As

filed with the U.S. Securities and Exchange Commission on November 4, 2016

Registration No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

CAR CHARGING GROUP, INC.

(Exact name of Registrant as specified in its charter)

| Nevada | 3612 | 03-0608147 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification Number) |

1691

Michigan Avenue

Suite 601

Miami Beach, Florida 33139

(305) 521-0200

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Michael J. Calise

Chief Executive Officer

1691

Michigan Avenue

Suite 601

Miami Beach, Florida 33139

(305) 521-0200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Joseph

M. Lucosky Steven A. Lipstein Lucosky Brookman LLP 101 Wood Avenue South, 5th Floor Woodbridge, NJ 08830 (732) 395-4400 |

Robert

G. O’Connor John Randall Lewis Wilson Sonsini Goodrich & Rosati, P.C. One Market Plaza Spear Tower, Suite 3300 San Francisco, CA 94105 (415) 947-2000 |

Barry

I. Grossman Sarah E. Williams Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105 (212) 370-1300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [ ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large-Accelerated Filer | [ ] | Accelerated Filer | [ ] |

| Non-Accelerated Filer | [ ] | Smaller Reporting Company | [X] |

| CALCULATION OF REGISTRATION FEE | ||||||||

| Title of Each Class of Securities to be Registered | Proposed

Maximum Aggregate Offering Price(1) | Amount

of Registration Fee | ||||||

| Common Stock, par value $0.001 per share(2)(3) | $ | 20,000,000 | $ | 2,318 | ||||

| Warrants to Purchase Common Stock(3)(4) | — | — | ||||||

| Representatives’ Warrant to Purchase Common Stock(4) | N/A | — | ||||||

| Shares of Common Stock issuable upon exercise of the Warrants(2)(3)(5) | $ | 20,000,000 | $ | 2,318 | ||||

| Shares of Common Stock issuable upon exercise of Representatives’ Warrant(2)(6) | $ | 1,250,000 | $ | 145 | ||||

| Total | $ | 41,250,000 | $ | 4,781 | ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (3) | Includes shares of common stock which may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

| (4) | In accordance with Rule 457(g) under the Securities Act, because the shares of the Registrant’s common stock underlying the Warrants and Representative’s warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby. |

| (5) | There will be issued a warrant to purchase one share of common stock for every one share offered. The warrants are exercisable at a per share price of 125% of the common stock public offering price. |

| (6) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The warrants are exercisable at a per share exercise price equal to 125.0% of the public offering price. As estimated solely for the purpose of recalculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the Representative’s warrants is $1,250,000 which is equal to 125% of $1,000,000 (5% of $20,000,000). |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED NOVEMBER 4, 2016

Shares of Common Stock

Warrants to Purchase up to Shares of Common Stock

Car Charging Group, Inc.

This is a firm commitment public offering of shares of common stock, $0.001 par value per share, and warrants to purchase shares of common stock, of Car Charging Group, Inc. We anticipate that the public offering price of our shares of common stock will be between $ and $ per share and $0.01 per warrant. The warrants are exercisable immediately, have an exercise price of $ per share and expire five years from the date of issuance.

Our common stock is presently quoted on the OTC Pink Current Information Marketplace under the symbol “CCGI”. We intend to apply to have our common stock and warrants listed on The NASDAQ Capital Market under the symbols “CCGI” and “CCGIW,” respectively. No assurance can be given that our application will be approved. On November 3, 2016, the last reported sale price for our common stock on the OTC Pink Current Information Marketplace was $0.29 per share. There is no established public trading market for the warrants. No assurance can be given that a trading market will develop for the warrants.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page [9] of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Combined

Per Share and Warrant | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds to us, before expenses(2) | $ | $ | ||||||

| (1) | Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Joseph Gunnar & Co., LLC, the representative of the underwriters. See “Underwriting” for a description of compensation payable to the Underwriters. |

| (2) | Assumes no exercise of the over-allotment option we have granted to the Underwriters as described below. |

We have granted a 45-day option to the representative of the underwriters to purchase up to an aggregate of additional shares of our common stock and/or warrants to purchase shares of our common stock, solely to cover over-allotments, if any.

The underwriters expect to deliver our shares and warrants to purchasers in the offering on or about , 2016.

Joseph Gunnar & Co.

TABLE OF CONTENTS

You should rely only on information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted.

The information in this prospectus is accurate only as of the date on the front cover of this prospectus and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

Through and including , 2016 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

The mark “Blink” is our registered trademark in the U.S., Australia, China, Hong Kong, Indonesia, Japan, South Korea, Malaysia, Mexico, New Zealand, Philippines, South Africa, Singapore, Switzerland, Taiwan, and is a trademark registered under the Madrid Protocol and pursuant to the Community Trade Mark (“CTM”) in certain European countries. The mark “HQ” is our registered trademark in the U.S. We also use certain trademarks, trade names, and logos that have not been registered. We claim common law rights to these unregistered trademarks, trade names and logos.

This summary highlights selected information appearing elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information you should consider before investing in our securities. You should read this prospectus carefully, especially the risks and other information set forth under the heading “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus, before making an investment decision. Some of the statements made in this prospectus discuss future events and developments, including our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks and uncertainties which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”. Unless otherwise indicated or the context requires otherwise, the words “we,” “us,” “our,” the “Company” or “our Company” and “CarCharging” refer to Car Charging Group, Inc., a Nevada corporation, and its subsidiaries.

Overview

We are a leading owner, operator, and provider of electric vehicle (“EV”) charging equipment and networked EV charging services. We offer both residential and commercial EV charging equipment, enabling EV drivers to easily recharge at various location types.

