www.proxyvote.com

1-800-690-6903

envelope included

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant [X] | Filed by a Party other than the Registrant [ ] |

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Under Rule 14a-12 |

BLINK CHARGING CO.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

BLINK CHARGING CO.

407 Lincoln Road, Suite 704

Miami Beach, Floria 33139

Notice of Annual Meeting of Stockholders

To be held on December 12, 2019

To the Stockholders of Blink Charging Co.

NOTICE IS HEREBY GIVEN that the 2019 Annual Meeting of Stockholders of Blink Charging Co., a Nevada corporation, will be held on December 12, 2019, at 10:00 a.m., local time, at Loews Miami Beach Hotel, 1601 Collins Avenue, Miami Beach, Florida 33139, for the following purposes:

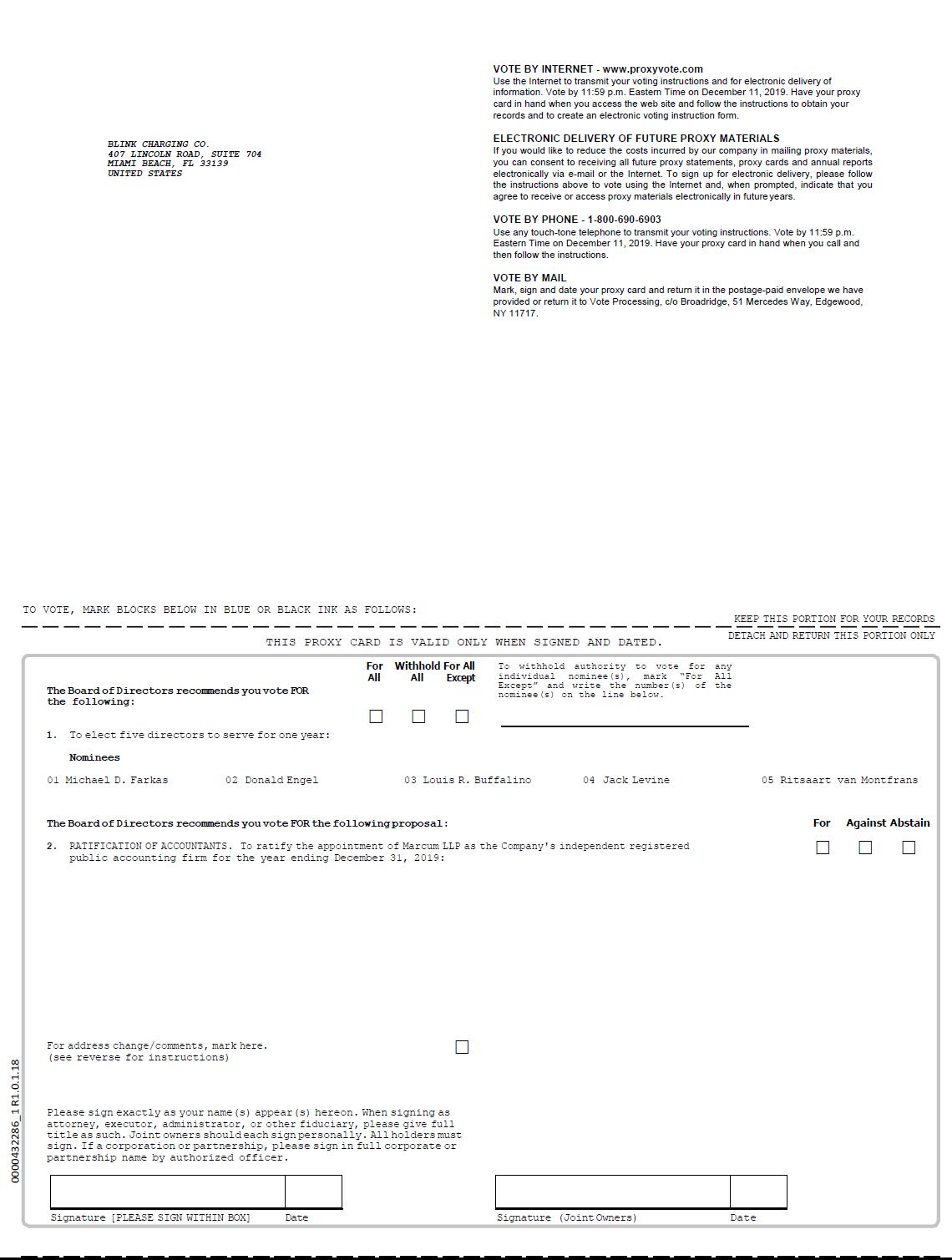

| 1. | Elect five directors to the Board of Directors of Blink Charging Co. for a one-year term of office expiring at the 2020 Annual Meeting of Stockholders, with the nominees for election being Michael D. Farkas, Donald Engel, Louis R. Buffalino, Jack Levine and Ritsaart J.M. van Montfrans. | |

| 2. | Ratify the appointment of Marcum LLP as our independent registered public accounting firm for the year ending December 31, 2019. | |

| 3. | Transact such other business as may properly come before the Annual Meeting or any continuation, postponement or adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders.

The Board of Directors has fixed the close of business on October 25, 2019 as the record date for the determination of stockholders entitled to notice of, and to vote at, this Annual Meeting and any continuation, postponement or adjournment thereof. Whether or not you plan on attending the Annual Meeting, we encourage you to submit your proxy as soon as possible using one of three convenient methods (i) by accessing the Internet site described in the voting instruction form provided to you, (ii) by calling the toll-free number in the voting instruction form provided to you, or (iii) by signing, dating and returning any proxy card or instruction form provided to you.

| By Order of the Board of Directors, | |

| MICHAEL D. FARKAS | |

| Chairman and Chief Executive Officer |

Miami Beach, Florida

November 18, 2019

| 1 |

You may vote in the following ways:

|

|

| ||

| VOTE

BY INTERNET - www.proxyvote.com |

VOTE

BY PHONE - 1-800-690-6903 |

VOTE

BY MAIL - envelope included | ||

| Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m., Eastern time, the day before the meeting date. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. | Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m., Eastern time, the day before the meeting date. Have your proxy card in hand when you call and then follow the instructions. | Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

| 2 |

Proxy Statement Summary

This summary contains highlights about the upcoming 2019 Annual Meeting of Stockholders. This summary does not contain all of the information that you should consider in advance of the meeting and we encourage you to read the entire Proxy Statement before voting.

2019 Annual Meeting of Stockholders

| Date and Time: | December 12, 2019 at 10:00 a.m., local time | |

| Location: | Loews Miami Beach Hotel, 1601 Collins Avenue, Miami Beach, Florida 33139 | |

| Record Date: | October 25, 2019 | |

| Mail Date: | We intend to mail the proxy materials to our stockholders on or about November 18, 2019 |

Voting Matters and Board Recommendations

| Proposals | Our Board Vote Recommendation | |

| Election of Directors (page 20) | FOR each Director Nominee | |

| Ratification of Independent Registered Public Accounting Firm (page 32) | FOR |

| 3 |

Proxy Statement

Information Concerning Voting and Solicitation

The enclosed proxy is solicited on behalf of the Board of Directors of Blink Charging Co., a Nevada corporation, for use at our 2019 Annual Meeting of Stockholders, to be held on December 12, 2019, at 10:00 a.m., local time, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this Proxy Statement and any business properly brought before the Annual Meeting. Blink Charging Co. may also be referred to as the Company, we, us or our in this Proxy Statement. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the Annual Meeting. The Annual Meeting will be held at Loews Miami Beach Hotel, 1601 Collins Avenue, Miami Beach, Florida 33139.

