding common stock, in the form of a reverse stock-split, on a one-for-fifty (1:50) basis (the “Reverse Stock-Split”). There was no change to the authorized amount of shares or to the par value. All share and per share amounts included in the consolidated financial statements have been adjusted retroactively to reflect the effects of the Reverse Stock-Split.

Merger

On December 7, 2009, CCGI entered into a Share Exchange Agreement (the “Agreement”) with CCI.

Pursuant to the terms of the Agreement, CCGI agreed to issue an aggregate of 10,000,000 restricted shares of CCGI's common stock and 10,000,000 shares of its Series A Convertible Preferred Stock to the CCI Shareholders in exchange for all of the issued and outstanding shares of CCI.

The merger was accounted for as a reverse acquisition and recapitalization. CCI is the acquirer for accounting purposes and CCGI is the issuer. Accordingly, CCGI’s historical financial statements for periods prior to the acquisition became those of the acquirer retroactively restated for the equivalent number of shares issued in the merger. Operations prior to the merger are those of CCI. From inception on September 3, 2009 until the merger date, December 7, 2009, CCI had minimal operations with no revenues. Earnings per share for the period prior to the merger are restated to reflect the equivalent number of shares outstanding.

The consolidated financial statements consist of CCGI and its wholly-owned subsidiaries, collectively referred to herein as the “Company” or “Car Charging.” All intercompany transactions and balances have been eliminated in consolidation.

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

BASIS OF PRESENTATION

The accompanying unaudited interim condensed consolidated financial statements and related notes have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information, and with the rules and regulations of the United States Securities and Exchange Commission (“SEC”) for Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. The unaudited interim financial statements furnished reflect all adjustments (consisting of normal recurring accruals) which are, in the opinion of management, necessary to a fair statement of the results for the interim periods presented. Interim results are not necessarily indicative of the results for the full year. These financial statements should be read in conjunction with the financial statements of the Company for the year ended December 31, 2011 and notes thereto contained in the Company’s Annual Report on Form 10-K as filed with the SEC on April 16, 2012.

DEVELOPMENT STAGE COMPANY

The Company is a development stage company as defined by the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 915-10 “Development Stage Entities.” The Company is still devoting substantially all of its efforts on establishing the business and developing revenue generating opportunities through its planned principal operations. In the latter half of 2011, the Company’s principal sales operations began, however the Company did not recognize significant revenues during the period. All losses accumulated since inceptions have been considered as part of the Company’s development stage activities.

USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the financial statements and reporting period. Accordingly, actual results could differ from those estimates.

LIQUIDITY

Historically, the Company has been dependent on debt and equity raised from individual investors to sustain its operations. The Company’s product has not been placed in enough locations to generate significant revenue. The Company has incurred losses and used cash for operating activities since inception. As of June 30, 2012, the Company had an accumulated deficit of $16,081,839. In conjunction with the Company’s sale of $1,000,000 in Series B convertible Preferred Stock, the purchaser was granted an option to purchase an additional 1,500,000 shares of the Series B Preferred stock at an exercise price of $1.00 per share within 60 days of the issuance of the original 1,000,000 shares in June 2012. Additionally, the Company anticipates selling additional shares of its common and/or preferred stock, exempt from registration, during the next twelve months sufficient to meet its working capital requirements. Although there can be no assurance of these matters, management believes that the Company has sufficient resources to fund the Company’s operations through at least June 30, 2013.

PRINCIPLES OF CONSOLIDATION

The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All significant intercompany transactions have been eliminated in consolidation.

CASH AND CASH EQUIVALENTS

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents in both the Condensed Consolidated Balance Sheets and Condensed Consolidated Statements of Cash Flows. The Company has cash on deposits in several financial institutions which, at times, may be in excess of FDIC insurance limits. Management has deemed this a normal business risk.

EV CHARGING STATIONS

EV Charging Stations represent the depreciable cost of charging devices that have been installed on the premises of participating owner/operator properties. They are stated at cost less accumulated depreciation. Depreciation is provided on the straight-line basis over an estimated useful life of three years. Upon sale, replacement or retirement, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in the Condensed Consolidated Statements of Operations. All purchases of EV Charging Stations from inception to June 30, 2012 have been from a single vendor. The Company believes that there are other vendors in the marketplace that could supply the Company with comparable EV Charging Stations at comparable prices and terms. The Company held approximately $343,000 and $185,000 in EV charging stations that were not placed in service as of June 30, 2012 and December 31, 2011, respectively. The Company will begin depreciating this equipment when installation is substantially complete. Depreciation for the three months and six months ended June 30, 2012 and 2011 and for the period from September 3, 2009 (inception) through June 30, 2012 was $54,916, $25,097, $83,384, $41,382 and $212,938, respectively.

In December 2010, management determined that EV Charging Stations that were previously recorded as inventory would be used for future installations and reclassified $72,768 in inventory to EV Charging Stations. While the Company’s primary strategy is to earn revenue through the installation of EV Charging stations, the Company will sell EV Charging stations on occasion when the opportunity presents itself.

OFFICE AND COMPUTER EQUIPMENT

Office and computer equipment are stated at cost less accumulated depreciation. Depreciation is provided on the straight-line basis over an estimated useful life of five years. Upon sale or retirement of furniture and fixtures, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in the Condensed Consolidated Statements of Operations. Depreciation for the three months and six months ended June 30, 2012 and 2011 and for the period from September 3, 2009 (inception) through June 30, 2012 was $3,053, $2,548, $5,673, $4,221 and $20,483, respectively.

AUTOMOBILES

Automobiles are stated at cost less accumulated depreciation. Depreciation is provided on the straight-line basis over an estimated useful life of five years. Upon sale or retirement of automobiles, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in the Condensed Consolidated Statements of Operations. The Company’s electrically-charged enabled automobile was placed in service in May 2012. Depreciation for the three months and six months ended June 30, 2012 and 2011 and for the period from September 3, 2009 (inception) through June 30, 2012 was $3,823, $0, $3,823, $0 and $3,823 respectively.

IMPAIRMENT OF LONG-LIVED ASSETS

The Company has adopted paragraph 360-10-35-17 of the FASB ASC for its long-lived assets. The Company’s long-lived assets, which include EV Charging Stations, office and computer equipment, automobile, domain names, and security deposits, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable.

The Company assesses the recoverability of its long-lived assets by comparing the projected undiscounted net cash flows associated with the related long-lived asset or group of long-lived assets over their remaining estimated useful lives against their respective carrying amounts. Impairment, if any, is based on the excess of the carrying amount over the fair value of those assets. Fair value is generally determined using the asset’s expected future discounted cash flows or market value, if readily determinable. If long-lived assets are determined to be recoverable, but the newly determined remaining estimated useful lives are shorter than originally estimated, the net book values of the long-lived assets are depreciated over the newly determined remaining estimated useful lives. The Company determined that there were no impairments of long-lived assets as of June 30, 2012 or December 31, 2011.