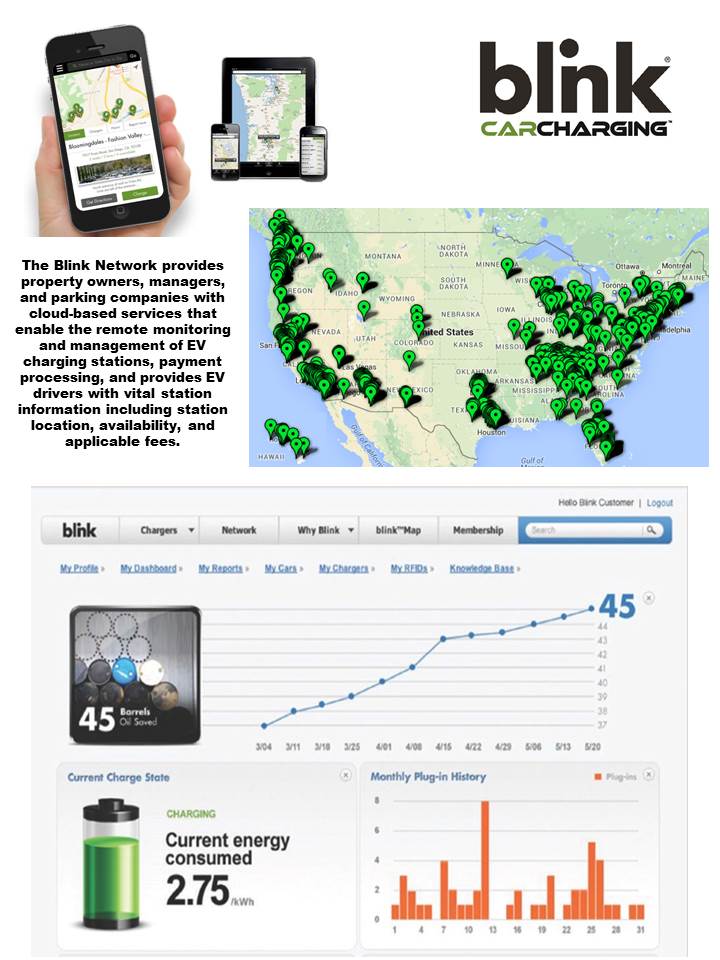

Our principal line of products and services is our Blink EV charging network (the “Blink Network”) and EV charging equipment (also known as electric vehicle supply equipment) and EV related services. Our Blink Network is proprietary cloud-based software that operates, maintains, and tracks all of the Blink EV charging stations and the associated charging data. The Blink Network provides property owners, managers, and parking companies, who we refer to as our “Property Partners”, with cloud-based services that enable the remote monitoring and management of EV charging stations, payment processing, and provides EV drivers with vital station information including station location, availability, and applicable fees.

We offer our Property Partners a flexible range of business models for EV charging equipment and services. In our comprehensive and turnkey business model, we own and operate the EV charging equipment, manage the installation, maintenance, and related services; and share a portion of the EV charging revenue with the property owner. Alternatively, Property Partners may share in the equipment and installation expenses, with CarCharging operating and managing the EV charging stations and providing connectivity to the Blink Network. For Property Partners interested in purchasing and owning EV charging stations that they manage, we can also provide EV charging hardware, site recommendations, connectivity to the Blink Network, and service and maintenance services.

We have strategic relationships with hundreds of Property Partners that include well-recognized companies, large municipalities, and local businesses. The types of properties include airports, auto dealers, healthcare/medical, hotels, mixed-use, municipal locations, multifamily residential and condo, parks and recreation areas, parking lots, religious institutions, restaurants, retailers, schools and universities, stadiums, supermarkets, transportation hubs, and workplace locations. Some examples are Caltrans, City of Azusa, City of Chula Vista, City of Springfield, City of Tucson, Cracker Barrel, Federal Realty, Fred Meyer Stores, Inc., Fry’s Food & Drug, Inc., IKEA, JBG Associates, LLC, Kroger Company and Ralphs Grocery Company. We continue to establish contracts with Property Partners that previously had contracts with ECOtality, Inc. (“ECOtality”), the former owner of the Blink related assets, which we acquired in October 2013.

|

| -1- |

As of November 1, 2016, we have approximately 13,244 charging stations deployed of which 5,150 are Level 2 public charging units, 165 DC Fast Charging EV chargers and 2,589 residential charging units in service on the Blink Network. Additionally, we currently have approximately 363 Level 2 charging units on other networks and there are also approximately an additional 4,977 non-networked, residential Blink EV charging stations. The non-networked, residential Blink EV charging stations are all partner owned. Level 2 EV chargers are ideal for commercial and residential use, and has the standard J1772 connector, which is compatible with all major auto manufacturer electric vehicle models. Our DC Fast Charging equipment (“DCFC”) currently has the CHAdeMo connector, which is compatible with Nissan, Kia, and Tesla electric vehicle models (additional models may be potentially available in the future), and typically provides a full-charge in less than 30 minutes.

Competitive Advantages/Operational Strengths

Early Mover Advantage: We continue to leverage our large and defendable first mover advantage and the digital customer experience we have created for both drivers and Property Partners. We believe that there are approximately 88,000 drivers registered with Blink that appreciate the value of using charging sessions on a leading, established, and robust network experience. We have thousands of Blink chargers deployed across the United States and the tendency, among users, is to stay within one consistent network for expansion on any given property.

Long-Term Contracts with Property Owners: We have strategic and often long term agreements with location exclusivity for Property Partners across numerous transit/destination locations, including airports, car dealers, healthcare/medical, hotels, mixed-use, municipal locations, multifamily residential and condo, parks and recreation areas, parking lots, religious institutions, restaurants, retailers, schools and universities, stadiums, supermarkets, transportation hubs, and workplace locations. We have hundreds of Property Partners that include well-recognized companies, large municipalities, and local businesses. Some examples are Caltrans, Carl’s Jr., City of Azusa, City of Chula Vista, City of Springfield, City of Tucson, Cracker Barrel, Federal Realty, Fred Meyer Stores, Inc., Fry’s Food & Drug, Inc., Garage Management Company, Icon Parking, IKEA, iPark, JBG Associates, Kohls, Kroger Company, LAZ Parking, Macy’s, McDonald’s, and Ralphs Grocery Company, Sears, Simon Properties, and SP+ Parking. We continue to establish new contracts with Property Partners that previously secured our services independently, or had contracts with ECOtality, an electric vehicle service provider and the former owner of the Blink related assets.

Flexible Business Model: We are able to offer and sell both EV charging equipment as well as access to our robust, cloud-based EV charging software, which we refer to as the Blink Network. We believe that we have an advantage in our ability to provide by offering various business models to Property Partners and leverage along with our technology to meet the needs of both Property Partners and EV drivers, we have an advantage compared to our competitors. Our Property Partner business model options include:

|

| 1. | CarCharging Owns: We provide and install EV charging equipment, which we own and maintain. The Property Partner pays for connectivity to our Blink Network and payment transaction fees, and receives a portion of the revenues generated from the stations. | |||

| 2. | Host Owned: The Property Partner purchases our EV charging equipment and pays for connectivity to our Blink Network as well as payment transaction fees and optional service fees. | |||

| 3. | Hybrid: This option combines features from the aforementioned business models. |

Ownership and Control of EV Charging Stations and Services: We own a large percentage of our stations, which is a significant differentiation between us and some of our primary competitors. This ownership model allows us to control the settings and pricing for our EV charging services, service the equipment as necessary, and have greater brand management and price uniformity.

|

| -2- |

Experience with Products and Services of Other EV Charging Service Providers. From inception in 2009 and via acquisitions of other EV charging service providers (Beam Charging, 350Green, EV Pass, and Blink), we have had the experience of owning and operating EV charging equipment provided by other EV charging service providers, including General Electric, ChargePoint, and SemaConnect. This experience has provided us with the working knowledge of the benefits and drawbacks of other equipment manufacturers and their applicable EV charging networks.