Our proxy materials are available electronically at www.proxyvote.com. At this website, you will find a complete set of the proxy materials including the Proxy Statement, 2018 Annual Report and form proxy card. You are encouraged to access and review all of the information contained in the proxy materials before submitting a proxy or voting at the meeting.

What You Are Voting On

You will be entitled to vote on the following proposals at the Annual Meeting:

| ● | The election of five directors to serve on our Board for a one-year term of office expiring at the 2020 Annual Meeting of Stockholders. | |

| ● | The ratification of the appointment of Marcum LLP as our independent registered public accounting firm for the year ending December 31, 2019. | |

| ● | Any other business as may properly come before the Annual Meeting. |

INFORMATION CONCERNING VOTING AND SOLICITATION

Who Can Vote

The Board has set October 25, 2019 as the record date for the Annual Meeting. You are entitled to notice and to vote if you were a stockholder of record of our common stock, par value $0.001 per share, as of the close of business on October 25, 2019. You are entitled to one vote on each proposal for each share of common stock you held on the record date. Your shares may be voted at the Annual Meeting only if you are present in person or your shares are represented by a valid proxy.

Difference Between a Stockholder “of Record” and a “Street Name” Holder

If your shares are registered directly in your name, you are considered the stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the stockholder of record with respect to those shares. However, you are still considered to be the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot submit a proxy or vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares.

| 4 |

Shares Outstanding and Quorum

At the close of business on October 25, 2019, there were 26,261,434 shares of our common stock outstanding and entitled to vote at the Annual Meeting. The presence of holders of one-third, or 33.34%, of the outstanding shares of our common stock entitled to vote constitutes a quorum, which is required to hold and conduct business at the Annual Meeting. Shares are counted as present at the Annual Meeting if:

| ● | you are present in person at the Annual Meeting; or | |

| ● | your shares are represented by a properly authorized and submitted proxy (submitted by mail, by telephone or over the Internet). |

If you are a record holder and you submit your proxy, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present at the Annual Meeting for the purpose of determining a quorum. If your shares are held in “street name,” your shares are counted as present for purposes of determining a quorum if your broker, bank, trust or other nominee submits a proxy covering your shares. Your broker, bank, trust or other nominee is entitled to submit a proxy covering your shares as to certain routine matters such as ratification of independent registered public accountants, even if you have not instructed your broker, bank, trust or other nominee on how to vote on those matters. Please see the subsection “If You Do Not Specify How You Want Your Shares Voted” below. In the absence of a quorum, the Annual Meeting may be adjourned to a day, time and place as determined by the chairman of the meeting.

INFORMATION CONCERNING VOTING AND SOLICITATION

Voting Your Shares

You may vote using any of the following methods:

| ✓ | By Mail — Stockholders of record may submit proxies by completing, signing and dating their proxy cards and mailing them in the accompanying pre-addressed envelopes. Blink stockholders who hold shares beneficially in street name may provide voting instructions by mail by completing, signing and dating the voting instruction forms provided by their brokers, banks or other nominees and mailing them in the accompanying pre-addressed envelopes. | |

| ✓ | By Internet — Stockholders of record may submit proxies by following the Internet voting instructions on their proxy cards. Most Blink stockholders who hold shares beneficially in street name may provide voting instructions by accessing the website specified on the voting instruction forms provided by their brokers, banks or nominees. Please check the voting instruction form for Internet voting availability. | |

| ✓ | By Telephone — Most Blink stockholders who hold shares beneficially in street name and live in the United States or Canada may provide voting instructions by telephone by calling the number specified on the voting instruction forms provided by their brokers, banks or nominees. Please check the voting instruction form for telephone voting availability. | |

| ✓ | In Person at the Annual Meeting — Shares held in your name as the stockholder of record may be voted in person at the Annual Meeting. Shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, bank or nominee that holds your shares giving you the right to vote the shares. |

| 5 |

Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions by mail, telephone or Internet so that your vote will be counted if you later decide not to attend the Annual Meeting. The Internet and telephone voting facilities will close at 11:59 p.m., Eastern time (for stockholders of record), and 11:59 p.m., Eastern time (for shares held beneficially in street name), on December 11, 2019, the day before the meeting date. Stockholders who submit a proxy by Internet or telephone need not return a proxy card or the form forwarded by your broker, bank, trust or other holder of record by mail.

Changing Your Vote

As a stockholder of record, if you submit a proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting. Stockholders of record may revoke a proxy prior to the Annual Meeting by (i) delivering a written notice of revocation to the attention of the Corporate Secretary at our offices at 407 Lincoln Road, Suite 704, Miami Beach, Florida 33139, (ii) duly submitting a later-dated proxy over the Internet, by telephone or by mail, or (iii) attending the Annual Meeting in person and voting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy. If your shares are held in the name of a broker, bank, trust or other nominee, you may change your voting instructions by following the instructions of your broker, bank, trust or other nominee.

If You Receive More Than One Proxy Card or Notice

If you receive more than one set of proxy materials, it means you hold shares that are registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or, if you submit a proxy by telephone or the Internet, submit one proxy for each proxy card you receive.

How Will Your Shares Be Voted

Stockholders of record as of the close of business on October 25, 2019 are entitled to one vote for each share of our common stock held on all matters to be voted upon at the Annual Meeting. All shares entitled to vote and represented by properly submitted proxies received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies.

INFORMATION CONCERNING VOTING AND SOLICITATION

If You Do Not Specify How You Want Your Shares Voted

As a stockholder of record, if you submit a signed proxy card or submit your proxy by telephone or Internet and do not specify how you want your shares voted, the person named in the proxy will vote your shares:

| ● | FOR the election of the five nominees listed in this Proxy Statement to serve on our Board for a one-year term of office expiring at the 2020 Annual Meeting of Stockholders. | |

| ● | FOR the ratification of the appointment of Marcum LLP as our independent registered public accounting firm for the year ending December 31, 2019. |

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner has not received voting instructions from the beneficial owner and the nominee does not have discretionary authority to vote the shares. If you hold your shares in street name and do not provide voting instructions to your broker or other nominee, your shares will be considered to be broker non-votes and will not be voted on any proposal on which your broker or other nominee does not have discretionary authority to vote. Shares that constitute broker non-votes will be counted as present at the Annual Meeting for the purpose of determining a quorum, but will not be considered entitled to vote on all the proposals in question. Brokers generally have discretionary authority to vote on the ratification of the appointment of Marcum LLP as our independent registered public accounting firm, which is considered a “routine” matter. Brokers, however, do not have discretionary authority to vote on the election of directors to serve on our Board, which is a matter considered “non-routine.”

| 6 |

In their discretion, the proxy holders named in the proxy are authorized to vote on any other matters that may properly come before the Annual Meeting and at any continuation, postponement or adjournment thereof. The Board knows of no other items of business that will be presented for consideration at the Annual Meeting other than those described in this Proxy Statement. No stockholder proposal or nomination was received prior to the deadline set forth in our Bylaws and, accordingly, no such matters may be brought to a vote at the Annual Meeting.

Inspector of Election and Counting of Votes

All votes will be tabulated as required by Nevada law, the state of our incorporation, by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Shares held by persons attending the Annual Meeting but not voting, shares represented by proxies that reflect abstentions as to one or more proposals and broker non-votes will be counted as present for purposes of determining a quorum.

Election of Directors. Vote by a plurality of the shares voting is required for the election of directors under Proposal 1. You may vote FOR all nominees, WITHHOLD your vote as to all nominees, or FOR all nominees except those specific nominees from whom you WITHHOLD your vote. There is no “against” option. The nominees receiving the most FOR votes will be elected. A properly executed proxy marked WITHHOLD with respect to the election of one or more directors will not be voted with respect to the director or directors indicated.