DISCOUNT ON DEBT

The Company allocated the proceeds received from convertible debt instruments between the underlying debt instruments and has recorded the conversion feature as a liability in accordance with paragraph 815-15-25-1 of the FASB ASC. The conversion feature and certain other features that are considered embedded derivative instruments, such as a conversion reset provision have been recorded at their fair value within the terms of paragraph 815-15-25-1 of the FASB ASC as its fair value can be separated from the convertible note and its conversion is independent of the underlying note value. The conversion liability is marked to market each reporting period with the resulting gains or losses shown on the Condensed Consolidated Statements of Operations.

DERIVATIVE INSTRUMENTS

The Company evaluates its convertible debt, warrants or other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives to be separately accounted for in accordance with paragraph 810-10-05-4 of the FASB ASC and paragraph 815-40-25 of the FASB ASC. The result of this accounting treatment is that the fair value of the embedded derivative is marked-to-market each balance sheet date and recorded as a liability. In the event that the fair value is recorded as a liability, the change in fair value is recorded in the Condensed Consolidated Statements of Operations as other income or expense. Upon conversion or exercise of a derivative instrument, the instrument is marked to fair value at the conversion date and then that fair value is reclassified to equity.

In circumstances where the embedded conversion option in a convertible instrument is required to be bifurcated and there are also other embedded derivative instruments in the convertible instrument that are required to be bifurcated, the bifurcated derivative instruments are accounted for as a single, compound derivative instrument.

The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is re-assessed at the end of each reporting period. Equity instruments that are initially classified as equity that become subject to reclassification are reclassified to liability at the fair value of the instrument on the reclassification date. Derivative instrument liabilities will be classified in the balance sheet as current or non-current based on whether or not net-cash settlement of the derivative instrument is expected within 12 months of the balance sheet date.

FAIR VALUE OF FINANCIAL INSTRUMENTS

U.S. GAAP for fair value measurements establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three levels. The fair value hierarchy gives the highest priority to quoted market prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). Level 2 inputs are inputs, other than quoted prices included within Level 1, which are observable for the asset or liability, either directly or indirectly. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs.

The carrying amounts of the Company’s financial assets and liabilities, such as cash, prepaid expenses, accounts payable and accrued expenses, approximate their fair values because of the short maturity of these instruments. The Company’s notes and convertible notes payable approximates the fair value of such instrument based upon management’s best estimate of interest rates that would be available to the Company for similar financial arrangement at June 30, 2012 and December 31, 2011.

The Company revalues its derivative liability at every reporting period and recognizes gains or losses in the Condensed Consolidated Statement of Operations that are attributable to the change in the fair value of the derivative liability. The Company has no other assets or liabilities measured at fair value on a recurring basis.

REVENUE RECOGNITION

The Company applies paragraph 605-10-S99-1 of the FASB ASC for revenue recognition. The Company will recognize revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured. Accordingly, when a customer completes use of a charging station, the service can be deemed rendered and revenue may be recognized.

RECLASSIFICATION

During the year ended December 31, 2011, management revised the Company’s operating plan in response to customer requests to purchase charging stations that would be provided and serviced by the Company. Management believes that this type of sales activity will continue and will continue to function as a reseller of charging stations. Accordingly, a sale of equipment that was classified in other income (expense) in the second quarter of 2011 was reclassified to sales revenue.

STOCK-BASED COMPENSATION FOR OBTAINING EMPLOYEE SERVICES

The Company accounts for equity instruments issued to employees and directors pursuant to paragraphs 718-10-30-6 of the FASB ASC, whereby all transactions in which services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more readily measurable. The measurement date used to determine the fair value of the equity instrument issued is the earlier of the date on which the performance is complete or the date on which it is probable that performance will occur.

The Company’s policy is to recognize compensation cost for awards with service conditions and when applicable a graded vesting schedule on a straight-line basis over the requisite service period for the entire award.

EQUITY INSTRUMENTS ISSUED TO PARTIES OTHER THAN EMPLOYEES FOR ACQUIRING GOODS OR SERVICES

The Company accounts for equity instruments issued to parties other than employees for acquiring goods or services under guidance of section 505-50-30 of the FASB Accounting Standards Codification (“FASB ASC Section 505-50-30”). Pursuant to FASB ASC Section 505-50-30, all transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable. The measurement date used to determine the fair value of the equity instrument issued is the earlier of the date on which the performance is complete or the date on which it is probable that performance will occur.

ADVERTISING

The Company expenses non-direct advertising as incurred. Total advertising expense for the three months and six months ended June 30, 2012 and 2011, and for the period from September 3, 2009 (inception) through June 30, 2012 was $75, $317, $75, $4,121, and $12,056, respectively.

INCOME TAXES

The Company follows Section 740-10-30 of the FASB ASC, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are based on the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the Condensed Consolidated Statements of Operations in the period that includes the enactment date.

The Company adopted section 740-10-25 of the FASB ASC (“Section 740-10-25”). Section 740-10-25 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under Section 740-10-25, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Section 740-10-25 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures.

NET LOSS PER COMMON SHARE

Net loss per common share is computed pursuant to section 260-10-45 of the FASB ASC. Basic net loss per common share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period. Diluted net loss per common share is computed by dividing net loss by the weighted average number of shares of common stock and potentially outstanding shares of common stock during the period.

The following table shows the weighted-average number of potentially outstanding dilutive shares excluded from the diluted net loss per share calculation for the three months and six months ended June 30, 2012 and 2011, as they were anti-dilutive (after giving effect to the Reverse Stock-Split):

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

|

Convertible Notes

|

|

|

- |

|

|

|

11,620,245

|

|

|

|

504,078

|

|

|

|

21,139,822 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock

|

|

|

25,000,000 |

|

|

|

25,000,000 |

|

|

|

25,000,000 |

|

|

|

25,000,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

11,933,169 |

|

|

|

7,590,999 |

|

|

|

11,838,745 |

|

|

|

7,577,738 |

|

|

Total Potential Dilutive Shares

|

|

|

36,933,169 |

|

|

|

44,211,244

|

|

|

|

37,342,823 |

|

|

|

53,717,560 |

|

COMMITMENTS AND CONTINGENCIES

The Company follows subtopic 450-20 of the FASB ASC to report accounting for contingencies. Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated.

CASH FLOWS REPORTING

The Company adopted paragraph 230-10-45-24 of the FASB ASC for cash flows reporting, classifies cash receipts and payments according to whether they stem from operating, investing, or financing activities and provides definitions of each category, and uses the indirect or reconciliation method (“Indirect Method”) as defined by paragraph 230-10-45-25 of the FASB ASC to report net cash flow from operating activities by adjusting net income to reconcile it to net cash flow from operating activities by removing the effects of (a) all deferrals of past operating cash receipts and payments and all accruals of expected future operating cash receipts and payments and (b) all items that are included in net income that do not affect operating cash receipts and payments.