Our Risks and Challenges

An investment in our securities involves a high degree of risk including risks related to the following:

|

| ● | Our Revenue Growth Depends on Consumers’ Willingness to Adopt EVS; | |||

| ● | We Need Additional Capital to Fund Our Growing Operations and Cannot Assure You That We Will Be Able to Obtain Sufficient Capital on Reasonable Terms or at All, and We May Be Faced to Limit the Scope of Our Operations; | |||

| ● | The Report of Our Independent Registered Public Accounting Firm Contains an Explanatory Paragraph That Expresses Substantial Doubt About Our Ability to Continue as a Going Concern; | |||

| ● | We Have a History of Significant Losses, and If We Do Not Achieve and Sustain Profitability, Our Financial Condition Could Suffer; | |||

| ● | We May Not Have The Liquidity to Support Our Future Operations and Capital Requirements; | |||

| ● | The Unavailability, Reduction or Elimination of Government Incentives Could Have a Material Adverse Effect on Our Business, Financial Condition, Operating Results and Prospects; and | |||

| ● | If We Are Unable to Keep up with Advances in Electric Vehicle Technology, We May Suffer a Decline in Our Competitive Position. |

Recent Developments

We entered into a Securities Purchase Agreement dated October 7, 2016 (the “Purchase Agreement”) with JMJ Financial, a Nevada sole proprietorship (“JMJ,” and together with our Company, the “Parties”). In accordance with its terms, the Purchase Agreement became effective upon (i) execution by the Parties of the Purchase Agreement, a note, and a warrant, and (ii) delivery of an initial advance pursuant to the note of $500,000, which occurred on October 13, 2016. The note and warrant were issued on October 13, 2016. Pursuant to the Purchase Agreement, JMJ purchased from our Company (i) a Promissory Note in the aggregate principal amount of up to $3,725,000 due and payable on the earlier of February 15, 2017 or if the Listing Approval End Date (as defined in the note) is February 28, 2017, March 31, 2017, or the third business day after the closing of the Public Offering (as defined in the Purchase Agreement), and (ii) a Common Stock Purchase Warrant to purchase 714,285 shares of our common stock at an exercise price per share equal to the lesser of (i) 80% of the per share price in the contemplated Public Offering, (ii) $0.70 per share, (iii) 80% of the unit price in the Public Offering (if applicable), (iv) the exercise price of any warrants issued in the Public Offering, or (v) the lowest conversion price, exercise price, or exchange price, of any security issued by us that is outstanding on October 13, 2016. The aggregate exercise price is $500,000. Pursuant to the terms of the note, JMJ has agreed that it will not convert the note into more than 9.99% of our outstanding shares. JMJ currently does not own any shares of our common stock. The initial amount borrowed under the note was $500,000, with the remaining amounts permitted to be borrowed under the note being subject to us achieving certain milestones. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Developments—Private Placements.”

|

| -3- |

We are subject to a number of additional risks which you should be aware of before you buy our securities in this offering. These risks are discussed more fully in the section entitled “Risk Factors” following this prospectus summary.

Listing on The Nasdaq Capital Market

We intend to apply to list our common stock and warrants on The Nasdaq Capital Market (“NASDAQ”) under the symbols “CCGI” and “CCGIW.” If our listing application is approved, we expect to list our common stock and warrants on NASDAQ upon consummation of this offering and our common stock will cease to be traded on the OTC Pink Current Information Marketplace. No assurance can be given that our listing application will be approved. This offering will occur only if NASDAQ approves the listing of our common stock and warrants on NASDAQ. If NASDAQ does not approve the listing of our common stock and warrants, we will not proceed with this offering.

Going Concern Considerations

As reflected in our consolidated financial statements for the year ended December 31, 2015, we had had a cash balance, a working capital deficiency and an accumulated deficit of $189,231, $14,437,434, and $73,372,655, respectively. During the years ended December 31, 2015 and 2014, we incurred net losses of $8,244,924 and $23,229,319, respectively. These factors raise substantial doubt about our ability to continue as a going concern, as expressed in the notes to our consolidated financial statements. Historically, we have been able to raise funds to support our business operations.

While we believe in the viability of our strategy to generate sufficient revenues and in our ability to raise additional funds through the completion of this offering, there can be no assurance that we will be able to generate sufficient revenues or complete this offering, raise anticipated proceeds, or that any other debt or equity financing will be available or, if available, that it will be available on terms acceptable to us. If we fail to complete this offering or raise anticipated proceeds, we may not be able to continue operations and as such our independent auditor’s report will continue to contain an uncertainty paragraph related to our ability to continue as a going concern.

Corporate Information

Car Charging Group, Inc., a Nevada corporation, is the parent company of Car Charging, Inc., a Delaware corporation, which serves as the main operating company and is, in turn, the parent company of several distinct wholly-owned subsidiary operating companies including, but not limited to, eCharging Stations LLC, Blink, Beam Charging LLC and EV Pass LLC. Car Charging Group, Inc. was formed in the State of Nevada on October 3, 2006, under our prior name, New Image Concepts, Inc. New Image Concepts, Inc. changed its name to Car Charging Group, Inc., on December 8, 2008. Car Charging, Inc. was incorporated in Delaware on September 8, 2009. We purchased the assets referred to as the Blink Network from ECOtality, Inc. on October 16, 2013. From April 22, 2013 to April 16, 2014, 350 Green LLC (“350 Green”) was a wholly-owned subsidiary of the Company in which the Company had full control and was consolidated. Beginning on April 17, 2014, when 350 Green’s assets and liabilities were transferred to a trust mortgage, 350 Green became a Variable Interest Entity. We determined that we are the primary beneficiary of 350 Green, and as such, 350 Green’s assets, liabilities and results of operations are included in our consolidated financial statements.

We maintain our principal offices at 1691 Michigan Avenue, Suite 601, Miami Beach, Florida, 33139. Our telephone number is (305) 521-0200. Our Silicon Valley office houses our Chief Executive Officer (“CEO”). Our website is www.CarCharging.com and we can be contacted by email at info@CarCharging.com. Our website and the information contained in, or accessible through, our website will not be deemed to be incorporated by reference into this prospectus and does not constitute part of this prospectus.