Ratification of the Independent Registered Accounting Firm. The ratification of the appointment of Marcum LLP requires the affirmative vote of the holders of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter. You may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on Proposal 2, the abstention will have the same effect as an AGAINST vote.

Solicitation of Proxies

We will bear the entire cost of solicitation of proxies, including preparation, assembly and mailing of this Proxy Statement, the proxy, the Notice and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding shares of our common stock in their names that are beneficially owned by others to forward to those beneficial owners. We may reimburse persons representing beneficial owners for their costs of forwarding the solicitation materials to the beneficial owners. Original solicitation of proxies may be supplemented by telephone, facsimile, electronic mail or personal solicitation by our directors, officers or staff members. No additional compensation will be paid to our directors, officers or staff members for such services. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose germane to the Annual Meeting during ordinary business hours at our principal executive offices at 407 Lincoln Road, Suite 704, Miami Beach, Florida 33139 for the ten days prior to the Annual Meeting and also at the Annual Meeting.

| 7 |

Corporate Governance

Board of Directors Corporate Governance Highlights

Highlights of our corporate governance include the following:

| ● | Independent Directors. Three of our directors qualify as independent under Nasdaq regulations. | |

| ● | Independent Committees. The Board has three standing committees — Audit, Compensation and Nominating and Corporate Governance. Each committee is comprised solely of independent directors. | |

| ● | Regular Executive Sessions of Independent Directors. Our independent directors plan to meet privately at least four times per year. | |

| ● | Board Authority to Retain Outside Advisors. Our Board and committees have the authority to retain outside advisors. | |

| ● | Director Outside Relationships Require Pre-Approval. Without the prior approval of disinterested members of the Board, directors should not enter into any transaction or relationship with the Company in which they will have a financial or a personal interest or any transaction that otherwise involves a conflict of interest. | |

| ● | Director Conflicts of Interest. If an actual or potential conflict of interest arises for a director or a situation arises giving the appearance of an actual or potential conflict, the director must promptly inform the other members of the Board. All directors will recuse themselves from any discussion or decision found to affect their personal, business or professional interests. |

Director Qualifications and Diversity

Our Nominating and Corporate Governance Committee is responsible for the review of corporate governance, identifying, review the composition of and evaluate the performance of the Board; recommend persons for election to the Board and evaluate director compensation; review the composition of committees of the Board and recommend persons to be members of such committees; review and maintain compliance of committee membership with applicable regulatory requirements; and review conflicts of interest of members of the Board and corporate officers. The Committee may use outside consultants to assist in identifying candidates and will also consider advice and recommendations from stockholders, management, and others as it deems appropriate.

When evaluating director nominees, our directors consider the following factors:

| ● | the current size and composition of the Board and the needs of the Board and the respective committees of the Board; | |

| ● | such factors as character, integrity, judgment, diversity of experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like; and | |

| ● | other factors that the directors may consider appropriate. |

Our goal is to assemble a Board that brings together a variety of skills derived from high quality business and professional experience.

| 8 |

Board Committees and Charters

The Board has three standing committees — Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. The Board maintains charters for each of these standing committees. To view the charters of our standing Board committees, please visit our website at https://ir.blinkcharging.com/governance-docs.

Audit Committee

Our audit committee is currently comprised of Robert C. Schweitzer, Donald Engel and Grant E. Fitz. Mr. Schweitzer is the current chairman of our audit committee. Following the Annual Meeting, we expect that our audit committee will be comprised of Jack Levine (who will be its chairman), Louis R. Buffalino and Ritsaart J.M. van Montfrans. Our Board has determined that each of the directors serving on the audit committee meets the requirements for financial literacy under applicable rules and regulations of the Securities and Exchange Commission (“SEC”) and Nasdaq. In addition, our Board has determined that Mr. Schweitzer met, and Mr. Levine will meet, the requirements of a financial expert as defined under the applicable rules and regulations of the SEC and who has the requisite financial sophistication as defined under the applicable rules and regulations of Nasdaq. Our Board has considered the independence and other characteristics of each existing member and each proposed member of our audit committee, and our Board believes that each member meets the independence and other requirements of Nasdaq and the SEC. Our audit committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq.

Our audit committee, among other things, is responsible for:

| ● | selecting and hiring the independent registered public accounting firm to audit our financial statements; | |

| ● | helping to ensure the independence and performance of the independent registered public accounting firm; | |

| ● | approving audit and non-audit services and fees; | |

| ● | reviewing financial statements and discussing with management and the independent registered public accounting firm our annual audited and quarterly financial statements, the results of the independent audit and the quarterly reviews, and the reports and certifications regarding internal controls over financial reporting and disclosure controls; | |

| ● | preparing the audit committee report that the SEC requires to be included in our annual proxy statement; | |

| ● | reviewing reports and communications from the independent registered public accounting firm; | |

| ● | reviewing earnings press releases and earnings guidance; | |

| ● | reviewing the adequacy and effectiveness of our internal controls and disclosure controls and procedures; | |

| ● | reviewing our policies on risk assessment and risk management; |

| 9 |

| ● | reviewing related party transactions; | |

| ● | establishing and overseeing procedures for the receipt, retention and treatment of accounting related complaints and the confidential submission by our employees of concerns regarding questionable accounting or auditing matters; and | |

| ● | reviewing and monitoring actual and potential conflicts of interest. |

During 2018, the audit committee met five times. Messrs. Schweitzer and Fitz are not standing for reelection at the Annual Meeting.

Compensation Committee

Our compensation committee is, among other things, responsible for:

| ● | reviewing, approving and determining, or making recommendations to our Board regarding, the compensation of our executive officers, including our Chief Executive Officer and other executive officers; | |

| ● | administering our incentive compensation plans and programs; | |

| ● | reviewing and discussing with our management our SEC disclosures; and | |

| ● | overseeing our submissions to stockholders on executive compensation matters. |

Our compensation committee is currently comprised of Messrs. Schweitzer and Engel. Mr. Schweitzer is the current chairman of our compensation committee. Following the Annual Meeting, we expect that our compensation committee will be comprised of Louis R. Buffalino (who will be its chairman) and Jack Levine. Our Board has considered the independence and other characteristics of each current and anticipated member of our compensation committee. Our Board believes that each member of our compensation committee meets the requirements for independence under the current requirements of Nasdaq, is a nonemployee director as defined by Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is an outside director as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986 (the “Code”).

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of Nasdaq.

During 2018, the compensation committee did not meet separately but only in conjunction with meetings of the full Board of Directors due to the small size of the Board and the committee’s limited activities

| 10 |

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is currently comprised of Messrs. Schweitzer and Fitz. Mr. Fitz is the current chairman of our nominating and corporate governance committee. Following the Annual Meeting, we expect that our nominating and corporate governance committee will be comprised of Jack Levine (who will be its chairman) and Louis R. Buffalino. Our nominating and corporate governance committee operates under a written charter. Under our policy, the independent directors of our Board nominate our directors. When evaluating director nominees, our directors consider the following factors:

| ● | the current size and composition of the Board and the needs of the Board and the respective committees of the Board; | |

| ● | such factors as character, integrity, judgment, diversity of experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like; and | |

| ● | other factors that the directors may consider appropriate. |

Our goal is to assemble a Board that brings together a variety of skills derived from high quality business and professional experience.

During 2018, the nominating and corporate governance committee did not meet separately but only in conjunction with meetings of the full Board of Directors due to the small size of the Board and the committee’s limited activities.

While we do not have a formal diversity policy for Board membership, the Board does seek to ensure that is membership consists of sufficiently diverse backgrounds, meaning a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. In considering candidates for the Board, the independent directors consider, among other factors, diversity with respect to viewpoints, skills, experience and other demographics.

Board Role in Risk Oversight

Risk assessment and oversight are integral parts of our governance and management processes. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through our Board as a whole, as well as through various standing committees of our Board that address risks inherent in their respective areas of oversight.