SUBSEQUENT EVENTS

The Company follows the guidance in Section 855-10-50 of the FASB ASC for the disclosure of subsequent events. The Company will evaluate subsequent events through the date when the financial statements were issued. Pursuant to ASU 2010-09 of the FASB ASC, the Company as an SEC filer considers its financial statements issued when they are widely distributed to users, such as through filing them on EDGAR.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

A variety of proposed or otherwise potential accounting standards are currently under study by standard-setting organizations and various regulatory agencies. Because of the tentative and preliminary nature of these proposed standards, management has not determined whether implementation of such proposed standards would be material to the condensed consolidated financial statements.

Management does not believe that any other recently issued, but not yet effective accounting pronouncements, if adopted, would have a material effect on the accompanying unaudited condensed consolidated financial statements.

CONVERTIBLE NOTES PAYABLE

Convertible notes payable bear interest of 6% annually which were payable upon maturity on September 25, 2011. The notes have a conversion price of $.0025.

During June, 2010, $5,000 of these notes was converted to 40,000 common shares.

During July, 2010, $10,000 of these notes was converted to 80,000 common shares.

During January, 2011, $4,000 of these notes was converted to 32,000 common shares.

During March, 2011, $50,000 of these notes together with $4,441 of accrued interest were converted to 21,776,544 common shares.

During May and June of 2011, $4,000 of these notes were converted to 1,600,000 common shares.

During July, 2011, $12,500 of these notes were converted to 5,000,000 common shares.

During September, 2011, $10,750 of these notes were converted to 4,300,000 common shares.

On February 29, 2012, the final $3,750 of convertible notes and accrued interest were converted into 1,529,036 common shares.

Subsequent to this transaction, there are no outstanding convertible notes.

DERIVATIVE ANALYSIS

Upon their origination, these notes had full reset adjustments based upon the issuance of equity securities by the Company in the future, they were subjected to derivative liability treatment under Section 815-40-15 of the FASB ASC (“Section 815-40-15”) (formerly FASB Emerging Issues Task Force (“EITF”) 07-5). These notes have been measured at fair value using a lattice model at each reporting period with gains and losses from the change in fair value of derivative liabilities recognized on the consolidated statement of operations. The convertible notes gave rise to a derivative liability which was recorded as a discount to the notes upon origination.

The embedded derivative of these notes was re-measured at December 31, 2010 yielding a gain on change in fair value of the derivative of $3,097,216, net of conversions to common stock, for the year ended December 31, 2010 and a loss of $5,799,110 for the period from September 3, 2009 through December 31, 2009. The derivative value of these notes at December 31, 2010, yielded a derivative liability at fair value of $2,701,894. During the year ended December 31, 2010, the Company converted $15,000 in convertible notes payable to 120,000 shares of common stock. The conversion resulted in a reduction of the derivative liability and increase to paid-in capital of approximately $553,000.

In March, 2011, the Company issued 21,776,544 common shares pursuant to the conversion of $50,000 in notes payable together with $4,441 of accrued interest. This conversion was negotiated to mitigate the effect of the 1:50 Reverse-Split on the note conversion price which Management determined could have significantly dilutive effects due to its resets and toxic convertible features.

In March, 2011, agreements between the Company and the remaining note holders to fix the conversion rate stated in the convertible notes effectively removed the embedded derivative from the convertible notes. Accordingly, as future conversions were no longer subject to reset, the derivative liability related to the notes was adjusted to $0 and the Company recognized a gain on the change in value of the derivative liability of $2,701,894 upon execution.

NOTE PAYABLE

In connection with the purchase of an electrically charged enabled automobile by the Company in the first quarter, the Company entered into a financing agreement. The five-year note, secured by the related asset, bears interest at 4.75% and requires minimum monthly payments, inclusive of interest, of $1,216 commencing in May 2012. Future minimum monthly note payments, exclusive of interest, by year are as follows:

|

Year

|

|

Amount

|

|

|

2013

|

|

$

|

11,817

|

|

|

2014

|

|

|

12,400

|

|

|

2015

|

|

|

13,013

|

|

|

2016

|

|

|

13,655

|

|

|

2017

|

|

|

11,893

|

|

|

Total

|

|

$

|

62,778

|

|

|

4.

|

COMMON STOCK EQUIVALENTS

|

SUBSCRIPTION WARRANTS

In connection with the closing of the Share Exchange Agreement, on December 7, 2009 the Company entered into a Subscription Agreement for the sale of 61,333 units of securities of the Company aggregating $920,000. Each unit consisted of one share of common stock and a warrant to purchase one share of Company’s common stock exercisable at $.60 per share. The exercise price was subject to a full ratchet reset feature. 16,667 of these warrants were cancelled in 2010. The remaining warrants were adjusted due to a sale of common stock for cash at $3.00 per share, resulting in 446,665 warrants outstanding. The fair value of these warrants granted, were estimated on the date of grant, and recorded as a derivative liability. The derivative was re-measured at December 31, 2010 using their reset value yielding a gain on the change in fair value of $225,579 for the year ended December 31, 2010 and a loss in fair value of $1,182,375 during the period from September 3, 2009 through December 31, 2009, the outstanding liability for the related derivative liability was $636,220 at December 31, 2010. As further disclosed in Note 5, in October 2011, the warrant holders agreed to the cancellation of their outstanding warrants in exchange for 565,000 shares of common stock. This agreement effectively eliminated the remaining derivative liability associated with these warrants of approximately $80,000.

As of May 5, 2010, 3,834 additional units aggregating $57,500 were issued under a private placement. Each unit consisted of one share of common stock and a warrant to purchase one share of Company’s common stock exercisable at $30.00 per share. The related warrants issued in this place did not contain a full ratchet reset.

In connection with the closing of the Share Exchange Agreement, on December 7, 2009 the Company also issued warrants to purchase 500,000 shares of Company’s common stock exercisable at $.60 per share. The exercise price was subject to a full ratchet reset feature. These warrants were adjusted due to a sale of common stock for cash at $3.00 per share, resulting in 100,000 warrants. The derivative for these 100,000 warrants was re-measured at December 31, 2010 yielding a derivative liability of $129,749, resulting in a gain on change in fair value for the year ended December 31, 2010 of $15,589 and a loss in fair value of $1,182,375 during the period from September 3, 2009 through December 31, 2009. The outstanding liability for the related derivative liability was $129,749 at December 31, 2010. In October 2011, the Company executed an agreement with the warrant holder which eliminated the reset feature of these warrants. As a result of this agreement, the derivative liability associated with the reset is no longer present and the gain on the remaining fair value of approximately $17,500 was recognized.

COMPENSATION WARRANTS

On April 1, 2010, the Company issued 55,000 warrants to purchase shares of the Company’s common stock, 5,000 at an exercise price of $15.00 and 50,000 warrants exercisable at $30.00 per share.

On April 12, 2010, the Company issued 5,000 warrants to purchase shares exercisable at $42.50 per share. The fair value of these warrants, estimated on the date of grant, was recorded as an expense for consulting services of $32,355.