|

| -4- |

| THE OFFERING | ||||

| Securities offered by us: | shares of our common stock and warrants to purchase shares of our common stock. Each warrant will have an exercise price of $ per share [125% of the public offering price of the common stock], is exercisable immediately and will expire five years from the date of issuance. | |||

| Common stock outstanding before the offering as of November 1, 2016: | 80,476,508 shares | |||

| Common stock to be outstanding after the offering: | shares | |||

| Option to purchase additional shares: | We have granted the underwriters a 45-day option to purchase up to additional shares of our common stock at a public offering price of $ per share and/or warrants to purchase shares of our common stock at a public offering price of $0.01 per warrant, solely to cover over-allotments, if any. | |||

| Use of proceeds: | We intend to use the net proceeds of this offering to expand our product offerings, deployment of charging stations, hiring of senior-level staff, and for general working capital purposes. See “Use of Proceeds.” | |||

| Risk factors: | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page [10] before deciding to invest in our securities. | |||

| Trading Symbol: | Our common stock is presently quoted on the OTC Pink Current Information Marketplace under the symbol “CCGI”. We intend to apply to have our common stock and warrants listed on The NASDAQ Capital Market under the symbols “CCGI” and “CCGIW,” respectively. | |||

| Lock-up: | We and our directors, officers and principal stockholders have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 180 days after the date of this prospectus, in the case of our directors and officers, and 90 days after the date of this prospectus, in the case of our principal stockholders. See “Underwriting” section on page 98. | |||

| -5- |

NASDAQ listing requirements include, among other things, a stock price threshold. As a result, prior to effectiveness, we will need to take necessary steps to meet NASDAQ listing requirements, including but not limited to a reverse split of our common stock.

The common stock to be outstanding after this offering is based on 80,476,508 shares outstanding as of November 1, 2016, and excludes the following as of such date:

|

| ● | [ ] shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $[ ]; | |||

| ● | shares of common stock underlying the warrants to be issued to the underwriters in connection with this offering; | |||

| ● | shares issuable upon exercise of outstanding warrants sold in this offering; and | |||

| ● | a reverse stock split to be effective prior to the closing of this offering. |

Unless otherwise stated, all information in this prospectus assumes no exercise of the underwriters’ over-allotment option to purchase additional shares.

|

| -6- |

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following summary consolidated statements of operations data for the years ended December 31, 2015 and 2014 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the six months ended June 30, 2016 and 2015 and the consolidated balance sheets data as of June 30, 2016 are derived from our unaudited consolidated financial statements that are included elsewhere in this prospectus. The historical financial data presented below is not necessarily indicative of our financial results in future periods, and the results for the six months ended June 30, 2016 are not necessarily indicative of our operating results to be expected for the full fiscal year ending December 31, 2016 or any other period. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles (“U.S. GAAP”). Our unaudited consolidated financial statements have been prepared on a basis consistent with our audited financial statements and include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations as of and for such periods.

SUMMARY STATEMENTS OF OPERATIONS DATA

|

| For

The Six Months Ended June 30, | For

The Fiscal Years Ended December 31*, | |||||||||||||||||

| (unaudited) 2016 | (unaudited) 2015 | 2015 | 2014 | |||||||||||||||

| (revised) | ||||||||||||||||||

| Revenues: | ||||||||||||||||||

| Total Revenues | 1,756,752 | 2,234,412 | 3,957,795 | 2,791,644 | ||||||||||||||

| Total Cost of Revenues | 1,604,740 | 1,721,105 | 2,861,738 | 5,634,379 | ||||||||||||||

| Gross Profit (Loss) | 152,012 | 513,307 | 1,096,057 | (2,842,735 | ) | |||||||||||||

| Operating Expenses: | ||||||||||||||||||

| Compensation | 2,652,787 | 4,855,564 | 8,200,246 | 8,246,442 | ||||||||||||||

| Other operating expenses | 714,373 | 822,151 | 1,662,748 | 735,259 | ||||||||||||||

| General and administrative expenses | 637,717 | 1,525,492 | 2,552,857 | 2,811,093 | ||||||||||||||

| Inducement expense | - | - | - | 321,877 | ||||||||||||||

| Impairments and loss of title of assets | - | - | - | 9,531,612 | ||||||||||||||

| Total Operating Expenses | 4,004,877 | 7,203,207 | 12,415,851 | 21,646,283 | ||||||||||||||

| Total Other (Expense) Income | (2,893,903 | ) | 1,769,068 | 3,074,870 | 1,259,699 | |||||||||||||

| Net Loss | (6,746,768 | ) | (4,920,832 | ) | (8,244,924 | ) | (23,229,319 | ) | ||||||||||

| Net Loss Attributable to Common Stockholders | $ | (7,430,468 | ) | $ | (5,402,226 | ) | (9,584,624 | ) | (22,718,817 | ) | ||||||||

| Net Loss Per Share | ||||||||||||||||||

| Basic and Diluted | $ | (0.09 | ) | $ | (0.07 | ) | (0.12 | ) | (0.29 | ) | ||||||||

| Weighted Average Number of Common Shares Outstanding | ||||||||||||||||||

| Basic and Diluted | 79,986,345 | 78,489,861 | 79,029,180 | 77,675,650 | ||||||||||||||

|

* derived from audited consolidated financial statements.

The following table presents consolidated balance sheets data as of June 30, 2016 on:

|

| ● | an actual basis; | |||

| ● | a pro forma basis, giving effect to the sale by us of a Promissory Note and a Common Stock Purchase Warrant to JMJ. | |||

| -7- |

| ● | a pro forma basis, giving effect to the sale by us of shares of common stock in this offering at an assumed public offering price of $ per share, after deducting underwriting discounts and commissions and estimated offering expenses. |

The pro forma information will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

|

| Actual | Pro Forma(1) | |||||||||

| Consolidated Balance Sheet Data: | ||||||||||

| Cash and cash equivalents | $ | 183,767 | $ | |||||||

| Working capital (deficit) | (19,508,293 | ) | ||||||||

| Total assets | 2,436,774 | |||||||||

| Total liabilities | 20,686,430 | |||||||||

| Total stockholders’ equity (deficit) | (19,074,656 | ) | ||||||||

| (1) | A $1.00 increase or decrease in the assumed public offering price per share would increase or decrease our cash and cash equivalents, working capital (deficit), total assets and total stockholders’ equity (deficit) by approximately $________, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the underwriting discount and estimated offering expenses payable by us. | ||

| -8- |

Investing in our common stock involves a high degree of risk. You should carefully consider the following risks and uncertainties described below, as well as other information included in this prospectus before deciding to purchase our securities. There are many risks that affect our business and results of operations, some of which are beyond our control. Our business, financial condition or operating results could be materially harmed by any of these risks. This could cause the trading price of our common stock to decline, and you may lose all or part of your investment. Additional risks that we do not yet know of or that we currently think are immaterial may also affect our business and results of operations.

Relating to Our Business

Our Revenue Growth Depends on Consumers’ Willingness to Adopt Electric Vehicles.