Our Board oversees an enterprise-wide approach to risk management, which is designed to support the achievement of the Company’s objectives, including the strategic objective to improve long-term financial and operational performance and enhance stockholder value. Our Board believes that a fundamental part of risk management is understanding the risks that we face, monitoring these risks and adopting appropriate control and mitigation of these risks.

The Board discusses risks with our senior management on a regular basis, including as a part of its strategic planning process, annual budget review and approval, and through reviews of compliance issues in the appropriate committees of our Board. While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board are structured to oversee specific risks, as follows:

| Committee | Primary Risk Oversight Responsibility | |

| Audit Committee | Oversees financial risk, including capital risk, financial compliance risk, internal controls over financial reporting and reporting of violations involving financial risk, internal controls and other non-compliance with our Code of Conduct. |

| 11 |

| Nominating and Corporate Governance Committee | Oversees the assessment of each Board member’s independence to avoid conflict, determine effectiveness of the Board and committees, and maintain good governance practices through our Corporate Governance Guidelines and Code of Conduct. | |

| Compensation Committee | Oversees our compensation policies and practices to ensure compensation appropriately incentivizes and retains management and determines whether such policies and practices balance risk-taking and reward in an appropriate manner. |

Code of Business Conduct and Ethics

We adopted a Code of Business Conduct and Ethics in December 2013. Our Code of Business Conduct and Ethics applies to all our employees, officers and directors, including our principal executive and senior financial officers. A copy of our Code of Business Conduct and Ethics is posted on our website at www.blinkcharging.com. We intend to disclose future amendments to certain provisions of our Code of Conduct and Business Ethics, or waivers of these provisions with respect to executive officers on our website or in our public filings with the SEC. There were no waivers of the Code of Business Conduct and Ethics in 2018. A copy of our Code of Business Conduct and Ethics will be provided without charge to any person submitting a written request to the attention of the Chief Executive Officer at our principal executive office.

Certain Relationships and Related Transactions

In addition to the compensation arrangements, including employment, termination of employment and change in control arrangements, discussed in the section titled “Executive Compensation,” the following is a description of each transaction since January 1, 2017 and each currently proposed transaction in which:

| ● | we have been or are to be a participant; | |

| ● | the amount involved exceeded the lesser of $120,000 or 1% (approximately $23,000) of the average of our total assets at year-end for the last two completed fiscal years (approximately $2.3 million); and | |

| ● | any of our directors, executive officers or holders of more than 5% of our outstanding capital stock, or any immediate family member of, or person sharing the household with, any of these individuals or entities, had or will have a direct or indirect material interest. |

Our policy with regard to related party transactions is for the Board as a whole to approve any material transactions involving our directors, executive officers or holders of more than 5% of our outstanding shares of capital stock.

Transactions with BLNK Holdings, LLC

On February 10, 2017, February 14, 2017, July 18, 2017 and July 30, 2017, we entered into promissory notes with BLNK Holdings, LLC, a company controlled by Michael D. Farkas, our Chairman and Chief Executive Officer, for the principal sums of $22,567, $25,000, $5,078 and $30,000, respectively, together with simple interest at the rate of 10% per year. On August 4, 2017, we entered into a secured promissory note with BLNK Holdings for the principal sum of $100,000.00, together with simple interest at the rate of 10% per year. The loan was secured by a first priority lien on and continuing security interest in all of our assets.

| 12 |

On March 16, 2018, 74,753 shares of common stock were issued as payment of $221,009 in principal and interest owed to BLNK Holdings, pursuant to a Conversion Agreement, dated August 23, 2017, between our company and BLNK Holdings. These shares were subsequently transferred to Mr. Farkas.

Transactions with Farkas Group Inc.

On August 7, 2017, we issued a 60-day convertible note in the principal amount of $50,000 to Farkas Group Inc. (“FGI”), a company controlled by Michael D. Farkas. Interest on the note accrued at a rate of 15% annually and was payable at maturity. The unpaid principal and accrued interest were convertible at the election of the holder into shares of common stock at $35.00 per share. In connection with the note issuance, we issued a five-year immediately-vested warrant to purchase 100,000 shares of common stock at an exercise price of $0.70 per share. On August 29, 2017, following the effectiveness of the 2017 reverse stock split, FGI exercised, on a cashless basis, warrants for 3,100,000 shares, accounted for as derivative liabilities, not subject to the reverse stock split. We issued 2,990,404 shares of common stock to FGI as a result of the cashless exercise. On December 6, 2017, we and Mr. Farkas signed a letter agreement, pursuant to which Mr. Farkas would cancel 2,930,596 of his shares of common stock. These shares were cancelled on April 16, 2018. In February 2018, in connection with the closing of our 2018 public offering, we repaid $688,238 in principal and interest owed to Mr. Farkas pursuant to convertible notes issued to FGI.

From January 1 to June 30, 2016, as a result of financings entered into by our company, we paid $52,500 in fees to FGI.

Transactions with Balance Labs, Inc.

In September 2016, we executed a consulting agreement with Balance Labs, Inc. (“Balance Labs”), a company controlled by Mr. Farkas. Balance Labs will, among other services, work to establish strategic partnerships, identify customers and identity hardware manufacturers. The consulting agreement calls for us pay a fee of 7% of any gross revenues realized by us as a result of Balance Labs’ introductions. Balance Labs will receive a fee, to the extent permitted by applicable federal and state law, of 5% with regard to any mergers (payable in-kind) of the aggregate consideration of the merger, sales of our company, or our assets. There is also compensation tied to hardware sales ($500 per unit) and any celebrity endorsements (18% of the compensation we pay) arranged by Balance Labs. Finally, if we execute an EV services agreement with a party introduced by Balance Labs and we retain ownership of the hardware, Balance Labs is entitled to 5% of the net revenues generated by the deployed hardware. To date, we have not paid any fees or other compensation to Balance Labs under this contract.

On July 28, 2016, as sub-landlord, we entered into a sublease agreement with Balance Labs, pursuant to which we agreed to sublease a portion of our Miami, Florida corporate headquarters to the sub-tenant. The term of the sublease agreement was from August 1, 2016 to September 29, 2018, subject to earlier termination upon written notice of termination by the landlord or us. This sublease agreement ended in March 2017 when the landlord commenced eviction proceedings against us. Throughout the term of the agreement, subtenant was to pay to us fixed base rent and operating expenses equal to 50% of our obligation under our primary lease agreement, resulting in monthly base rent payments ranging from approximately $7,500 to $8,000 per month, for a total of approximately $200,000 for the total term of the sublease agreement.

| 13 |

Transactions with Ardour Capital

On August 3, 2016, we executed a consulting agreement with Ardour Capital to serve as our financial advisor with respect to any private equity offerings, derivative equity offerings or debt offerings. Mr. Farkas has a less than 5% ownership interest in Ardour Capital. For acting as our placement agent, Ardour Capital is entitled to receive a sales commission of 5% of the gross proceeds from any private equity offering and a five-year warrant to purchase 5% of the common stock from such private equity transaction with an exercise price based on the valuation of the private equity transaction. Ardour Capital is entitled to receive a sales commission of 3% of gross proceeds from a non-convertible debt-related transaction in which there is no equity component other than customary warrant coverage not in excess of 10% of the associated debt. JMJ lent $3,500,000 to us between October 2016 and October 2017. In connection with these loans, we had paid $120,000 (and owed $120,000) to Ardour Capital as sales commissions.

In February 2018, in connection with the closing of our 2018 public offering, we paid $120,000 to Ardour Capital.