On April 27, 2010, the Company issued warrants to purchase 440,000 shares of Company’s common stock exercisable at $15 per share. The exercise price of these 440,000 shares was subject to a full ratchet reset feature. These warrants were adjusted in June 2011 due to a sale of common stock for cash at $3.00 per share, resulting in 2,200,000 warrants. The fair value of all of these warrants, estimated on the date of grant, was recorded as compensation expense of $3,099,009.

On August 25, 2010, the Company issued 1,033,433 warrants to purchase shares of the Company’s common stock exercisable at $15 per share. The exercise price of these warrants was subject to a full ratchet reset feature. These warrants were adjusted in June 2011 due to a sale of common stock for cash at $3.00 per share, resulting in 5,167,565 warrants. The Company also issued 10,000 warrants to purchase shares of the Company’s common stock exercisable at $51.50 per share. The fair value of all of the warrants, estimated on the date of grant, was recorded as compensation expense of $3,896,075.

On February 17, 2011, the Company issued 50,000 warrants to purchase shares of the Company’s common stock exercisable at $20 per share. The fair value of all of the warrants, estimated on the date of grant, was recorded as compensation expense of $483,583.

On July 18, 2011, the Company issued 1,277,170 warrants to purchase shares of the Company’s common stock exercisable at $1.66 per share. The fair value of all of the warrants, estimated on the date of grant, was recorded as other operating incentive expense of $528,111.

On August 10, 2011, the Company issued 200,000 warrants to purchase shares of the Company’s common stock exercisable at $2.50 per share; 500,000 warrants to purchase shares of the Company’s common stock exercisable at $5.00 per share; 500,000 warrants to purchase shares of the Company’s common stock exercisable at $7.50 per share; and 500,000 warrants to purchase shares of the Company’s common stock exercisable at $10.00. The fair value of all of these warrants, estimated on the date of grant, was recorded as consulting compensation expense of $81,633.

On September 23, 2011, the Company issued 100,000 warrants to purchase shares of the Company’s common stock exercisable at $3.00 per share. The exercise price was subject to a full ratchet reset feature. As a result, the fair value of these warrants, estimated on the date of grant, was recorded as a derivative liability and related discount of short-term notes of $20,751. On October 24, 2011, the warrants were amended to remove the ratchet feature and the exercise price was reduced to a $1.00 per share. The note was paid in full in November 2011 and the remaining discount recorded as interest expense.

On November 15, 2011, the Company issued 250,000 warrants to purchase shares of the Company’s common stock exercisable at $1.50 per share. The fair value of all of the warrants, estimated on the date of grant, was recorded as consulting compensation expense of $77,993.

In October 2011, the Company executed agreements with certain employees and consultants which eliminated the reset feature of 7,467,165 warrants. As of December 31, 2011 all outstanding warrants have fixed exercise prices.

The fair value of all warrant issuances through December 31, 2011 was computed using the Lattice Model, incorporating transaction details such as stock price, contractual terms, maturity and risk free rates, as well as assumptions about future financing, volatility and holder behavior.

On January 16, 2012, the Company, in connection with the hire of a Chief Operating Officer, issued 1,000,000 warrants, at an exercise price of $1.75 per warrant that vest over a three year period, subject to continued employment.

On March 27, 2012, the Company, in connection with the hire of a Sales Manager, issued 15,000 warrants, at an exercise price of $1.75 per warrant that vest over a three year period, subject to continued employment.

The fair value of the warrants on the date of the grant issued for the six months ended June 30, 2012, was estimated at approximately $1.7 million and $26,000, respectively, which will be recognized over the respective service periods. The fair value of the options on the grant date was estimated using a Black-Scholes valuation model and the following assumptions: (1) expected volatility of nearly 390% based on historical volatility, (2) a discount rate of 2.11%, (3) expected life of 3 years and (4) zero dividend yield. The fair value of the warrants was determined based on the closing price of the Company’s common stock on the date of grant. The Company recognized compensation cost related to the vesting of these warrants of $142,864 and $236,651 in the three months and six months periods ended June 30, 2012, respectively.

The following table summarizes outstanding warrants by Expiration Date at June 30, 2012:

|

Quantity

|

|

Exercise Price

|

|

Expiration Date

|

| |

|

|

|

|

|

200,000

|

|

$2.50

|

|

August 10, 2012

|

|

515,000

|

|

$3.00

|

|

August 25, 2012

|

|

100,000

|

|

$3.00

|

|

December 7, 2012

|

|

5,000

|

|

$15.00

|

|

April 1, 2013

|

|

50,000

|

|

$30.00

|

|

April 1, 2013

|

|

2,200,000

|

|

$3.00

|

|

April 27, 2013

|

|

500,000

|

|

$5.00

|

|

August 10, 2013

|

|

500,000

|

|

$7.50

|

|

August 10, 2013

|

|

500,000

|

|

$10.00

|

|

August 10, 2013

|

|

4,652,165

|

|

$3.00

|

|

August 25, 2012

|

|

10,000

|

|

$51.50

|

|

August 25, 2013

|

|

1,277,170

|

|

$1.66

|

|

July 13, 2014

|

|

250,000

|

|

$1.50

|

|

November 15, 2014

|

|

3,834

|

|

$30.00

|

|

May 5, 2015

|

|

50,000

|

|

$20.00

|

|

January 11, 2016

|

|

300,000

|

|

$1.75

|

|

January 16, 2016

|

|

5,000

|

|

$1.75

|

|

March 19, 2016

|

|

300,000

|

|

$1.75

|

|

January 16, 2017

|

|

5,000

|

|

$1.75

|

|

March 19, 2017

|

|

400,000

|

|

$1.75

|

|

January 16, 2018

|

|

5,000

|

|

$1.75

|

|

March 19, 2018

|

|

100,000

|

|

$1.00

|

|

September 22, 2018

|

| 11,928,169 |

|

|

|

|

|

Warrants Outstanding as of June 30, 2012

|

|

Range of Exercise Price

|

Number

Outstanding

|

Weighted Average

Contractual Life (in years)

|

|

|

Weighted Average

Exercise Price

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

$1.00-$51.50

|

11,928,169

|

2.17

|

|

|

|

|

The Company is authorized to issue 500,000,000 shares of common stock and 40,000,000 shares of preferred stock.

PREFERRED STOCK

Series A Convertible Preferred Stock

In connection with the closing of the Share Exchange Agreement, on December 7, 2009 the Company issued 10,000,000 shares of Series A Convertible Preferred Stock with a par value of $0.001.

The Series A has five (5) times the number of votes on all matters to which common shareholders are entitled, bears no dividends, has a liquidation value eight times that sum available for distribution to common stock holders and is convertible at the option of the holder after the date of issuance at a rate of 2.5 shares of common stock for every preferred share issued however, the preferred shares cannot be converted if conversion would cause the holder to own more than 4.99% of the outstanding shares of common stock (or after 61 days up to 9.99%).