Our growth is highly dependent upon the adoption by consumers of electric vehicles (“EV”), and we are subject to a risk of any reduced demand for EVs. If the market for EVs does not gain broad market acceptance or develops more slowly than we expect, our business, prospects, financial condition and operating results will be harmed. The market for alternative fuel vehicles is relatively new, rapidly evolving, characterized by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards, frequent new vehicle announcements, long development cycles for EV original equipment manufacturers, and changing consumer demands and behaviors. Factors that may influence the purchase and use of alternative fuel vehicles, and specifically EVs, include:

| ● | perceptions about EV quality, safety (in particular with respect to lithium-ion battery packs), design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of EVs; | |

| ● | the limited range over which EVs may be driven on a single battery charge and concerns about running out of power while in use; | |

| ● | improvements in the fuel economy of the internal combustion engine; | |

| ● | consumers’ desire and ability to purchase a luxury automobile or one that is perceived as exclusive; | |

| ● | the environmental consciousness of consumers; | |

| ● | volatility in the cost of oil and gasoline; | |

| ● | consumers’ perceptions of the dependency of the U.S. on oil from unstable or hostile countries and the impact of international conflicts; | |

| ● | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; | |

| ● | access to charging stations, standardization of EV charging systems and consumers’ perceptions about convenience and cost to charge an EV; and | |

| ● | the availability of tax and other governmental incentives to purchase and operate EVs or future regulation requiring increased use of nonpolluting vehicles. |

| -9- |

The influence of any of the factors described above may negatively impact the widespread consumer adoption of EVs, which would materially adversely affect our business, operating results, financial condition and prospects.

We Need Additional Capital to Fund Our Growing Operations and Cannot Assure You That We Will Be Able to Obtain Sufficient Capital on Reasonable Terms or at All, and We May Be Faced to Limit the Scope of Our Operations.

We need additional capital to fund our growing operations and if adequate additional financing is not available on reasonable terms or available at all, we may not be able to undertake expansion or continue our marketing efforts and we would have to modify our business plans accordingly. The extent of our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products and/or services by our competition; (iii) the level of our investment in research and development; (iv) the amount of our capital expenditures, including acquisitions; and (v) our growth. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing stockholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

The Report of Our Independent Registered Public Accounting Firm Contains an Explanatory Paragraph That Expresses Substantial Doubt About Our Ability to Continue as a Going Concern.

The report of our independent registered public accounting firm with respect to our financial statements as of December 31, 2015 and for the year then ended indicates that our financial statements have been prepared assuming that we will continue as a going concern. The report states that, since we have incurred net losses since inception and we need to raise additional funds to meet our obligations and sustain our operations, there is substantial doubt about our ability to continue as a going concern. Our plans in regard to these matters are described in Note 2 to our audited financial statements as of December 31, 2015 and 2014 and for the years then ended. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We Have a History of Significant Losses, and If We Do Not Achieve and Sustain Profitability, Our Financial Condition Could Suffer.

We have experienced significant net losses, and we expect to continue to incur losses for the foreseeable future. We incurred net losses of $8.2 million and $23.2 million the years ended December 31, 2015 and 2014, respectively, and as of December 31, 2015 our accumulated deficit was $73.4 million. Our prior losses, combined with expected future losses, have had and will continue to have, for the foreseeable future, an adverse effect on our stockholders’ equity and working capital. If our revenue grows more slowly than we anticipate, or if our operating expenses are higher than we expect, we may not be able to achieve profitability and our financial condition could suffer. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Whether we can achieve cash flow levels sufficient to support our operations cannot be accurately predicted. Unless such cash flow levels are achieved in addition to the proceeds from this offering, we may need to borrow additional funds or sell debt or equity securities, or some combination thereof, to provide funding for our operations. Such additional funding may not be available on commercially reasonable terms, or at all.

| -10- |

If the proceeds from this offering are insufficient for us to continue as a going concern, it could make it more difficult for us to raise additional capital, should it be needed, or cause our customers, suppliers and other business partners to lose confidence in us thereby resulting in a reduction of revenue, loss of supply resources and other effects that would be significantly harmful to our business. If adequate funds are not available when needed, our liquidity, financial condition and operating results would be materially and adversely affected, and we may not be able to operate our business without significant changes in our operations or at all.

We May Not Have The Liquidity to Support Our Future Operations and Capital Requirements.

Whether we can achieve cash flow levels sufficient to support our operations cannot be accurately predicted. Unless such cash flow levels are achieved, in addition to the proceeds from this offering, we may need to borrow additional funds or sell debt or equity securities, or some combination thereof, to provide funding for our operations. Such additional funding may not be available on commercially reasonable terms, or at all. If adequate funds are not available when needed, our financial condition and operating results would be materially and adversely affected and we may not be able to operate our business without significant changes in our operations, or at all.

We Are Applying For Listing of Our Common Stock And Warrants on NASDAQ. We Can Provide No Assurance That Our Common Stock And Warrants Qualify to Be Listed, And if Listed, That Our Securities Will Continue to Meet The NASDAQ Listing Requirements. If We Fail to Comply With The Continuing Listing Standards of NASDAQ, Our Securities Could Be Delisted.

We expect that our securities will be eligible to be listed on NASDAQ subject to our ability to satisfy the initial listing requirements. Our ability to have our securities become listed on NASDAQ will require us to, among other items, improve our balance sheet, which we may be unable to accomplish. As of June 30, 2016, we had accumulated stockholders’ deficiency of approximately $19 million, and our stockholders’ deficiency may increase as a result of additional net losses in subsequent quarterly periods.

We can provide no assurance that our listing application will be approved, and that an active trading market for our common stock will develop and continue. If, after listing, we fail to satisfy the continued listing requirements of NASDAQ, such as the corporate governance requirements, stockholder equity requirements or the minimum closing bid price requirement, NASDAQ may take steps to delist our common stock. Such a delisting would likely have a negative effect on the price of our common stock and would impair your ability to sell or purchase common stock underlying the units when you wish to do so. In the event of a delisting, we can provide no assurance that any action taken by us to restore compliance with listing requirements would allow our common stock to become listed again, stabilize the market price or improve the liquidity of our common stock, prevent our common stock from dropping below the NASDAQ minimum bid price requirement or prevent future non-compliance with NASDAQ’s listing requirements.

To meet the requirements of NASDAQ, we may be required to restructure certain of our equity securities or satisfy certain liabilities through the issuance of additional equity securities. Our ability to restructure certain of our equity securities may require us to enter into new agreements with the applicable security holders, which we may be unable to do on favorable terms or at all. Any such agreement may result in the issuance of new securities or the modification of the rights of existing securities in a manner that may be dilutive to our common stock holders. In addition, NASDAQ has certain requirements that are beyond our control, such as financial requirements that are based on the trading price of our stock. If we are unable to meet the minimum financial eligibility of NASDAQ, we may be unable to list our stock, and we may be unsuccessful in completing this offering. Moreover, it would prevent us from increasing liquidity in our shares of common stock and make it more difficult for us to raise capital on favorable terms, or at all.

| -11- |

The Unavailability, Reduction or Elimination of Government Incentives Could Have a Material Adverse Effect on Our Business, Financial Condition, Operating Results and Prospects.