On March 22, 2018, in connection with the closing of our 2018 public offering, we issued 360,441 shares of common stock to Ardour Capital as placement agent fees related to the $3,500,000 lent by JMJ and the separate $250,000 lent by JMJ to us on January 22, 2018. On the same day, we issued 1,167 shares of common stock to Ardour Capital in connection with placement agent fees related to the sale of our series C preferred stock in December 2014.

On December 6, 2018, in connection with the sale of Series C Preferred Convertible stock in 2014 and 2016, we paid Ardour Capital $93,333 in sales commissions.

Transaction between BLNK Holdings and JMJ Financial

In February 2018, prior to the closing of our 2018 public offering, Mr. Farkas reached an agreement with JMJ Financial, a Nevada sole proprietorship owned by Justin Keener (“JMJ”), that, following the closing of the 2018 public offering, BLNK Holdings would transfer 260,000 shares to JMJ as additional consideration for JMJ agreeing to waive its claims to $12 million as a mandatory default amount pursuant to previous agreements with us. This transfer took place on April 18, 2018. The fair value of $785,200 of the 260,000 shares of common stock that were to be transferred to JMJ by BLNK Holdings is reflected as interest expense on our consolidated statements of operations during the year ended December 31, 2018, with a corresponding credit to additional paid-in capital.

Transactions with JMJ Financial

On October 7, 2016, we executed a Promissory Note in favor of JMJ in the amount up to $3,725,000 bearing interest on the unpaid balance at the rate of 6% per year. The initial amount borrowed under the promissory note was $500,000, with the remaining amounts permitted to be borrowed under the promissory note being subject to us achieving certain milestones.

All advances after February 28, 2017 were at the discretion of JMJ without regard to any specific milestones occurring. Additional advances of $250,000 and $30,000 under the promissory note occurred on March 14, 2017 and March 24, 2017, respectively, and two more warrants to purchase our common stock were issued, one for 7,143 shares and the other for 857 shares. An additional advance of $400,000 occurred on April 5, 2017 and a warrant to purchase 11,429 shares of our common stock was issued on the same date. An additional advance of $295,000 occurred on May 9, 2017 and a warrant to purchase 8,429 shares of our common stock was issued on the same date. On July 27, 2017, an additional advance of $50,000 was made to us and a warrant to purchase 1,429 shares of our common stock was issued to JMJ. We and JMJ entered into a Lockup, Conversion and Additional Investment Agreement, dated October 23, 2017 (the “Additional Agreement”). In accordance with the terms of the Additional Agreement, on October 24, 2017, JMJ advanced to us $949,900 available pursuant to previous agreements with JMJ and a warrant to purchase 27,140 shares of our common stock was issued to JMJ. As of the closing of our 2018 public offering, ten warrants to purchase a total of 100,001 shares of our common stock had been issued to JMJ. The aggregate exercise price was $3,500,000.

| 14 |

The Additional Agreement extended the maturity date of the JMJ loans to December 15, 2017. On November 29, 2017, we and JMJ entered into the first amendment to the Additional Agreement, extending the maturity date to December 31, 2017. On January 4, 2018, we and JMJ entered into the second amendment to the Additional Agreement, extending the maturity date to January 31, 2018. On February 1, 2018, we and JMJ entered into the third amendment to the Additional Agreement, extending the maturity date to February 10, 2018. On February 7, 2018, we and JMJ entered into the fourth amendment to the Additional Agreement, extending the maturity date to February 15, 2018.

In addition, JMJ claimed that we would owe JMJ $12 million as a mandatory default amount pursuant to previous agreements with us. JMJ, in the Additional Agreement, agreed to allow us to have two options for settling a previously issued note (including settling the mandatory default amount for either $1.1 million or $2.1 million), securing a lockup agreement from JMJ, and exchanging previously issued warrants for shares of common stock. Each of these options depended upon the closing of our 2018 public offering by December 15, 2017 (subsequently extended to February 15, 2018). The option chosen was at our sole discretion. “Origination Shares” was defined in the purchase agreement with JMJ as the following: on the fifth trading day after the closing of our public offering we would deliver to JMJ shares of our common stock equal to 48% of the consideration paid by JMJ under the Promissory Note divided by the lowest of (i) $35 per share, or (ii) the lowest daily closing price of our common stock during the ten days prior to delivery of the Origination Shares (subject to adjustment for stock splits), or (iii) 80% of the common stock price of the public offering, or (iv) 80% of the unit price of the public offering (if applicable), or (v) the exercise price of any warrants issued in the offering. The number of shares to be issued was to be determined based on the offering price of the public offering.

The first option was that we, upon the closing of our 2018 public offering: (a) would pay $2.0 million in cash to JMJ; and (b) would issue shares of common stock to JMJ with a value of $9,005,000 (including the Origination Shares). The second option was that we, upon the closing of our 2018 public offering, would not pay any cash to JMJ and would issue shares of common stock to JMJ with a value of $12,005,000 (including the Origination Shares). Upon the closing of our public offering, we chose the second option and did not pay any cash to JMJ. Although our public offering closed one day after the February 15, 2018 maturity date, JMJ accepted payment on February 16, 2018 and did not declare a default. Prior to our choosing the option at the closing (with the first option including some cash and the second option not including any cash), JMJ could elect to receive some or all of the share consideration (to be issued pursuant to either option) in the form of convertible preferred stock. On January 29, 2018, JMJ made the election to receive all of the share consideration in the form of shares of convertible preferred stock.

Pursuant to the second option and to the election by JMJ to receive convertible preferred stock instead of common stock as permitted by the Additional Agreement, on February 16, 2018, we issued to JMJ 12,005 shares of series D preferred stock convertible into 3,847,756 shares of common stock, to reflect the full payment of all dollar amounts and share amounts owed in connection with the JMJ financing. On May 7, 2018, we received a notice of conversion from JMJ to convert 4,368 shares of series D preferred stock with a stated value of $4,368,000 at the conversion price of $3.12 per share into 1,400,000 shares of our common stock. On May 10, 2018, we effected the preferred stock conversion and issued 1,400,000 shares of common stock to JMJ.

Separately from and unrelated to the JMJ financing, JMJ lent $250,000 to us on January 22, 2018. We agreed with JMJ to issue units of unregistered shares of common stock and warrants as repayment of this $250,000 advance at the closing of our public offering (with each unit consisting of one share of common stock and two warrants each to purchase one share of common stock). On March 16, 2018, we issued 73,529 shares of common stock to JMJ and, on April 9, 2018, we issued 147,058 warrants to JMJ.

| 15 |

Indemnification Agreements

Nevada corporation law limits or eliminates the personal liability of directors to corporations and their stockholders for monetary damages for breaches of directors’ fiduciary duties as directors. Our Bylaws include provisions that require the company to indemnify our directors or officers against monetary damages for actions taken as a director or officer of our company. We are also expressly authorized to carry directors’ and officers’ insurance to protect our directors, officers, employees and agents for certain liabilities. Our articles of incorporation do not contain any limiting language regarding director immunity from liability.

We have entered into separate indemnification agreements with our directors and executive officers, in addition to indemnification provided for in our Bylaws. These agreements, among other things, provide for indemnification of our directors and executive officers for certain expenses, judgments, fines and settlement amounts, among others, incurred by such person in any action or proceeding arising out of such person’s services as a director or executive officer in any capacity. We believe that these provisions in our Bylaws and indemnification agreements are necessary to attract and retain qualified persons as directors and executive officers.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling our company pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Related Person Transaction Policy

Our policy with regard to related party transactions is for the Board as a whole to approve any material transactions involving our directors, executive officers or holders of more than 5% of our outstanding capital stock.