Series B Convertible Preferred Stock

On February 6, 2012, the Company entered into a stock purchase agreement to sell 1,000,000 shares of a new class of preferred stock at per share price of $1.00. The Series B has one vote per share in CarCharging Limited, a subsidiary formed in June 2012, as if the shares were converted into common stock as of the date immediately prior to the record date for determining the stockholders eligible to vote on any such matter, bears no dividends and is junior to Series A Preferred stock with respect to dividends and distribution of assets. The preferred stock, has been authorized and issued as Series B Convertible Preferred Stock as of June 28, 2012. At the discretion of the Purchaser, the shares are convertible into (i) one percent (1%) of the issued and outstanding common stock of CarCharging, Limited for every 500,000 shares of Series B Preferred Stock until February 6, 2017 or (ii) the Purchaser may convert each share of Series B Preferred Stock into Common Stock of the Company on a one for one basis during the period of July 1, 2015 through December 31, 2015. The agreement includes an option to purchase an additional 1,500,000 shares of the Series B Preferred stock at an exercise price of $1.00 per share within 60 days of the issuance of the original 1,000,000 shares. Simultaneously with the issuance of the original 1,000,000 Series B Preferred shares, the Purchaser was entitled to receive two percent (2%) of the issued and outstanding common stock of CarCharging Limited in exchange for consulting services for developing business relationships and obtaining charging station locations in Romania. Additionally, if the Purchaser exercises its options in the initial stock purchase agreement, it will receive additional payment for its consulting services for developing business relationships and obtaining charging station locations in Greece in the form of three percent (3%) of the total outstanding common stock of CarCharging Limited. The Company received the $900,000, net of issuance costs, in February 2012 and issued 1,000,000 shares of the Series B Convertible Preferred Stock in June 2012. The fair value of the option to purchase additional shares on the date the Series B Preferred shares were issued was estimated at approximately $226,000, which has been credited to Additional Paid In Capital. The fair value of the option on the stock issuance date was estimated using a Black-Scholes valuation model and the following assumptions: (1) expected volatility of nearly 54% based on historical volatility (2) a discount rate of 0.65%, (3) expected life of 60 days and (4) zero dividend yield. The fair value of the option was determined based on the closing price of the Company’s common stock on the date of the stock issuance.

COMMON STOCK

On December 7, 2009 the Company entered into a Subscription Agreement for the sale of 61,333 units of securities of the Company aggregating $920,000. Each unit consisted of one share of common stock and a warrant to purchase one share of Company’s common stock exercisable at $30.00 per share. The Company received $885,000, which was net of costs of $35,000.

On February 19, 2010, the Company issued 92,000 shares of its common stock at $.05 per share, to extinguish a debt to its founders of $4,600 included in accounts payable. The stock was treated as founders’ shares and issued at its par value of $0.001.

On February 19, 2010, the Company issued 8,500 shares of its common stock at $15 per share, for services performed with a fair value of $127,500.

On May 5, 2010, the Company issued 3,834 shares of common stock at $15.00 per share with warrants attached exercisable at $30.00 per share. See the description of warrants with embedded derivatives in Note 5 above for a more complete description of this transaction.

During June 2010, the Company issued 40,000 shares of common stock at $.125 each, in exchange for $5,000 of convertible notes payable. During July 2010 the Company issued 80,000 shares of common stock at $.125 each, in exchange for $10,000 of convertible notes payable. During January 2011, the Company issued 32,000 shares of common stock at $.125 each, in exchange for $4,000 of convertible notes payable. During March, 2011, the Company issued 21,776,544 common shares in exchange for $50,000 of convertible notes payable and related interest of $4,441. See the derivative analysis of this transaction in Note 3 above for a description of this transaction.

On July 30, 2010, the Company issued 36,667 shares of common stock at $15.00 per share.

On August 19, 2010, the Company issued 6,000 shares of its common stock at $ 51.50 per share, for services performed with a fair value of $ 309,000.

On September 7, 2010, the Company issued 66,667 shares of common stock at $15.00 per share, together with 6,667 shares of common stock for services performed in connection with the sale of these share. The Company received $886,005, which was net of costs of $113,995.

On January 3, 2011, the Company issued 250 shares of common stock in payment of $17,000 in services that had been received during 2010. In addition, the Company entered into a continuing services agreement that provides for issuance of $1,500 of common stock per month. The Company issued 3,706 shares of common stock during the three months ended March 31, 2011, in accordance with the agreement.

On February 4, 2011, the Company issued 3,000 shares of common stock in payment of $81,000 in services.

During June, 2011, the Company issued 1,005 shares of common stock in payment of $3,000 in services and issued 333,333 shares for cash at $3.00 per share.

During July, 2011, the Company issued 50,000 shares of common stock at $1.80 per share for services performed.

During August, 2011, the Company issued 400,000 shares of common stock at $1.25 per share for services performed.

During September, 2011, the Company issued 17,482 shares of common stock in exchange for forgiveness of a $25,000 account payable.

During October, 2011, the Company issued 3,527 shares of stock in exchange for $6,000 worth of services.

In October 2011, the Company entered into an agreement with three warrant holders, whereby the Company issued 565,000 shares of common stock in exchange for warrants to purchase 446,665 shares. The exchange agreement terminates all rights associated with the warrants. Due to the reset feature of these warrants, they represented a derivative liability of approximately $80,000 at the time of the exchange. The Company elected to treat this transaction in accordance with ASC 470-50-40 “Extinguishment of Debt”. Per the ASC, the Company recognized a loss for the excess of consideration in the form of common stock given over the fair value of the extinguished instrument. On the measurement date, the fair value of the common stock issued was $1.00 per share and the warrants had a combined fair market value of $80,000. The exchange resulted in the Company recording a loss on the conversion of $485,000, which was recorded as a Loss on Exchange in the Other Income (Expense) section of the Consolidated Statement of Operations for the year ended December 31, 2011.

In November, 2011, the Company entered into a stock purchase agreement for 2.5 million shares of common stock in exchange for $2.5 million in cash. In accordance with this agreement, the Company issued 1,500,000 shares of common stock at $1.00 per share. The agreement called for the issuance of 500,000 additional shares to be issued in March of 2012, funding of which was received on April 3, 2012 and 500,000 additional shares to be issued in June of 2012, funding of which was received on June 28, 2012, each at $1.00 per share. Issuance costs associated with this transaction totaled $190,000. The stock subscription, net of common share amount to be issued, resulted in stock subscription receivable of $999,000 at December 31, 2011.

During December, 2011, the Company issued 5,000 shares in connection with the receipt of a loan resulting in a discount on the loan of approximately $21,000. The loan was paid in full prior to year end and the discount was recognized as interest.

During 2011, the Company issued 32,708,544 shares of common stock pursuant to the conversion of $81,250 in convertible notes payable, as further described in Footnote 3. On February 29, 2012, the final $3,750 of convertible notes and related interest were converted into 1,529,036 of common stock.

Subsequent to this transaction, there are no outstanding convertible notes.

On January 6, 2012, the Company issued 50,000 shares of common stock, at $1.00 per share, related to a stock purchase agreement executed in 2011.

On February 27, 2012, the Company, in connection with the hire of a Chief Financial Officer and Director, issued 75,000 shares of restricted common stock at $1.95 per share.