As of December 31, 2015, government grants accounted for 29.5% of our revenues. Any reduction, elimination or discriminatory application of government subsidies and economic incentives because of policy changes, fiscal tightening or other reasons may result in diminished revenues from government sources and diminished demand for our products. This could materially and adversely affect our business, prospects, financial condition and operating results.

Our growth depends in part on the availability and amounts of government subsidies for EV charging equipment. In the event such subsidies discontinue, our business outlook and financial conditions could be negatively impacted.

If We Are Unable to Keep Up With Advances in EV Technology, We May Suffer a Decline in Our Competitive Position.

The EV industry is characterized by rapid technological change. If we are unable to keep up with changes in EV technology, our competitive position may deteriorate which would materially and adversely affect our business, prospects, operating results and financial condition. As technologies change, we plan to upgrade or adapt our EV charging stations and Blink Network software in order to continue to provide EV charging services with the latest technology. However, due to our limited cash resources, our efforts to do so may be limited. For example, the EV charging network that we acquired from ECOtality was originally funded, in part, by the U.S. Department of Energy (“DOE”), which funding is no longer available to us. As a result, we may be unable to grow, maintain and enhance the network of charging stations that we acquired from ECOtality at the same rate and scale as ECOtality did prior to the acquisition or at levels comparable our current competitors. Any failure of our charging stations to compete effectively with other manufacturers’ charging stations will harm our business, operating results and prospects.

We Need to Manage Growth in Operations to Realize Our Growth Potential and Achieve Our Expected Revenues, and Our Failure to Manage Growth Will Cause a Disruption of Our Operations Resulting in the Failure to Generate Revenue and an Impairment of Our Long-Lived Assets.

In order to take advantage of the growth that we anticipate in our current and potential markets, we believe that we must expand our marketing operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures and management information systems. We will also need to effectively train, motivate and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

| -12- |

In order to achieve the above-mentioned targets, the general strategies of our Company are to maintain and search for hard-working employees who have innovative initiatives, as well as to keep a close eye on expansion opportunities through merger and/or acquisition.

If Our Estimates or Judgments Relating to Our Critical Accounting Policies Prove to Be Incorrect, Our Financial Condition And Results of Operations Could Be Adversely Affected.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, as discussed under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included elsewhere in this prospectus and in our consolidated financial statements included herein. The results of these estimates form the basis for making judgments about the carrying values of assets, liabilities and equity, and the amount of revenue and expenses that are not readily apparent from other sources. Significant assumptions and estimates used in preparing our consolidated financial statements include those related to revenue recognition, allowance for doubtful accounts, inventory reserves, impairment of goodwill, indefinite-lived and long-lived assets, pension and other post-retirement benefits, product warranty, valuation allowances for deferred tax assets, valuation of common stock warrants, and share-based compensation. Our financial condition and results of operations may be adversely affected if our assumptions change or if actual circumstances differ from those in our assumptions, which could cause our results of operations to fall below the expectations of securities analysts and investors, resulting in a decline in the price of our common stock.

| -13- |

We Face Risks Arising From Acquisitions.

In 2012 and 2013, we acquired certain assets from 350 Green and Beam Charging. We may pursue similar strategic transactions in the future. Risks in acquisition transactions include difficulties in the integration of acquired businesses into our operations and control environment, difficulties in assimilating and retaining employees and intermediaries, difficulties in retaining the existing clients of the acquired entities, assumed or unforeseen liabilities that arise in connection with the acquired businesses, the failure of counterparties to satisfy any obligations to indemnify us against liabilities arising from the acquired businesses, and unfavorable market conditions that could negatively impact our growth expectations for the acquired businesses. Fully integrating an acquired company or business into our operations may take a significant amount of time. We cannot assure you that we will be successful in overcoming these risks or any other problems encountered with acquisitions and other strategic transactions. These risks may prevent us from realizing the expected benefits from acquisitions and could result in the failure to realize the full economic value of a strategic transaction or the impairment of goodwill and/or intangible assets recognized at the time of an acquisition. These risks could be heightened if we complete a large acquisition or multiple acquisitions within a short period of time. In addition, in connection with the acquisition of 50% of the interests of the ECOtality Estate in April 2015, we issued certain shares of Series B Preferred Stock, which we believe constitute an exempt issuance as intended under agreements with certain of our investors as such shares (i) were issued to effectuate the strategic acquisition of ECOtality, and (ii) permit us, in our sole control, to settle these shares for cash at stated optional redemption dates, as opposed to a variable number of shares. However, there can be no assurance that our investors agree with our interpretation of our investment documents and won’t pursue any of the potential remedies that may be available to them.

We Have Limited Insurance Coverage, and Any Claims Beyond Our Insurance Coverage May Result in Our Incurring Substantial Costs and a Diversion of Resources.

We hold employer’s liability insurance generally covering death or work-related injury of employees. We hold public liability insurance covering certain incidents involving third parties that occur on or in the premises of our Company. We hold directors and officers liability insurance. We do not maintain key-man life insurance on any of our senior management or key personnel, or business interruption insurance. Our insurance coverage may be insufficient to cover any claim for product liability, damage to our fixed assets or employee injuries. Any liability or damage to, or caused by, our facilities or our personnel beyond our insurance coverage may result in our incurring substantial costs and a diversion of resources.

Our Future Success Depends, in Part, on the Performance and Continued Service of Our Officers.

We presently depend to a great extent upon the experience, abilities and continued services of our management team, which consists of Michael Calise (our CEO), Michael D. Farkas (our Executive Chairman), Andy Kinard (our President) and Ira Feintuch (our Chief Operating Officer). The loss of services of Mr. Calise, Mr. Farkas, Mr. Kinard or Mr. Feintuch could have a material adverse effect on our business, financial condition or results of operation. Failure to maintain our management team could prove disruptive to our daily operations, require a disproportionate amount of resources and management attention and could have a material adverse effect on our business, financial condition and results of operations.

Our Future Success Depends, in Part, on Our Ability to Attract and Retain Highly Qualified Personnel.

Our future success also depends upon our ability to attract and retain highly qualified personnel. We are in the process of building our management team. Among other positions, we need to hire a Chief Financial Officer with public company experience. Mr. Calise currently acts as our interim Chief Financial Officer. Although we intend to hire a Chief Financial Officer soon, there is no assurance that we will have sufficient financial resources to do so. Our accounting controls may continue to be deficient unless we obtain the services of an experienced Chief Financial Officer who can help us address material weaknesses. In addition, expansion of our business and the management and operation of our Company will require additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. There can be no assurance that we will be able to attract or retain highly qualified personnel. As our industry continues to evolve, competition for skilled personnel with the requisite experience will be significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

| -14- |

We Are in an Intensely Competitive Industry and There Can Be No Assurance That We Will Be Able to Compete with Our Competitors Who May Have Greater Resources.