Director Independence

At least annually, the Nominating and Corporate Governance Committee reviews the independence of each non-employee director and makes recommendations to the Board and the Board affirmatively determines whether each director qualifies as independent. No director qualifies as “independent” unless the Board affirmatively determines that the director has no material relationship with the Company (either directly or as a stockholder or officer of an organization that has a relationship with the Company). In addition, in affirmatively determining the independence of any director who will serve on the Compensation Committee, the Board must consider all factors specifically relevant to determining whether a director has a relationship to the Company which is material to that director’s ability to be independent from management in connection with the duties of a Compensation Committee member. Each director must keep the Nominating and Corporate Governance Committee fully and promptly informed as to any development affecting a director’s independence.

Our shares of common stock and warrants are listed for trading on the Nasdaq Capital Market. Under the rules of Nasdaq, “independent” directors must make up a majority of a listed company’s board of directors. In addition, applicable Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit and compensation committees be independent within the meaning of the applicable Nasdaq rules. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act.

| 16 |

The Board has determined that each of our non-employee directors during 2018 (Messrs. Engel, Schweitzer and Fitz) was independent under the listing standards of Nasdaq and the requirements of the SEC. Messrs. Farkas and Christodoulou are not independent based on their service as our Chairman and Chief Executive Officer and our President and Chief Operating Officer, respectively. Mr. Christodoulou is not standing for reelection at the Annual Meeting. The Board has also determined that the new Board nominees, Messrs. Buffalino, Levine and van Montfrans, are independent under the listing standards of Nasdaq and the requirements of the SEC. In making its independence determinations, the Board reviewed direct and indirect transactions and relationships between each director, or any member of his or her immediate family, and us or one of our subsidiaries or affiliates based on information provided by the director, our records and publicly available information. None of our directors directly or indirectly provides any professional or consulting services to us.

As a result, a majority of our directors are independent, as required under applicable Nasdaq rules. As required under applicable Nasdaq rules, we anticipate that our independent directors will meet in regularly scheduled executive sessions at which only independent directors are present.

Board Leadership Structure

The Board held 17 meetings in 2018 and all of the directors attended at least 75% of the total number of meetings of the Board and committees on which they served. We, and the Board, expect all current directors to attend our annual meetings of stockholders barring unforeseen circumstances or irresolvable conflicts. We do not have a written policy on Board attendance at annual meetings of stockholders; however, we do schedule of Board meeting immediately after the annual meeting for which members attending receive compensation.

Michael D. Farkas has been a director since 2010, our Chairman of the Board since January 2015 and Chief Executive Officer from 2010 to July 2015 and again since October 2018. We believe that having one person, particularly Mr. Farkas with his wealth of industry and executive management experience, his extensive knowledge of the operations of the Company and his own history of strategic thinking, serve as both Chairman and Chief Executive Officer is the best leadership structure for us because it demonstrates to our employees, customers and stockholders that the Company is under strong leadership, with a single person setting the tone and having primary responsibility for managing our operations. This unity of leadership promotes strategy development and execution, timely decision-making and effective management of our resources. We believe that we have been well-served by this structure.

As described above, three of our five current directors are independent. In addition, all of the directors on each of the audit committee, compensation committee and nominating and corporate governance committee are independent directors and each of these committees is led by a committee chair. The committee chairs set the agendas for their committees and report to the full board on their work. As required by Nasdaq, our independent directors meet in executive session without management present as frequently as they deem appropriate, typically at the time of each regular in-person Board meeting. All of our independent directors are highly accomplished and experienced business people in their respective fields, who have demonstrated leadership in significant enterprises and are familiar with Board processes. Our independent directors bring experience, oversight and expertise from outside our company and industry, while management directors bring company-specific experience and expertise.

| 17 |

Board Meetings

The Board held 17 meetings in 2018 and all of the directors attended at least 75% of the total number of meetings of the Board and committees on which they served. We, and the Board, expect all current directors to attend our annual meetings of stockholders barring unforeseen circumstances or irresolvable conflicts. We do not have a written policy on Board attendance at annual meetings of stockholders; however, we do schedule of Board meeting immediately after the annual meeting for which members attending receive compensation.

Communication with the Board

Our Annual Meeting of Stockholders provides an opportunity each year for stockholders to ask questions of, or otherwise communicate directly with, members of the Board on appropriate matters. In addition, any interested party may communicate in writing with any particular director, including our Chairman, any committee of the Board, or the directors as a group, by sending such written communication to our Corporate Secretary at our principal executive offices at Blink Charging Co., 407 Lincoln Road, Suite 704, Miami Beach, Florida 33139. Copies of written communications received at such address will be provided to the Board or the relevant director unless such communications are considered, in the reasonable judgment of our Corporate Secretary, to be inappropriate for submission to the intended recipient(s). The Corporate Secretary or his designee may analyze and prepare a response to the information contained in communications received and may deliver a copy of the communication to other Company staff members or agents who are responsible for analyzing or responding to complaints or requests. Communications concerning potential director nominees submitted by any of our stockholders will be forwarded to the Chair of the Nominating and Corporate Governance Committee.

Corporate Governance Materials Available on the Blink Website

Our corporate governance principles are intended to provide a set of flexible guidelines for the effective functioning of the Board of Directors and are reviewed regularly and revised as necessary or appropriate in response to changing regulatory requirements, evolving best practices and other considerations. Many of these principles and policies relating to corporate governance at Blink are available on the Corporate Governance section of our website, https://ir.blinkcharging.com/board-of-directors, including:

| ● | Audit Committee Charter | |

| ● | Compensation Committee Charter | |

| ● | Nominating and Corporate Governance Committee Charter | |

| ● | Code of Business Conduct and Ethics |

You may obtain copies of these materials, free of charge, by sending a written request to: Corporate Secretary, Blink Charging Co., 407 Lincoln Road, Suite 704, Miami Beach, Florida 33139. Please specify which documents you would like to receive.

| 18 |

Proposal 1 -

Election of Directors

Our Board of Directors has nominated each of the five individuals identified below to stand for election at the Annual Meeting, two of whom are currently directors of our company. Our remaining current directors James Christodoulou, who serves as our President and Chief Operating Officer, Robert C. Schweitzer and Grant E. Fitz, are not standing for reelection.

The Board nominees, committee involvement and certain other relevant information is set forth below:

| Director | Age | Director Since | Audit Committee | Compensation Committee | Nominating

& Corporate Governance Committee | |||||

| Michael D. Farkas | 47 | 2010 | ||||||||

| Donald Engel | 87 | 2014 | ||||||||

Louis R. Buffalino | 64 | – | X | X (Chair) | X | |||||

| Jack Levine | 69 | – | X (Chair) | X | X (Chair) | |||||

| Ritsaart J.M. van Montfrans | 48 | – | X |

Pursuant to our Bylaws, only our Board of Directors will be able to fill any vacancies on our Board of Directors until the next succeeding Annual Meeting of Stockholders. Each director’s term continues until the election and qualification of such director’s successor, or such director’s earlier death, resignation or removal. Between successive annual meetings, the Board of Directors has the power to appoint one or more additional directors, but not more than half the number of directors fixed at the last shareholder meeting at which directors were elected.

With respect to Proposal 1, you may vote FOR all nominees, WITHHOLD your vote as to all nominees, or FOR all nominees except those specific nominees from whom you WITHHOLD your vote. The nominees receiving the most FOR votes will be elected. A properly executed proxy marked WITHHOLD with respect to the election of one or more directors will not be voted with respect to the director or directors indicated.