On February 27, 2012, the Company entered into a stock purchase agreement for 500,000 shares of restricted common stock in exchange for $500,000 cash.

On February 29, 2012, the Company issued 250,000 shares of common stock in connection with a consulting agreement at $1.80 per share.

On April 23, 2012 and May 21, 2012, the Company issued 4,930 shares of common stock at $1.72 per share and 12,400 shares of common stock at $1.25 per share, respectively, in exchange for services valued at $23,980.

On May 21, 2012 the Company granted an employee the right to receive 15,000 shares of its common stock valued $1.25 per share upon the anniversary date of the grant and the continued employment of the employee with the Company.

The Company paid consulting fees to a company that is owned by its Chief Executive Officer amounting to $0, $30,000, $0, $60,000 and $306,000 for the three months and six months ended June 30, 2012 and 2011, and for the period from September 3, 2009 (inception) through June 30, 2012, respectively. These fees were paid pursuant to the terms of a two-year support services contract that was in place prior to the CEO’s employment. Additionally, the Company paid commissions totaling $40,250 during the three months ended June 30, 2012 to this company for business development related to installations of EV stations by the Company in accordance with the support services contract.

The Company incurred accounting and tax service fees totaling $31,560 for the six months ended June 30, 2012 provided by a company that is partially owned by the Company’s Chief Financial Officer.

On March 29, 2012, the Company entered into a patent license agreement with a stockholder of the Company and a related party under common ownership. Under terms of the agreement, the Company has agreed to pay royalties to the licensors equal to 10% of the gross profits received by the Company from bona fide commercial sales and/or use of the licensed products and licensed processes. As of June 30, 2012, the Company has not paid any royalty fees related to this agreement.

The Company has entered into several contracts that obligate it to future office space lease payments and consulting contracts for financial and investor relations services. The following is a summary of these commitments:

|

a.

|

On March 31, 2011, the Company entered into a three (3) year lease for office space at approximately $132,480 per year, with an option to renew for an additional three years at approximately $137,655 per year. In the fourth quarter of 2011, the office owner space declared bankruptcy and the Company has not been required to pay any rent payments. However, the Company had continued to accrue monthly rent based on the contracted amount through December 31, 2011 and $55,200 has been accrued for in accounts payable and accrued expenses as of June 30, 2012 and December 31, 2011, respectively. In addition, the Company wrote off the related $34,000 security deposit, as it is not expected to be recovered.

|

On May 4, 2012, the Company entered into a 39 month lease for 4,244 square feet of office space in Miami Beach, Florida commencing as of March 1, 2012. The lease requires a security deposit of $33,952 and initial annual minimum rental payment of $135,808 with annual increase of approximately 3% over the life of the lease and a rent holiday for the first three months of the lease. The lease contains one-three year option to renew based upon notice as defined by the lease at prevailing rates at such time. The deferred rent on the Condensed Consolidated Balance Sheet at June 30, 2012 represents the excess of the minimum monthly straight line payments over the life of the lease over the actual lease payments made as of June 30, 2012.

On March 22, 2012, the Company entered into a three year lease for 1,543 square feet of office space in San Jose, California commencing on April 1, 2012. The lease requires a security deposit of $7,869 and initial annual minimum rental payment of $29,626 with annual increase of approximately 3% over the life of the lease. The lease contains one-three year option to renew based upon notice as defined by the lease at prevailing rates at such time.

Total rent expense for the three months and six months ended June 30, 2012 and June 30, 2011 and for the period from September 3, 2009 (inception) through June 30, 2012 was $51,018, $25,954, $53,487, $46,363 and $272,719, respectively.

Future minimum monthly rental commitments relating to the Miami Beach and San Jose leases are as follows:

|

Year

|

|

Amount

|

|

|

2013

|

|

$ |

176,170 |

|

|

2014

|

|

|

180,831 |

|

|

2015

|

|

|

164,930 |

|

|

Total

|

|

$ |

521,931 |

|

|

b.

|

Pursuant to the terms of the amendment of March 30, 2012 master agreement, the Company has committed to purchase 500 charging stations over the year, at prices ranging from $2,500 to $2,700 per unit. If the Company fails to take delivery of the total specified number units, it will be responsible for reimbursement of certain price discounts on units previously received. As of June 30, 2012, the Company has purchased 90 units under this master agreement. In the opinion of the Company’s management, the vendor has not performed in accordance with the terms of the master agreement. As of June 30, 2012, the ultimate resolution of this matter is unknown.

|

|

c.

|

The Company has certain lawsuits pending. The first is for past due fees due to a consulting firm in the amount of $41,000. Although the outcome of this matter is uncertain, the Company has reserved for this amount in accounts payable and accrued expenses at June 30, 2012 and December 31, 2011. Additionally, in March and April 2012, a former officer and director of the Company filed declaratory actions against the Company relating to compensatory matters, certain warrant exercise rights and the termination of his employment. No determination can be made as to the outcome of this matter at this time. Management believes these suits to be without merit and intends to vigorously defend itself.

|

The Company has evaluated all events that occurred after the balance sheet date through the date these condensed consolidated financial statements were issued.

On July 16, 2012, the Company announced that it has entered into a term sheet to acquire 350Green LLC, an owner and operator of EV charging stations throughout the United States. The deal is subject to the negotiation of the final terms of the definitive agreement and regulatory approval, and is anticipated to close between thirty and seventy-five days after the definitive agreement is signed.

In July 2012, the Company issued 100,000 shares of common stock at $1.30 per share for consulting and equity funding services rendered through June 30, 2012 which are included in accounts payable and accrued expenses as of June 30, 2012.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation

Cautionary Notice Regarding Forward Looking Statements

This Quarterly Report on Form 10-Q (this “Report”) contains “forward-looking statements” within the meaning of the Section 27A of the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future operations, future cash needs, business plans and future financial results, and any other statements that are not historical facts.

From time to time, forward-looking statements also are included in our other periodic reports on Form 10-K, Forms 10-Q and 8-K, in our press releases, in our presentations, on our website and in other materials released to the public. Any or all of the forward-looking statements included in this Report and in any other reports or public statements made by us are not guarantees of future performance and may turn out to be inaccurate. These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

For discussion of factors that we believe could cause our actual results to differ materially from expected and historical results see “Item 1A — Risk Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on April 16, 2012.

Overview

We provide an electric charging service for the electric vehicle (EV) automobile market, delivering convenient access for EV drivers to refuel their automobiles wherever they live, work and play. We seek to become a leading provider of EV charging services throughout North America and ultimately in Europe and Asia. In order for electric vehicles to become a mainstream reality, public EV charging stations need to be in place and readily available to consumers nationally.

We install electric charging services where EV owners are likely to live, commute, and shop, leading to a higher utilization on every installation investment. We contract with property owners and managers who control locations in high traffic areas where there is accelerating consumer adoption of electric cars as a less expensive means of transportation coupled with a focus on greenhouse gas savings.