We face strong competition from competitors in the EV charging services industry, including competitors who could duplicate our model. Many of these competitors may have substantially greater financial, marketing and development resources and other capabilities than us. In addition, there are very few barriers to entry into the market for our services. There can be no assurance, therefore, that any of our current and future competitors, many of whom may have far greater resources, will not independently develop services that are substantially equivalent or superior to our services. Therefore, an investment in our Company is very risky and speculative due to the competitive environment in which we may operate.

Our competitors may be able to provide customers with different or greater capabilities or benefits than we can provide in areas such as technical qualifications, past contract performance, geographic presence and price. Furthermore, many of our competitors may be able to utilize substantially greater resources and economies of scale to develop competing products and technologies, divert sales away from us by winning broader contracts or hire away our employees by offering more lucrative compensation packages. In the event that the market for EV charging stations expands, we expect that competition will intensify as additional competitors enter the market and current competitors expand their product lines. In order to secure contracts successfully when competing with larger, well-financed companies, we may be forced to agree to contractual terms that provide for lower aggregate payments to us over the life of the contract, which could adversely affect our margins. Our failure to compete effectively with respect to any of these or other factors could have a material adverse effect on our business, prospects, financial condition or operating results.

We Have Experienced Significant Customer Concentration in Recent Periods, And Our Revenue Levels Could Be Adversely Affected if Any Significant Customer Fails To Purchase Products From Us At Anticipated Levels.

We are subject to customer concentration risk as a result of our reliance on a relatively small number of customers for a significant portion of our revenues. The relative magnitude and the mix of revenue from our largest customers have varied significantly quarter to quarter. During the nine months ended September 30, 2016, certain customers have accounted for significant revenues, varying by period, to our Company. The loss of these customers could have a material adverse effect on our business.

| -15- |

We May Have Certain Liabilities Associated with the Assets of 350 Green.

The status of the assets of 350 Green, a former wholly-owned subsidiary, are uncertain and not within our control. We transferred the assets of 350 Green to a trust mortgage and 350 Green became a Variable Interest Entity (a “VIE”). We are in the process of periodically reevaluating the nature of our interests in 350 Green, including whether or not we have achieved full isolation of the assets and membership interests of 350 Green, ensuring that we could not be required to provide direct or indirect financial support to our former subsidiary or its creditors. If we are required to provide financial support to our former subsidiary or its creditors, it would adversely impact our working capital.

If a Third Party Asserts That We Are Infringing Its Intellectual Property, Whether Successful or Not, It Could Subject Us to Costly and Time-Consuming Litigation or Expensive Licenses, and Our Business May Be Harmed.

The EV and EV charging industries are characterized by the existence of a large number of patents, copyrights, trademarks and trade secrets. As we face increasing competition, the possibility of intellectual property rights claims against us grows. Our technologies may not be able to withstand any third-party claims or rights against their use. Additionally, although we have acquired from other companies proprietary technology covered by patents, we cannot be certain that any such patents will not be challenged, invalidated or circumvented. Intellectual property infringement claims against us could harm our relationships with our customers, may deter future customers from subscribing to our services or could expose us to litigation with respect to these claims. Even if we are not a party to any litigation between a customer and a third party, an adverse outcome in any such litigation could make it more difficult for us to defend our intellectual property in any subsequent litigation in which we are a named party. Any of these results could harm our brand and operating results.

Any intellectual property rights claim against us or our customers, with or without merit, could be time-consuming, expensive to litigate or settle and could divert management resources and attention. An adverse determination also could prevent us from offering our services to our customers and may require that we procure or develop substitute services that do not infringe.

With respect to any intellectual property rights claim against us or our customers, we may have to pay damages or stop using technology found to be in violation of a third party’s rights. We may have to seek a license for the technology, which may not be available on reasonable terms, may significantly increase our operating expenses or require us to restrict our business activities in one or more respects. The technology also may not be available for license to us at all. As a result, we may also be required to develop alternative non-infringing technology, which could require significant effort and expense.

The Success of Our Business Depends in Large Part on Our Ability to Protect and Enforce Our Intellectual Property Rights.

We rely on a combination of patent, copyright, service mark, trademark, and trade secret laws, as well as confidentiality procedures and contractual restrictions, to establish and protect our proprietary rights, all of which provide only limited protection. We cannot assure you that any patents will issue with respect to our currently pending patent applications, in a manner that gives us the protection that we seek, if at all, or that any future patents issued to us will not be challenged, invalidated or circumvented. Our currently issued patents and any patents that may issue in the future with respect to pending or future patent applications may not provide sufficiently broad protection or they may not prove to be enforceable in actions against alleged infringers. Also, we cannot assure you that any future service mark registrations will be issued with respect to pending or future applications or that any registered service marks will be enforceable or provide adequate protection of our proprietary rights.

| -16- |

We endeavor to enter into agreements with our employees and contractors and agreements with parties with whom we do business in order to limit access to and disclosure of our proprietary information. We cannot be certain that the steps we have taken will prevent unauthorized use of our technology or the reverse engineering of our technology. Moreover, others may independently develop technologies that are competitive to ours or infringe our intellectual property. The enforcement of our intellectual property rights also depends on our legal actions against these infringers being successful, but we cannot be sure these actions will be successful, even when our rights have been infringed.

Furthermore, effective patent, trademark, service mark, copyright and trade secret protection may not be available in every country in which our services are available over the Internet. In addition, the legal standards relating to the validity, enforceability and scope of protection of intellectual property rights in EV-related industries are uncertain and still evolving.

Changes to Federal, State or International Laws or Regulations Applicable To Our Company Could Adversely Affect Our Business.

Our business is subject to a variety of federal, state and international laws and regulations, including those with respect government incentives promoting fuel efficiency and alternate forms of energy, electric vehicles and others. These laws and regulations, and the interpretation or application of these laws and regulations, could change. Any reduction, elimination or discriminatory application of government subsidies and economic incentives because of policy changes, fiscal tightening or other reasons may result in diminished revenues from government sources and diminished demand for our products. In addition, new laws or regulations affecting our business could be enacted. These laws and regulations are frequently costly to comply with and may divert a significant portion of management’s attention. If we fail to comply with these applicable laws or regulations, we could be subject to significant liabilities which could adversely affect our business.

There are many federal, state and international laws that may affect our business, including measures to regulate charging systems, electric vehicles, and others. If we fail to comply with these applicable laws or regulations we could be subject to significant liabilities which could adversely affect our business.

There are a number of significant matters under review and discussion with respect to government regulations which may affect the business we intend to enter and/or harm our customers, and thereby adversely affect our business, financial condition and results of operations.

Our Ability to Use Our Net Operating Loss Carryforwards May Be Limited.