Nominees for Election at this Annual Meeting

Set forth below is biographical information for each nominee and a summary of the specific qualifications, attributes, skills and experiences which led our Board to conclude that each nominee should serve on the Board at this time. All of our nominees meet the qualifications and skills of our Board of Directors Corporate Governance Guidelines – Criteria for Director Nomination. There are no family relationships among any of our nominee directors or among any of our nominee directors and our executive officers.

| 19 |

Michael D. Farkas

Michael D. Farkas served as our Chief Executive Officer from 2010 to July 2015 and from October 2018 to date. Mr. Farkas has served as a member of the Board since 2010 and has been the Chairman of the Board since January 1, 2015. Mr. Farkas is the founder and manager of FGI, a privately-held investment firm. Mr. Farkas is the founder, Chief Executive Officer and a director of Balance Labs, Inc., a consulting firm that provides business development and consulting services to startup development stage businesses. Mr. Farkas also currently holds the position of Chairman and Chief Executive Officer of the Atlas Group, in which its subsidiary, Atlas Capital Services, was a broker-dealer that had raised capital for a number of public and private clients until it withdrew its FINRA registration in 2007. Over the last 20 years, Mr. Farkas has established a successful track record as a principal investor across a variety of industries, including telecommunications, technology, aerospace and defense, agriculture, and automotive retail. Mr. Farkas attended Brooklyn College where he studied Finance.

As the Chairman, Chief Executive Officer and one of the Company’s largest stockholders, Mr. Farkas leads the Board and guides the Company. Mr. Farkas brings extensive industry knowledge of the Company and a deep background in emerging growth companies and capital market activities. His service as Chairman and Chief Executive Officer creates a critical link between management and the Board.

Donald Engel

Donald Engel has served on our Board since July 2014. Mr. Engel is currently a consultant to Palisades Capital Management LLC. Mr. Engel served as Managing Director and consultant at Drexel Burnham Lambert for 15 years. Mr. Engel managed and developed new business relationships and represented clients such as Warner Communications and KKR & Co., L.P. Mr. Engel also served as a consultant to Bear Stearns and as a director of such companies as Revlon, Uniroyal Chemical, Levitz, Banner Industries, Savannah Pulp & Paper, and APL Corp. In the last decade, Mr. Engel was a consultant with Morgan Joseph TriArtisan. Mr. Engel attended the University of Richmond.

Mr. Engel’s extensive knowledge of capital markets and experience in fostering new business relationships makes him well qualified as a member of the Board.

| 20 |

Louis R. Buffalino

Louis R. Buffalino has been a senior real estate executive for more than 35 years. He is currently a Senior Vice President of Cushman & Wakefield, a global real estate services firm, since 2012. At Cushman & Wakefield, Mr. Buffalino is responsible for institutional property investment sales, site selection, lease negotiations and corporate consulting. Mr. Buffalino has previously worked at other commercial real estate services and investment firms including serving as a Senior Vice President at Jones Lang LaSalle from 2009 to 2012, a First Vice President at CB Richard Ellis from 2002 to 2009, and a First Vice President at Donaldson, Lufkin & Jenrette/Credit Suisse in its corporate real estate group from 2000 to 2002. Mr. Buffalino received a B.A. degree from Providence College.

Mr. Buffalino has extensive experience and contacts working with large property owners, managers and developers, making his input invaluable to the Board’s discussions of EV charging station deployment decisions, and our ongoing sales, marketing and growth strategies.

Jack Levine

Jack Levine has been the President of Jack Levine, PA, a certified public accounting firm, since 1984. For more than 30 years, he has been advising corporations on financial and accounting matters and serving as an independent director on numerous boards, frequently as head of their audit committees. Mr. Levine is currently a director and chairman of the audit committee of SignPath Pharma, Inc., a development-stage biotechnology company, since 2010.

Mr. Levine previous board memberships included Provista Diagnostics, Inc., a cancer detection and diagnostics company focused on women’s cancer, from 2011 to 2018 (also serving as chairman of its audit committee); Biscayne Pharmaceuticals, Inc., a biopharmaceutical company discovering and developing novel therapies based on growth hormone-releasing hormone analogs; Grant Life Sciences, a research and development company focused on early detection of cervical cancer, from 2004 to 2008 (also serving as chairman of its audit committee); and Pharmanet, Inc., a global drug development services company providing a comprehensive range of services to pharmaceutical biotechnology, generic drug and medical device companies, from 1999 to 2007 (also serving as chairman of its audit and other committees). Mr. Levine also served as a director and audit committee chair of Beach Bank, a community bank, from 2000 to 2006, Prairie Fund, a mutual fund, from 2000 to 2006, and Bankers Savings Bank, a community bank, from 1996 to 1998, and was a member of the audit committee of Miami Dade County School Board, the nation’s third largest school system, from 2004 to 2006.

Mr. Levine is a certified public accountant licensed by the States of Florida and New York. He also is a member of the National Association of Corporate Directors, Association of Audit Committee Members and American Institute of Certified Public Accountants. Mr. Levine received a B.A. degree from Hunter College of the City University of New York and an M.A. from New York University.

Mr. Levine demonstrates extensive knowledge of complex financial, accounting, tax and operational issues highly relevant to our growing business. Through his decades of service as a board member, he also brings significant working experience in corporate controls and governance.

Ritsaart J.M. van Montfrans

Ritsaart J.M. van Montfrans is an experienced entrepreneur in Europe. He is currently the Chief Executive Officer of Incision Group, a medtech startup in team performance and education, since January 2017, and co-founded and led ScaleUpNation, a growth accelerator for ventures with large scale-up potential, from February 2016 to January 2017, each in Amsterdam, the Netherlands.

| 21 |

In February 2009, Mr. van Montfrans founded NewMotion, which grew to become the leading service provider for electric vehicles in Europe, with the largest public network of charging stations. Mr. van Montfrans served as Chief Executive Officer and International Business Development Director of NewMotion until February 2016, shortly before the company was purchased by Royal Dutch Shell.

Prior to NewMotion, Mr. van Montfrans was a partner of H2 Equity Partners, an investment firm in Amsterdam, from September 2002 to February 2009, an engagement manager at McKinsey & Co. in Amsterdam from May 1999 to September 2002, and an associate in the mergers and acquisitions group of J.P. Morgan in London.Mr. van Montfrans received a degree in economics, politics and mathematics from Bradford University, United Kingdom, and a Master of Science degree in business from the University of Groningen in the Netherlands.

Mr. van Montfrans’ day-to-day operational leadership of NewMotion and in-depth knowledge of the EV charging market and broad range of companies in the industry (with a focus on Western Europe) make him well qualified to be a member of the Board.

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE FIVE NOMINEES NAMED ABOVE.

PROXIES WILL BE VOTED “FOR” THE ELECTION OF THE NOMINEES UNLESS OTHERWISE.

| 22 |

Executive Compensation Discussion

Blink Charging Co. 2018 Named Executive Officers |

Michael D. Farkas Chairman and Chief Executive Officer

James Christodoulou President and Chief Operating Officer

Jonathan New Chief Financial Officer |

Executive Compensation Tables

Summary Compensation Table

The following summary compensation table sets forth all compensation awarded to, earned by, or paid to our principal executive officer who served as such during all of 2018 (Michael D. Farkas), our two most highly compensated executive officers other than our principal executive officer who were serving as executive officers at the end of 2018 (James Christodoulou and Jonathan New), and two additional individuals for whom disclosure would have been provided but were not serving as executive officers at the end of 2018 (Michael Calise, former Chief Executive Officer, and Ira Feintuch, former Chief Operating Officer) (collectively, the “named executive officers”).