We install fast charging stations, enabling most EV owners to fully recharge their batteries from empty in about four hours. However, most drivers will use our service to “top off” their batteries, to re-energize their batteries from approximately half a charge to a full charge. We set prices based on a variety of factors, some of which are local electricity tariffs, location, and competitive services. The stations that provide our service are sourced from a third party today, most of which are purchased from Coulomb Technologies.

Our approach is to become a strategic partner with property owners, who own high value real estate, and to demonstrate the value we offer their locations. Consumers seek businesses that support energy conservation and our service provides a differentiator for those real estate owners who want to promote themselves as supporters of the “green” movement. Electric vehicle charging provides this missing component for many property owners. Furthermore, our business model provides for the potential for increased revenue per parking spot. We offer the property owner a share in the revenue stream generated from the charging sessions as well as any other revenue derived from the location.

Over the past year and half, we have entered into contracts with and generated strong relationships with many of the essential property owners required to build a profitable charging business. Real estate segments we have established strong ties with include apartment complexes/MDUs for residential living, REITs, national parking garage owners and managers, retailers, shopping centers and malls, high population density municipalities, and office parks. Partnerships under contract in the parking market segment include ICON, Central, ACE, and LAZ Parking.

In the residential arena, contracts include Equity Residential, and Kettler. In the commercial venue, we have agreements with Forest City and Equity One. In the retail segment, relationships include Walgreens, Mall of America, Aventura Mall, and Four Seasons in Miami. Lastly, municipalities own and operate prime locations where we have relationships and those include the Pennsylvania Turnpike Hollywood, Florida, Norwalk, Connecticut and Dania Beach, Florida.

Our main source of revenue will be derived from the electric charging services, with pricing set as an hourly rate or on a per kilowatt hour rate. As more states adopt electricity deregulation, we will be in a more advantageous position to competitively price our service vis-a-vis refueling at home. As a first mover in the EV infrastructure category, we are set to capitalize on the opportunities presented by this emerging industry.

We are able to facilitate the purchase of EV charging stations through our wholly owned subsidiary, eCharging Stations, LLC. The installation and maintenance of the EV charging equipment is subcontracted through approved local vendors. It is competitively bid so as to maintain the lowest installation and on-going costs possible.

During the six months ended June 30, 2012, we have installed 56 charging units at 30 additional locations, bringing the total number of charging units and locations that we currently service to 164 and 94, respectively.

History

We were incorporated in October 2006 in Nevada with the intention of providing personal consultation services to the general public. On December 7, 2009, we entered into a Share Exchange Agreement with Car Charging, Inc., a Delaware corporation (“Car Charging”).

At closing, pursuant to the majority consent of our board of directors and shareholders, we approved (i) an amendment to our Articles of Incorporation changing our name to Car Charging Group, Inc. and (ii) the authorization of 20,000,000 shares of preferred stock of the Company; subsequently amended to 40,000,000 shares of preferred stock. Additionally, we filed a Certificate of Designation with the state of Nevada designating rights to the authorized preferred stock of the Company.

During February, 2011, the Shareholders and Board of Directors authorized a decrease of our issued and outstanding common stock, in the form of a reverse stock-split, on a one-for-fifty (1:50) basis (the “Reverse Stock-Split”). All share and per share amounts included in the consolidated financial statements have been adjusted retroactively to reflect the effects of the Reverse Stock-Split.

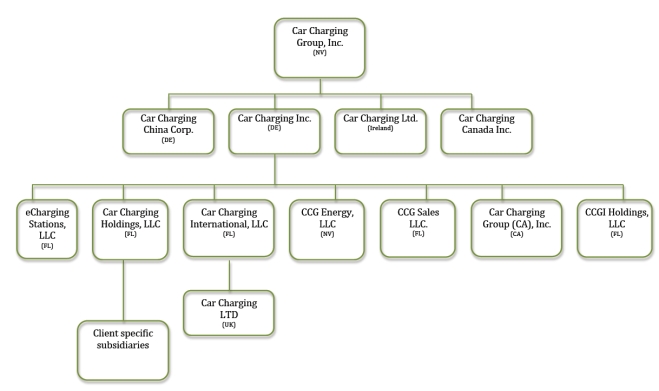

Corporate Structure

Car Charging Group, Inc. is the parent company of Car Charging, Inc., a Delaware corporation, which serves as the main operating company and is, in turn, the parent company of several distinct wholly-owned subsidiary operating companies.

Results of Operations

For the three months ended June 30, 2012 and 2011

Revenues

We generated revenues of $3,410 from service fees related to installed EV Charging Stations for the three months ended June 30, 2012. The Company did not derive any service fee revenue from operations for the three months ended June 30, 2011. While our primary strategy is to earn revenue through the installation and maintenance of EV Charging Stations, we will sell EV Charging Stations on occasions when the opportunity presents itself. During the quarter ended June 30, 2012, we sold 68 EV Charging Stations to a customer for a total price of $231,472 and at a gross profit of $44,416. During the quarter ended June 30, 2011, we sold seven EV Charging Stations to a customer for $59,490 at a loss of $1,340.

Operating Expenses

Operating expenses include selling, marketing and advertising, payroll, administrative, finance and professional expenses.

Compensation expense increased by $264,279 from $322,899 for the three months ended June 30, 2011 to $587,178 for the three months ended June 30, 2012. The increase was attributable to higher payroll costs as a result of the hiring of a Chief Operating Officer and controller, the hiring of additional employees to support the growth in the number of EV Charging Station installations and higher non-cash compensation costs as result of the issuance of warrants.

Other operating expenses increased by $55,134 from $124,278 for the three months ended June 30, 2011 to $179,412 for the three months ended June 30, 2012. The increase was attributable to an increase in rent due to the new leases executed during 2012 and travel costs as a result of the increase in the number of EV Charging Station installations.

General and administrative expenses decreased by $39,768 from $217,329 for the three months ended June 30, 2011 to $177,561 for the three months ended June 30, 2012. The decrease was primarily as a result of a decrease in outside consulting expenses during the three months ended June 30, 2012.

Operating Loss

Our operating loss for the three months ended June 30, 2012 increased by $231,861 as compared to the three months ended June 30, 2011 from $665,846 in 2011 to $897,707 in 2012 primarily as a result of increase in compensation expenses and other operating expenses offset by an increase in sales and a decrease in general and administrative expenses.

Other Income (Expense)

Other expense decreased from $63,998 for the three months ended June 30, 2011 to $509 for the three months ended June 30, 2012 primarily as result of the notes payable outstanding during the 2011 being converted into common stock subsequently thereafter.

Net Income (Loss)

Our net loss for the three months ended June 30, 2012 increased by $168,372 to $898,216 as compared to $729,844 for the three months ended June 30, 2011. The increase was attributable to a net increase in operating expenses of $279,645 offset by a decrease in other expenses of $63,489 and an increase in gross profit of $47,784.