For the year ended December 31, 2015, we had net operating loss carryforwards (“NOLs”) for U.S. federal income tax purposes of approximately $53.3 million. We generally are able to carry NOLs forward to reduce taxable income in future years. These NOLs may be offset against future taxable income through 2034, if not utilized before that time. However, our ability to utilize the NOLs is subject to the rules of Section 382 of the Internal Revenue Code of 1986, as amended (“Section 382”). Section 382 generally restricts the use of NOLs after an “ownership change.” An ownership change occurs if, among other things, the stockholders (or specified groups of stockholders) who own, have owned or are treated as owning, directly or indirectly, five percent or more of our common stock increase their aggregate percentage ownership of our stock by more than 50 percentage points over the lowest percentage of the stock owned by these stockholders over a three-year rolling period. In the event of an ownership change, Section 382 imposes an annual limitation on the amount of taxable income that we may offset with NOLs. Any unused annual limitation may be carried over to later years until the applicable expiration date for the respective NOLs.

| -17- |

The rules of Section 382 are complex and subject to varying interpretations. Because of our numerous capital raises, uncertainty exists as to whether we may have undergone an ownership change in the past or will undergo one as a result of the various transactions discussed herein or other future transactions. Accordingly, no assurance can be given that our NOLs will be fully available or utilizable.

Risks Associated with Our Common Stock

If We Fail to Establish and Maintain an Effective System of Internal Control, We May Not Be Able to Report Our Financial Results Accurately or Prevent Fraud. Any Inability to Report and File Our Financial Results Accurately and Timely Could Harm Our Reputation and Adversely Impact the Trading Price of Our Common Stock.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operations and access to capital. We have also experienced complications reporting as a result of material weaknesses and have at times been delinquent in our reporting obligations. We have carried out an evaluation under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, of the effectiveness of the design and operation of our disclosure controls and procedures as of the end of the most recent period covered by this report. Based on the foregoing, our principal executive officer and principal financial officer concluded that our disclosure controls and procedures were not effective at the reasonable assurance level due to the material weaknesses described below.

A material weakness is a deficiency, or a combination of deficiencies, within the meaning of Public Company Accounting Oversight Board (“PCAOB”) Audit Standard No. 5, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. Management has identified the following material weaknesses which have caused management to conclude that as of December 31, 2015 and June 30, 2016 our internal controls over financial reporting (“ICFR”) were not effective at the reasonable assurance level:

| 1. | We do not have written documentation of our internal control policies and procedures. Written documentation of key internal controls over financial reporting is a requirement of Section 404 of the Sarbanes-Oxley Act which is applicable to us for the year ended December 31, 2015 and that will end on December 31, 2016. Management evaluated the impact of our failure to have written documentation of our internal controls and procedures during our assessment of our disclosure controls and procedures and concluded that the control deficiency that resulted represented a material weakness. | |

| -18- |

| 2. | We do not have sufficient resources in our accounting function, which restricts our ability to gather, analyze and properly review information related to financial reporting in a timely manner. In addition, due to our size and nature, segregation of all conflicting duties may not always be possible and may not be economically feasible. However, to the extent possible, the initiation of transactions, the custody of assets and the recording of transactions should be performed by separate individuals. Management evaluated the impact of our failure to have segregation of duties during our assessment of our disclosure controls and procedures and concluded that the control deficiency that resulted represented a material weakness. | |

| 3. | We do not have personnel with sufficient experience with U.S. GAAP to address complex transactions. | |

| 4. | We have inadequate controls to ensure that information necessary to properly record transactions is adequately communicated on a timely basis from non-financial personnel to those responsible for financial reporting. Management evaluated the impact of the lack of timely communication between non–financial and financial personnel on our assessment of our reporting controls and procedures and has concluded that the control deficiency represented a material weakness. | |

| 5. | We have determined that oversight over our external financial reporting and internal control over our financial reporting by our audit committee is ineffective. The audit committee has not provided adequate review of our SEC filings and consolidated financial statements and has not provided adequate supervision and review of our accounting personnel or oversight of the independent registered accounting firm’s audit of our consolidated financial statement. |

We have taken steps to remediate some of the weaknesses described above, including by engaging third party financial consultants with expertise in accounting for complex transactions and SEC reporting. We intend to continue to address these weaknesses as resources permit.

Our Common Stock Is Currently Quoted Only on the OTC Pink Current Information Marketplace (“OTC Pink”), Which May Have an Unfavorable Impact on Our Stock Price and Liquidity.

Our common stock is quoted on the OTC Pink. The OTC Pink is a significantly more limited market than the New York Stock Exchange or NASDAQ. The quotation of our shares on the OTC Pink may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future.

There can be no assurance that there will be an active market for our shares of common stock either now or in the future. Market liquidity will depend on the perception of our operating business and any steps that our management might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. As a result, holders of our securities may not find purchasers for our securities should they to desire to sell them. Consequently, our securities should be purchased only by investors having no need for liquidity in their investment and who can hold our securities for an indefinite period of time.

| -19- |

Shares of Our Common Stock Which May Be Issued Upon Conversion of Indebtedness by JMJ May Dilute The Ownership Interests of Our Stockholders.

On October 7, 2016, we executed a convertible promissory note in favor of JMJ in the amount up to $3,725,000 bearing interest on the unpaid balance at the rate of six percent. The initial amount borrowed under the note was $500,000, with the remaining amounts permitted to be borrowed under the note being subject to us achieving certain milestones. The notes are convertible into shares of our common stock based on the lesser of a per share price of $0.70 or 60% of the lowest trade prices in the 25 trading days prior to the date of conversion. If JMJ elects to convert the principal balance of its convertible note into shares of our common stock under the terms of the note, our current stockholders would be subject to dilution of their interests. Pursuant to the terms of the note, JMJ has agreed that it will not convert the note into more than 9.99% of our outstanding shares. JMJ currently does not own any shares of our common stock.

We have also issued a warrant to JMJ to purchase 714,285 shares of our common stock at an exercise price equal to the lesser of: (i) 80% of the per share price of the common stock in our contemplated public offering, (ii) $0.70 per share, (iii) 80% of the unit price in a public offering (if applicable), (iv) the exercise price of any warrants issued in such public offering, or (v) the lowest conversion price, exercise price, or exchange price, of any security issued by us that is outstanding on October 13, 2016. The aggregate exercise price is $500,000.

The conversion of the foregoing notes and warrant issued to JMJ, in addition to any other outstanding options, warrants, convertible notes, as well as potential future transactions, would result in dilution, possibly substantial, to present and prospective holders of our common stock.

Our Shares of Common Stock Are Very Thinly Traded, and the Price May Not Reflect Our Value and There Can Be No Assurance That There Will Be an Active Market for Our Shares of Common Stock Either Now or in the Future.

Our shares of common stock are very thinly traded, and the price, if traded, may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business and any steps that our management might take to increase awareness of our Company with investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for loans.