| Award Compensation | ||||||||||||||||||||||||||

| Name and Principal Position | Year | Salary | Bonus | Stock Awards (6) | Option Awards (6) | All Other Compensation | Total | |||||||||||||||||||

| Michael D. Farkas (1) | 2018 | $ | 442,500 | $ | 515,713 | $ | - | $ | 1,337 | $ | 2,379,166 | $ | 3,338,716 | |||||||||||||

| Chairman and Chief Executive Officer | 2017 | $ | 981,563 | $ | - | $ | - | $ | 74,336 | $ | 1,178,780 | $ | 2,234,679 | |||||||||||||

| James Christodoulou (2) | 2018 | $ | 88,141 | $ | 61,888 | $ | - | $ | - | $ | 4,176 | $ | 154,205 | |||||||||||||

| President and Chief Operating Officer | 2017 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||

| Jonathan New (3) | 2018 | $ | 107,452 | $ | 72,779 | $ | - | $ | - | $ | 6,264 | $ | 186,495 | |||||||||||||

| Chief Financial Officer | 2017 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||

| Michael J. Calise (4) | 2018 | $ | 256,794 | $ | 272,321 | $ | - | $ | - | $ | 351,719 | $ | 880,834 | |||||||||||||

| Former Chief Executive Officer | 2017 | $ | 286,450 | $ | - | $ | 769,047 | $ | - | $ | 97,887 | $ | 1,153,384 | |||||||||||||

| Ira Feintuch (5) | 2018 | $ | 200,801 | $ | 206,101 | $ | - | $ | 345,996 | $ | 752,898 | |||||||||||||||

| Former Chief Operating Officer | 2017 | $ | 250,000 | $ | - | $ | - | $ | 26,402 | $ | 46,725 | $ | 323,127 | |||||||||||||

(1) Michael D. Farkas serves as our Chairman and Chief Executive Officer and was appointed to these positions in January 2015 and October 2018 (and previously from 2010 to July 2015), respectively. Pursuant to the Third Amendment and the Conversion Agreement (as each term is defined under “Employment and Management Contracts, Termination of Employment and Change-in-Control Arrangements – Michael D. Farkas Employment Agreement” below), we paid $560,295 and $397,500 in salary to Mr. Farkas in 2018 and 2017, respectively, in the form of shares of common stock and stock options. We also paid a bonus to Mr. Farkas in the form of 75,235 shares of common stock having a fair value of $515,713 at the time of issuance (inclusive of a tax gross-up of $155,713).

Included in All Other Compensation for Mr. Farkas are (i) company-paid health insurance benefits of $22,220 and $18,142 in 2018 and2017, respectively, (ii) company-paid car lease and insurance expenses of $29,548 in 2018, and (iii) $394,466 of commissions payable to Farkas Group Inc., a company controlled by Mr. Farkas, relating to the installation of chargers and a placement fee. The compensation listed in All Other Compensation is also for Mr. Farkas’ service as a member of our Board. In 2018, Mr. Farkas received director fees of $72,644, of which $34,404 represented payment in the form of warrants, and in 2017, he received director fees of $63,157, of which $55,843 represented payment in the form of warrants.

(2) Mr. Christodoulou serves as our President, Chief Operating Officer and a director. Mr. Christodoulou was appointed Chief Operating Officer in August 2018 and was appointed as President and a director in October 2018. Included in Mr. Christodoulou’s 2018 bonus of $61,888 includes a $21,404 accrual for 2018, which is expected to be paid during the first half of 2019.

(3) Mr. New serves as our Chief Financial Officer, joining our company in July 2018. Included in Mr. New’s 2018 bonus of $72,779 is a $21,404 accrual for 2018, which is expected to be paid during the first half of 2019.

(4) Mr. Calise served as our Chief Executive Officer through October 2018, and currently serves as our Senior Vice President of Sales. Mr. Calise received a 2018 bonus of $247,321, representing 47,022 shares of common stock having such fair value at the time of issuance (inclusive of a tax gross-up of $97,321). Included in All Other Compensation for Mr. Calise are (i) $54,498 of 2018 director fees paid in the form of shares of common stock and warrants and $52,923 of 2017 director fees paid in the form of shares of common stock and warrants, and (ii) $225,000 in repositioning severance in 2018, which was paid during the first quarter of 2019.

| 23 |

(5) Mr. Feintuch served as our Chief Operating Officer through the date of his resignation in July 2018. Mr. Feintuch was paid a 2018 bonus of $206,101, which consisted of 39,185 shares of common stock. Included in All Other Compensation for Mr. Feintuch is compensation of $134,318 during 2018, of which $94,657 represented accrued commissions that were paid in the form of 52,461shares of common stock and warrants.

(6) The amounts reported in these columns represent the grant-date fair value of the stock and option awards granted during the years ended December 31, 2018 and 2017, calculated in accordance with FASB ASC Topic 718.

Employment Agreements

Michael D. Farkas Employment Agreement

On October 15, 2010, we entered into an employment agreement with Michael D. Farkas to serve as our Chief Executive Officer (“Original Farkas Employment Agreement”). The agreement was for three years and stipulated a base salary of $120,000 in year one, $240,000 in year two and $360,000 in year three. The agreement also included a signing bonus of $60,000. At a Board meeting on April 17, 2014, the Board resolved to enter into a three-year contract with Mr. Farkas, in which Mr. Farkas was to receive a monthly salary of $40,000 with an increase to $50,000 per month in the event our shares became listed for trading on a national securities exchange. On December 23, 2014, in connection with the closing and as a condition to the closing of a series C preferred stock securities purchase agreement, we entered into an amendment to the employment agreement with Mr. Farkas (who was still Chief Executive Officer at that time) (“First Amendment”). The First Amendment provided that Mr. Farkas was to have a salary of $40,000 per month. However, for such time as any of the aggregate subscription amount from the December 2014 securities purchase agreement was still held in escrow, Mr. Farkas was to receive $20,000 in cash and the remaining amount of his compensation (i) was to be deferred and (ii) was to be determined by the compensation committee of the Board to be fair and equitable. Additionally, beginning on the date that the aggregate subscription amount was released from escrow and continuing for so long as the series C preferred stock remained outstanding, Mr. Farkas’ salary was only to be paid in cash if doing so would not have put us in a negative operating cash flow position. Effective July 24, 2015, we again amended our employment agreement with Mr. Farkas, such that Mr. Farkas was appointed our Chief Visionary Officer and was no longer our Chief Executive Officer (“Second Amendment”).

Effective June 15, 2017, we and Mr. Farkas entered into a third amended employment agreement (“Third Amendment”). The Third Amendment was approved by our compensation committee and the Board as a whole (with Mr. Farkas recusing himself from this vote). The Third Amendment, which superseded the First Amendment and Second Amendment, clarified that, on a going-forward basis, the Chairman position held by Mr. Farkas would be the principal executive officer of our company. Mr. Farkas was appointed to this position for a term of three years, with an automatic one-year renewal unless either party terminates Mr. Farkas’ employment with our company at least 60 days prior to the expiration of the term. We agreed that Mr. Farkas was to be paid $20,000 per month from July 24, 2015 to November 24, 2015 and we agreed to pay Mr. Farkas the equivalent of $15,000 per month in cash compensation for the past 18 months (from December 1, 2015 to May 31, 2017), or $270,000. Prior to entering into the Original Farkas Employment Agreement, we and an entity controlled by Mr. Farkas entered into (i) a Consulting Agreement, dated October 20, 2009 (“Consulting Agreement”), and (ii) a Car Charging Group, Inc. Fee/Commission Agreement, dated November 17, 2009 (“Fee Agreement”), and, after entering into the Original Farkas Employment Agreement, the parties entered into a Patent License Agreement, dated March 29, 2012, among our company, Mr. Farkas and Balance Holdings, LLC and the March 11, 2016 Agreement regarding the Patent License Agreement (with the Fee Agreement and the Consulting Agreement, “Affiliate Agreements”). Additionally, the Original Farkas Employment Agreement included a provision whereby any stock options or warrants awarded to Mr. Farkas (or Farkas Group, Inc.) by us that were exercised by Mr. Farkas or that expired would be replaced by us. Such replacement stock options and warrants would have a new exercise price that is 1% above the market price on the new issue date.

| 24 |