For the six months ended June 30, 2012 and 2011

Revenues

We generated revenues of $6,015 from service fees related to installed EV Charging Stations for the six months ended June 30, 2012. We did not derive any revenue from service fees for the six months ended June 30, 2011. While our primary strategy is to earn revenue through the installation and maintenance of EV Charging Stations, we will sell EV Charging Stations on occasions when the opportunity presents itself. During the six months ended June 30, 2012, we sold 68 EV Charging Stations to a customer for a total price of $231,472 and at a gross profit of $44,416. During the six months ended June 30, 2011, we sold seven EV Charging Stations to a customer for a total price of $59,490 and at a loss of $1,340.

Operating Expenses

Operating expenses include selling, marketing and advertising, payroll, administrative, finance and professional expenses.

Compensation expense increased by $145,538 from $970,419 for the six months ended June 30, 2011 to $1,115,957 for the six months ended June 30, 2012. The increase was attributable to higher payroll costs as a result of the hiring of a Chief Operating Officer and controller, the hiring of additional employees to support the growth in the number of EV Charging Station installations and higher non-cash compensation costs as result of the issuance of warrants.

Other operating expenses increased by $78,544 from $225,676 for the six months ended June 30, 2011 to $304,220 for the six months ended June 30, 2012. The increase was attributable to an increase travel costs as a result of the increase in the number of EV Charging Station installations offset by a decrease in website design and hosing expenses.

General and administrative expenses increased by $639,687 from $419,257 for the six months ended June 30, 2011 to $1,058,944 for the six months ended June 30, 2012. The increase was primarily as a result of an increase in non-cash outside consulting expenses during the three months ended March 31, 2012, an increase in depreciation expense relating to EV Charging Stations due to an increase in installations during the 2012 period and an increase in professional fees.

Operating Loss

Our operating loss for the six months ended June 30, 2012 increased by $813,788 as compared to the six months ended June 30, 2011 from $1,616,692, in 2011 to $2,430,480 in 2012 primarily as a result of increase in compensation expenses, operating expenses and general and administrative expenses offset by an increase in sales

Other Income (Expense)

Other income decreased from $3,257,431 for the six months ended June 30, 2011 to other expense of $542 for the six months ended June 30, 2012 primarily as result of a one-time gain of $3,278,163 from the change in fair value of a derivative liability in 2011.

Net Income (Loss)

Our net loss for the six months ended June 30, 2012 increased by $4,071,761 to $2,431,022 as compared to net income of $1,640,739 for the six months ended June 30, 2011. The increase was attributable to an increase in operating expenses of $863,769, other expense of $3,257,973 offset by an increase in gross profit of $49,981.

Period from September 3, 2009 (date of inception) through June 30, 2012

Our cumulative net operating loss since inception is attributable to the fact that we have not derived significant revenue from operations to offset our business development expenses. Losses from operations since inception have amounted to $16,081,839 (including non-cash charges of $10,741,287 which includes the estimated value of warrants and common stock issued for services) primarily consisting of consulting, professional fees and public/investor relations fees. Our officers and staff have initiated a number of negotiations to install the selected charging stations through-out the United States and Europe. Manufacture and supply of electric vehicles that will require utilization of our services is not anticipated to be significant until the last calendar quarter of 2014; this gives us adequate time to develop its distribution plan, but also requires that we continue to develop capital sources.

Liquidity and Capital Resources

On February 6, 2012, we entered into a stock purchase agreement to sell 1,000,000 shares of Series B preferred stock at per share price of $1.00. The agreement includes an option to purchase an additional 1,500,000 shares of the Series B Preferred stock at an exercise price of $1.00 per share within 60 days of the issuance of the original 1,000,000 shares in June 2012. Simultaneously with the issuance of the original 1,000,000 Series B Preferred shares, Purchaser was entitled to receive two percent (2%) of the issued and outstanding common stock of CarCharging Limited (a subsidiary formed June 2012) in exchange for consulting services for developing business relationships and obtaining charging station locations in Romania. Additionally, if the Purchaser exercises its options in the initial stock purchase agreement, it will receive additional payment for their consulting services for developing business relationships and obtaining charging station locations in Greece in the form of 3% of the total outstanding common stock of CarCharging Ltd. We received the $900,000, net of issuance costs, in February 2012 and have issued 1,000,000 shares of Series B Preferred Stock as of June 28, 2012.

On February 27, 2012, we entered into a stock purchase agreement for 500,000 shares of restricted common stock in exchange for $500,000 cash.

We have financed our activities from sales of our capital stock and from loans from unrelated and related parties. A significant portion of the funds raised from the sale of capital stock has been used to cover working capital needs such as personnel and office expenses and various consulting and professional fees.

For the six months ended June 30, 2012 and 2011, we used cash of $1,407,435 and $1,024,779 for operations, respectively, and $5,275,648 since inception. Such cash use and accumulated losses have resulted primarily from costs related to various personnel, consulting and professional fees and costs. During the six months ended June 30, 2012, cash used for investing activities consisted of $528,550 for purchases of electric vehicle charging stations, automobile, domain names and office equipment as compared with $154,789 for the six months ended June 30, 2011. Cash provided by financing activities for the six months ended June 30, 2012 was $2,258,085 of which $1,360,000 was from the sale of shares of our common stock, net of issuance costs, and $900,000 from the sale of shares of our preferred stock, net of issuance costs, as compared to $999,999 provided by net proceeds from the sale of shares of our common stock for the six months ended June 30, 2011. The net increase in cash during the six months ended June 30, 2012 was $322,100 as compared with a net decrease of $179,569 for the six months ended June 30, 2011.

Since its inception, we have used cash for investing activities of $1,186,523 for the purchase of fixed and other assets and we have received cash provided by financing activities of $100,000 from notes payable and $7,093,045 from sales of shares of our preferred and common stock.

Off Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Not required for smaller reporting companies.

Item 4. Controls and Procedures

Disclosure controls and procedures An evaluation was conducted by the Company’s principal executive officer and principal financial officer of the effectiveness of the design and operation of the Company’s “disclosure controls and procedures,” as such term is defined in Rule 13a-15(e) under the Securities Act of 1934, as amended (the “Exchange Act”), as of the end of the period covered by this Quarterly Report on Form 10-Q. Based on that evaluation, the principal executive officer and principal financial officer concluded that the Company’s controls and procedures were ineffective as of June 30, 2012 to ensure that information required to be disclosed in the reports that the registrant files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms, and includes controls and procedures designed to ensure that information required to be disclosed by the Company in such reports is accumulated and communicated to Company’s management, including the Company’s principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. If the Company develops new business or engages or hires a new chief financial officer or similar financial expert, the Company intends to review its disclosure controls and procedures.

Management is aware of the lack of an independent audit committee or audit committee financial expert. Although our board of directors serves as the audit committee it has no independent directors. Further, we have not identified an audit committee financial expert on our board of directors. These factors are counter to corporate governance practices as defined by the various stock exchanges and may lead to less supervision over management.

Changes in internal controls over financial reporting. There were no changes in the Company's internal controls over financial reporting that occurred during the fiscal quarter covered by this Quarterly Report on Form 10-Q that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings